Next steps for Camden-Rockport school payment investigation

ROCKPORT — With a lawsuit filed in Knox County Superior Court by one town against its own school district, as well as a neighboring town, open discussions about what happens next are being muted and conversations ensue behind closed doors with municipal attorneys. It is a convoluted situation, as Rockport assumes a legal stance against Camden and School Administrative District 28, of which Rockport taxpayers are also a part of, as are Camden taxpayers.

Those close to the details say they hope the matter will be resolved amicably and that a stay of litigation will help; however, the digging for financial details has only just begun, as a former Maine Department of Education Acting Deputy Commissioner has been retained to pore over the records of the last 11 years.

At issue is just how much Rockport has overpaid its portion of funding SAD 28 (Camden-Rockport K-8 elementary and middle schools) since 2009, and Camden underpaid.

The inequity came to public light in August, when SAD 28 Superintendent Maria Libby announced that the cost-sharing formula used for levying taxes on Camden and Rockport property owners to keep the K-8 schools running had been incorrectly calculated over the past nine years, perhaps longer.

In its suit, filed Aug. 28, the Town of Rockport claims that the cost sharing formula used by SAD 28 to determine the additional local share of the annual budgets (that share of the budget that the local taxpayers are required to fund absent any state reimbursement for education) must be based on a property valuation method using each town’s property fiscal capacity.

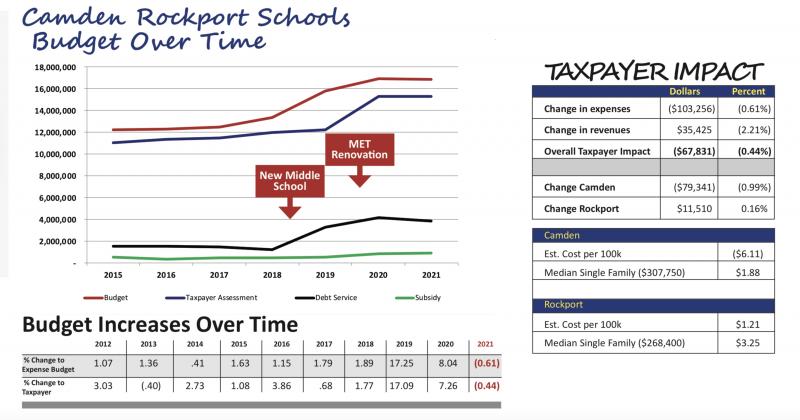

The reality for Camden and Rockport is that they are both low-receiver municipalities, meaning they are financially well off in the eyes of the Maine Department of Education and thus receive minimal state funding for their K-8 public education. Which also means that the bulk of that funding falls squarely on the property owners – the taxpayers of Camden and Rockport. This year alone, the SAD 28 budget, approved by voters, was approximately $17 million.

According to Rockport Select Board Chair Debra Hall, Camden and SAD 28 agreed late last week to hire Suzan Beaudoin to review the school district’s calculations since 2009. Beaudoin was initially hired by SAD 28 to look at the apportionment levies of 2020-2021, which she accomplished in August. She reinforced the district’s decision to reduce Rockport’s share of the current year’s budget and increase Camden’s share.

Now, Beaudoin, who retired from the DOE as acting deputy commissioner after 31 years and specialized in education formula calculations, is to review the last decade, and more, of SAD 28 apportionments.

“The school district expects it will take 7-10 days,” said Hall.

Although Camden had hoped for a joint meeting between the select boards and the school board concerning how to proceed with the investigation of the cost-sharing, Hall said Sept. 4:

“Rockport believes that any meeting should wait until after we have done further research and determined the amounts that were overcharged to Rockport residents. Along those lines, we have requested that a forensic accounting of the incorrect assessment amounts be conducted going back to at least 2009. Rockport believes that Suzan Beaudoin would be an appropriate person to conduct this analysis given her familiarity with the issue and qualifications. It is our position that the costs should be borne by the school district under the circumstances.”

She said that once Rockport has “sufficient information to know the scope of the issue,” then the town will plan to meeting with SAD 28’s board and the Camden Select Board.

“We hope that we will be able to work out an amicable resolution,” she said. “And in that regard we have suggested a stay of the litigation to provide time for us to do so.”

Hall said Rockport’s position is that its taxpayers be fully reimbursed for overpayments made.

“It is not acceptable for the residents of one town to bear the financial burdens of the residents of another town,” she said. “This situation is not the fault of either Rockport or Camden Select Boards or residents — all of whom were unaware of the situation. We have no reason to believe at this time that Camden was aware of the issue, but the school district certainly was because Rockport staff, as it turns out, approached the school district a number of times. Those concerns were disregarded. It was incumbent upon the school district to have taken these concerns seriously and double checked their understanding of the way in which the assessments were calculated. They did not. The school district was wrong both in terms of their understanding of how the assessment formula worked and in terms of how they addressed — or not — the concerns raised by Rockport staff.”

Hall said any settlement discussions, “have to be done in private.”

She added: “We will do our best to keep the public informed about the fact that negotiations are ongoing or have concluded.”

While this case of taxpayer suing each other, and on one sense, themselves, is unusual, though not unheard of, Hall said the Rockport Select Board will take conversations about it behind closed doors.

“There is a reason that Select Boards discuss litigation matters in executive session, to maintain the attorney-client privilege and to openly discuss matters with their counsel,” she said. “To the extent that the Rockport Select Board can keep the public informed about the general status of matters it will but strategies, tactics, settlement offers and responses cannot be disclosed without prejudicing the town’s position. It is in the best interests of Rockport residents to maintain this confidentiality though I certainly understand their desire to be informed as much as possible.”

Reach Editorial Director Lynda Clancy at lyndaclancy@penbaypilot.com; 207-706-6657

Event Date

Address

United States