SAD 28 tax levy miscalculation reverberates through Camden, Rockport; consultant hired

CAMDEN/ROCKPORT — When School Administrative District 28 Superintendent Maria Libby informed the town managers of Camden and Rockport about the overpayment of Rockport’s school funding share, the select boards in both towns went into respective closed-door meetings to talk the implications, legal and financial.

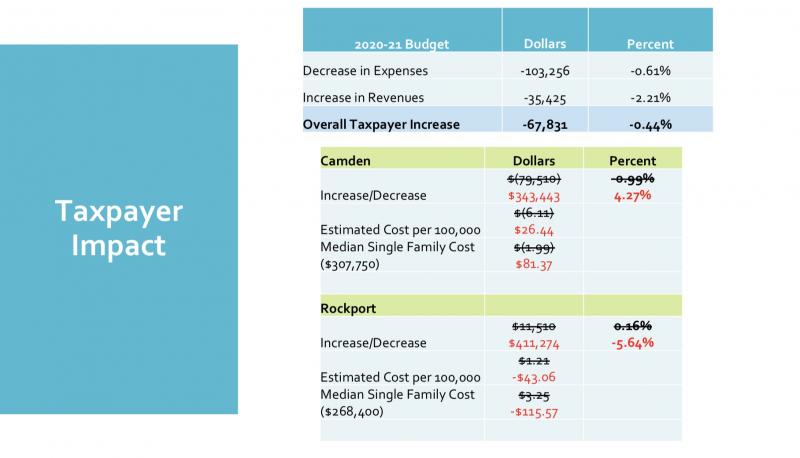

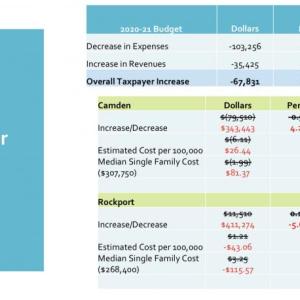

The mistake was discovered this summer, to the effect that this year alone, “A shift of $422,784.40 will increase Camden’s share and lower Rockport’s share,” said Libby, in an Aug. 3 announcement.

The cost-sharing formula used for levying taxes on Camden and Rockport property owners to keep the K-8 schools running has been incorrectly calculated over the past nine years, perhaps longer, she said.

By Tuesday evening, Aug. 5, Camden Town Manager Audra Caler was also ready to talk publicly, and at the end of a Select Board meeting, she said the initial goal of this complex problem is to verify that the allocations for Rockport’s and Camden’s shares of the 2020-2021 SAD 28 budget are accurately determined.

Property taxpayers of both towns almost entirely fund SAD 28 (formed in 1964).

This year’s $17 million budget not only carries the cost of educating K-8 students, but the debt associated with constructing the new middle school on Knowlton Street.

Caler told the Camden Select Board that school district hired consultant Suzan Beaudoin for the first step of sorting out this year’s budget implications.

Libby said Aug. 6: “Our Drummon Woodsum attorney, Bill Stockmeyer, reached out to the DOE regarding a suggested expert in the field. They recommended Suzan Beaudoin, who used to head the School Finance Department at DOE. She expressed a willingness to be hired and was approved by the Camden and Rockport town managers. Bill Stockmeyer has been the one who is in communication with her, but the district is paying for her services.”

Beaudoin, according to the DOE, retired after 31 years, specializing as the education formula calculator. She started in the department as an accountant for Special Services and went on to hold eight other positions before being named Acting Deputy Commissioner in January.

Camden Select Board member Alison McKellar had asked Aug. 5 how the public will learn more about the issue, as the two towns work toward a solution.

“People have a right to be kept up to speed,” said McKellar.

Caler responded: ‘This is the first step in all of this,” adding that the information will be posted and made publicly available.

She anticipated a meeting of the SAD 28 Board of Directors with the Camden and Rockport select boards at a future date.

“ I think before anybody moves forward with a look back, that’s when that meeting should occur,” said Caler.

Rockport Town Manager William Post wrote in his memo to the Rockport Select Board preceding the Aug. 10 regularly scheduled meeting:

“As the Board knows, the Town of Rockport was recently notified by SAD 28 that the calculation to determine the allocation for Rockport and Camden’s share of the school budget was incorrectly calculated for the 2020-2021 budget in an amount of $422,784.40 over-assessed to Rockport taxpayers, and that the assessments have likely been calculated using an incorrect formula since at least 2009. The school district is working with an independent school finance consultant to verify the assessments for FY21 so that both Towns can commit taxes later this month.

“While the District has announced that it is working to correct the issue for the 2020-2021 assessment, there must be a thorough examination and investigation of prior year calculations to fully understand the overall amount and extent of incorrect assessments to Rockport taxpayers. The Town has begun to work with SAD 28 and the Town of Camden to ensure a comprehensive investigation and potential solutions.

“It is important to note that the error was discovered after inquiries from Rockport staff about the assessment calculation.”

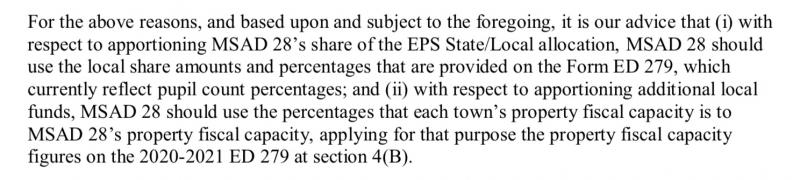

According to Attorney Stockmeyer, who wrote Libby July 29 and provided a legal opinion: “....it is our understanding that the recently-hired SAD 28 business manager, using the business office’s Excel spreadsheets to determine apportionment of taxes, noticed some minor discrepancies between the spreadsheet results and results based on his own mathematical calculations. The business manager called this minor discrepancy to your attention. As you and he began to work on resolving the correct apportionment, you deciding to research the source documentation for MSAD 28’s cost sharing apportionment. On or about July 17, your research disclosed (and we confirmed) that in 2009 the State Board of Education had issued MSAD 28 a Certificate of Organization, containing a reference to ‘State valuation.’ You realized that this reference appeared to be at odds with the business office Excel spreadsheets, which use pupil counts to apportion cost sharing.”

Stockmeyer’s complete July 29 legal opinion to Libby is attached separately as PDF.

In the legal opinion, Stockmeyer researches the history of cost sharing of Camden and Rockport, as well as state statute, most specifically, statutes governing cost sharing, the per pupil counts and a municipality’s property fiscal capacity.

Reach Editorial Director Lynda Clancy at lyndaclancy@penbaypilot.com; 207-706-6657

Event Date

Address

United States