SBA provided 2,085 area businesses COVID-19 loans of less than $150,000 each

WASHINGTON, D.C. — The U.S. Small Business Administration, in consultation with the U.S. Treasury Department, released detailed information about Paycheck Protection Loan (PPP) recipients.

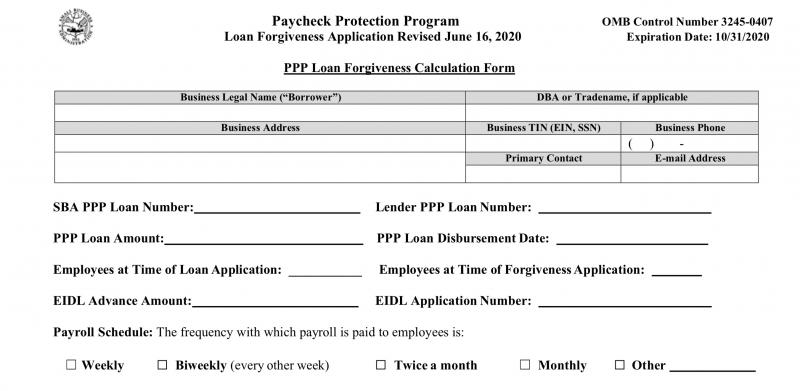

The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll.

This loan provides small businesses, including eligible self-employed individuals, with funds to cover payroll costs including benefits, utilities, mortgage interest and rent.

The SBA will forgive loans if the criteria of the loan is met.

“Small businesses are the driving force of American economic stability and are essential to America economic rebound from the pandemic,” said the SBA in a memo.

For recipients receiving loans of less than $150,000, the SBA has released the amount of loan funds they received but is not making the business name public.

PPP loans are not made by SBA, but by lending institutions and then guaranteed by SBA.

Accordingly, borrowers apply to lenders and self-certify they are eligible for PPP loan, according to the SBA.

The self-certification includes a good faith certification that the borrower has economic need requiring the loan and that the borrower has applied the affiliation rules and is a small business, per the SBA.

The lender then reviews the borrower’s application, and if all the paperwork is in order, approves the loan and submits it to SBA.

A small business or non-profit organization listed in the data has been approved for a PPP loan by a delegated lender. However, the lender’s approval does not reflect a determination by SBA that the borrower is eligible for a PPP loan or entitled to loan forgiveness, the SBA noted.

“All PPP loans are subject to SBA review and all loans over $2 million will automatically be reviewed,” per the SBA. “Because a borrower is listed in the data as having a PPP loan does not mean that SBA has determined that the borrower complied with program rules or is eligible to receive a PPP loan and loan forgiveness.”

The following is a rundown of the businesses falling within the Penobscot Bay Pilot coverage area (Knox County, Waldo County and Waldoboro in Lincoln County) that received PPP loans of less than $150,000.

In total, $54,950,605.67 was provided through PPP loans to small businesses that qualified for a maximum loan amount of $150,000.

The nearly $55 million in loans assisted 2,085 businesses across 48 municipal areas at an average loan of $26,355.21.

The PPP loans helped those 2,085 businesses retain 9,144 jobs or an average of 4.02 per business.

| Area | Loan | Org. | Jobs Retained | Avg. Loan | Avg. Jobs Retained |

| Appleton | $400,664.35 | 20 | 66 | $20,033.22 | 3.47 |

| Belfast | $6,102,534.61 | 184 | 958 | $33,165.95 | 5.26 |

| Belmont | $239,737.50 | 12 | 64 | $19,978.13 | 5.33 |

| Brooks | $561,242.85 | 18 | 62 | $31,180.16 | 3.65 |

| Camden | $6,858,054.89 | 234 | 1,038 | $29,307.93 | 4.44 |

| Cushing | $762,486.69 | 45 | 98 | $16,944.15 | 2.18 |

| Frankfort | $315,501.68 | 11 | 46 | $28,681.97 | 4.18 |

| Freedom | $215,682 | 7 | 27 | $30,811.71 | 3.86 |

| Friendship | $975,652.68 | 77 | 155 | $12,670.81 | 2.01 |

| Hope | $799,480.96 | 36 | 113 | $22,207.80 | 3.14 |

| Isle au Haut | $22,894.86 | 2 | 9 | $11,447.43 | 4.50 |

| Islesboro | $472,286.22 | 18 | 72 | $26,238.12 | 4.00 |

| Jackson | $174,507.57 | 7 | 36 | $24,929.65 | 5.14 |

| Knox | $211,359.00 | 8 | 29 | $26,419.88 | 4.14 |

| Liberty | $397,654.80 | 15 | 106 | $26,510.32 | 7.07 |

| Lincolnville | $1,644,853.99 | 64 | 237 | $25,700.84 | 3.76 |

| Matinicus | $181,320.87 | 9 | 12 | $20,146.76 | 1.33 |

| Monroe | $195,184.58 | 13 | 32 | $15,014.20 | 2.46 |

| Montville | $100,169.46 | 7 | 20 | $14,309.92 | 2.86 |

| Morrill | $375,552.72 | 17 | 57 | $22,091.34 | 3.35 |

| North Haven | $698,681.72 | 30 | 121 | $23,289.39 | 4.03 |

| Northport | $464,772.69 | 20 | 53 | $23,238.63 | 2.65 |

| Owls Head | $959,907.09 | 54 | 135 | $17,776.06 | 2.50 |

| Palermo | $210,953.00 | 14 | 24 | $15,068.07 | 1.17 |

| Port Clyde | $341,511.80 | 21 | 64 | $16,262.47 | 3.05 |

| Prospect | $56,914.00 | 3 | 11 | $18,971.33 | 3.67 |

| Rockland | $7,965,392.81 | 249 | 1,251 | $31,989.53 | 5.04 |

| Rockport | $5,566,798.60 | 153 | 746 | $36,384.30 | 4.91 |

| St. George | $184,452.25 | 5 | 30 | $36,890.45 | 6.00 |

| Searsmont | $503,926.00 | 28 | 90 | $17,997.37 | 3.21 |

| Searsport | $1,251,351.49 | 44 | 161 | $28,439.81 | 3.74 |

| South Thomaston | $1,295,180.72 | 67 | 151 | $19,331.06 | 2.32 |

| Spruce Head | $392,141.70 | 31 | 51 | $12,649.73 | 1.70 |

| Stockton Springs | $282,328.62 | 12 | 73 | $23,527.39 | 6.08 |

| Swanville | $211,631.84 | 11 | 32 | $19,239.26 | 2.91 |

| Tenants Harbor | $693,230.92 | 39 | 161 | $17,775.15 | 4.13 |

| Thomaston | $1,680,993.21 | 56 | 273 | $30,017.74 | 4.88 |

| Thorndike | $451,973.74 | 13 | 68 | $34,767.21 | 5.23 |

| Troy | $83,000.00 | 4 | 25 | $20,750.00 | 6.25 |

| Union | $1,425,684.52 | 62 | 210 | $22,994.91 | 3.39 |

| Unity | $407,617.55 | 19 | 60 | $21,453.56 | 3.33 |

| Vinalhaven | $1,675,524.98 | 113 | 215 | $14,827.65 | 1.92 |

| Waldo | $392,145.90 | 9 | 68 | $43,571.77 | 7.56 |

| Waldoboro | $2,284,990.48 | 81 | 324 | $28,209.76 | 4.05 |

| Warren | $2,225,469.37 | 72 | 323 | $30,909.30 | 4.49 |

| Washington | $613,958.42 | 23 | 96 | $26,693.84 | 4.17 |

| West Rockport | $645,824.00 | 8 | 74 | $80.728.00 | 9.25 |

| Winterport | $977,425.97 | 40 | 230 | $24,435.65 | 5.90 |

| 48 Areas | $54,950,605.67 | 2,085 | 9,144 | $26,355.21 | 4.02 |

Event Date

Address

United States