Rockport over-billed by Camden-Rockport school district for at least nine years, Superintendent says

CAMDEN/ROCKPORT – Today, Aug. 3, School Administrative District 28 Superintendent Maria Libby said the cost-sharing formula used for levying taxes on Camden and Rockport property owners to keep the K-8 schools running has been incorrectly calculated over the past nine years, perhaps longer.

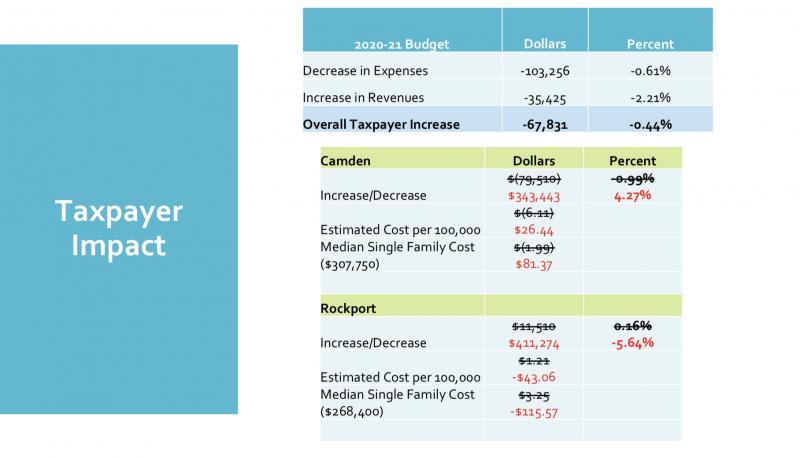

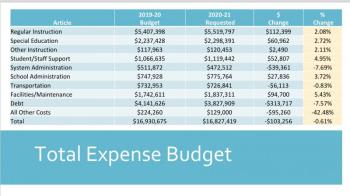

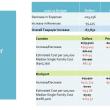

As such, Rockport was to pay $422,784 more than its share for this year alone. An investigation continues to determine the full extent of the error, said Superintendent Maria Libby, in an Aug. 3 news release. The 2020-2021 $17 million budget was approved by voters July 14 in Camden and Rockport.

“The allocations for Rockport’s and Camden’s shares of the 2020-2021 SAD 28 budget will be different than those forecast in this spring’s budget presentations,” the release said. “A shift of $422,784.40 will increase Camden’s share and lower Rockport’s share. Superintendent Libby also shared that prior years’ allocations were calculated incorrectly, as well.”

Rockport agrees that a deeper investigation is necessary.

“The Town of Rockport was recently notified by SAD 28 that the calculation to determine the allocation for Rockport and Camden’s share of the school budget was incorrectly calculated for the 2020-2021 budget in an amount of $422,784.40 over-assessed to Rockport taxpayers, and that the assessments have likely been calculated using an incorrect formula since at least 2009,” said Rockport Town Manager Bill Post, Aug. 3. “While the District has announced that it is working to correct the issue for the 2020-2021 assessment, there must be a thorough examination and investigation of prior year calculations to fully understand the overall amount and extent of incorrect assessments to Rockport taxpayers. The Town has begun to work with SAD 28 and the Town of Camden to ensure a comprehensive investigation and potential solutions.”

Camden issued its own statement, courtesy of Town Manager Audra Caler: “We appreciate this error being brought to our attention. Given the nature of this error it’s important to have a third party outside the school district and towns review the source documents and budgetary figures to verify the updated assessments. Until we have a better understanding of this we’re in no position to determine a solution to this issue.”

Libby credited a new district business office team for discovering the error.

“Following the July 14 local elections and voter approval of the SAD 28 2020-2021 school budget, the district business office began preparing tax assessment documents for the two towns as it does annually,” she wrote. “In doing so, they double-checked initial calculations and realized the numbers slightly differed. Digging deeper, the team sought to gain a thorough understanding of the historical formulas governing the allocations. Research and legal counsel revealed the complex formulas for determining the allocation, formulas which differ depending on the type of district organization, allocation agreements between towns, changes in state law and Department of Education policies over the years, and any special legislation or votes.”

Libby met with the Rockport and Camden Town Managers, respectively, to inform them of the errors. Corrected information has been posted on the district’s website: https://sad.fivetowns.net/school_board/budget_and_financial_statements.

She said the district has consulted with legal counsel, Bill Stockmeyer, of the Portland firm Drummon Woodsum, and that the numbers would be verified by an independent expert in school finance.

According to Libby, when SAD 28 became Regional School Unit 28 in 2009 following Maine’s implementation of its massive school consolidation effort (Consolidation Law), the district received a new Certificate of Organization from the state.

That certificate stipulated that SAD 28 was required to allocate the “local additional” portion of tax assessment based on property valuations.

“This was never done,” said Libby. “Instead, since that time, the district has used student counts for the ‘required local’ portion of the total tax assessments and for the ‘additional local’ portion. Because of not using valuation for the additional local portion of the calculations, the district has determined that Rockport has paid more than its share in at least the past nine years. Due to changing state funding formulas, lack of historical data, and natural workplace turnover, it has not been possible to determine how far back in time an incorrect formula was used.”

Libby said in the release that the district delayed the towns’ 2020-2021 tax assessment warrants to be certain those would be done correctly.

“As a result of the proper calculation of this year’s apportionments, Camden will see an increased tax impact of 4.27 percent over last year’s school budget and Rockport will see a decrease of 5.64 percent,” the release said. “This translates to $26.44/$100,000 property value in Camden and a decrease of $43.06/$100,000 property value in Rockport. This will be verified by an independent expert in school finance.”

Libby said the towns and school district continue to discuss the errors and are, “ working on possible solutions.” She said that she will continue talking with Rockport Town Manager Bill Post and Camden Town Manager Audra Caler.

“It it is very complex, records aren't complete, and we need more time to determine how far back we can reasonably go to determine how long it has been calculated incorrectly,” said Libby, later in the day, Aug. 3. “The laws have changed, the funding formula has changed, and the way the information is provided to districts has changed during the district's history.”

The corrected information has been posted on the district’s website: https://sad.fivetowns.net/school_board/budget_and_financial_statements

Event Date

Address

United States