Rockland considers signing on to Skowhegan solar farm project

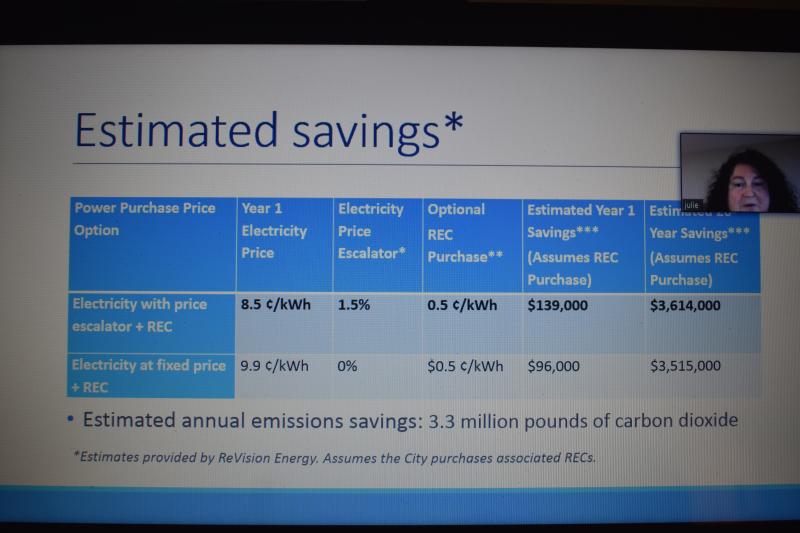

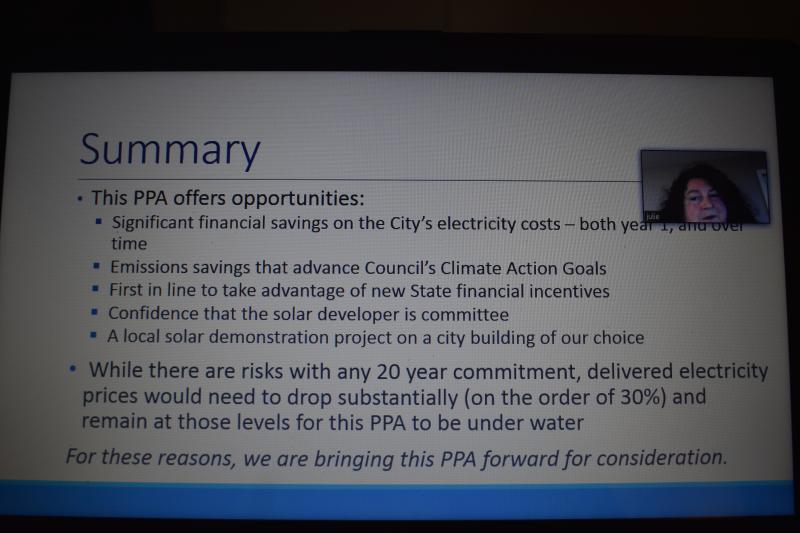

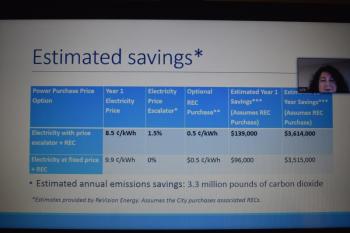

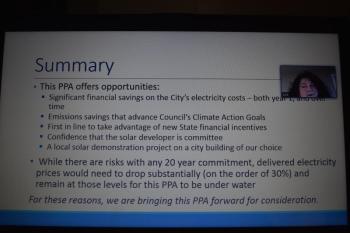

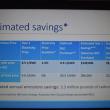

ROCKLAND — The City of Rockland is deciding whether to take advantage of an incentive program for solar energy. City councilors have been told that estimated municipal savings could reach $140,000 for Rockland in 2020, if they commit to a contract that is being presented as a first-come, first serve offer.

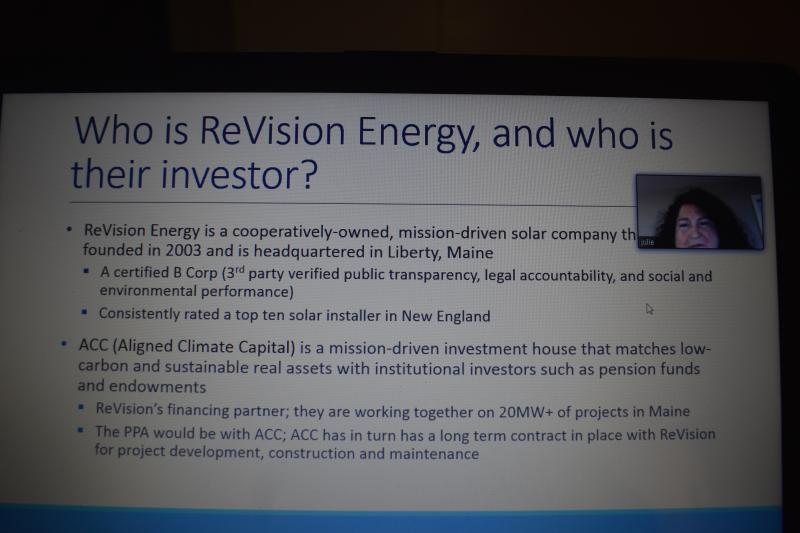

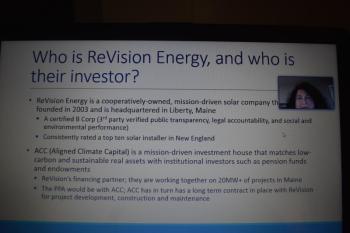

ReVision Energy is building a solar power farm in Skowhegan for municipalities only, with federal dollars being funded by the USDA Rural Development, which provides financial backing for qualifying projects in rural areas, according to Rockland’s Community Development Director, Julie Hashem.

This is a different project than the solar power farm project that Five Town CSD (governing Camden Hills Regional High School) and School Administrative District 28 (Camden-Rockport K-8) elected to joined, though both involve ReVision and Aligned Climate Capital.

For Rockland, it means an opportunity to obtain a share of a depreciating investment tax credit at 30 percent last year and 26 percent this year, dropping down to 22 percent next year, and then down to 10 percent, according to ReVision representative Kurt Penney.

“I’m enthusiastic, and I think it’s a good deal,” said Councilor Nate Davis, during a March 30 City Council meeting conducted through video conference.

According to Davis, the program will allow Rockland to achieve its municipal renewable energy goals quickly while working with a reputable company. The project is also the first shared municipal solar farm created under new Maine legislation LD 1711.

Rockland would continue purchasing electricity from Central Maine Power, as well. However, it will benefit from an incentive credit attached that bill.

“This is the only offer on the table,” said Councilor Valli Geiger. “To do nothing is to pay our current electrical bill, which is approximately – based on those savings – it came up $139,000 more than we have the opportunity to pay under this project.”

An ordinance for entering in a contract for this project “Ordinance Amendment #15 Authorizing Power Purchase Agreement” will be on the April 13 City Council meeting agenda.

How it works

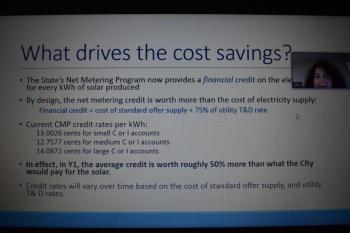

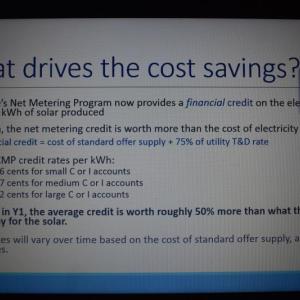

The solar farm generates electricity in the form of kilowatt hours. Rockland will purchase credit throughout the year through the farm’s net metering. The value of the credit is tied to the total delivered cost of electricity.

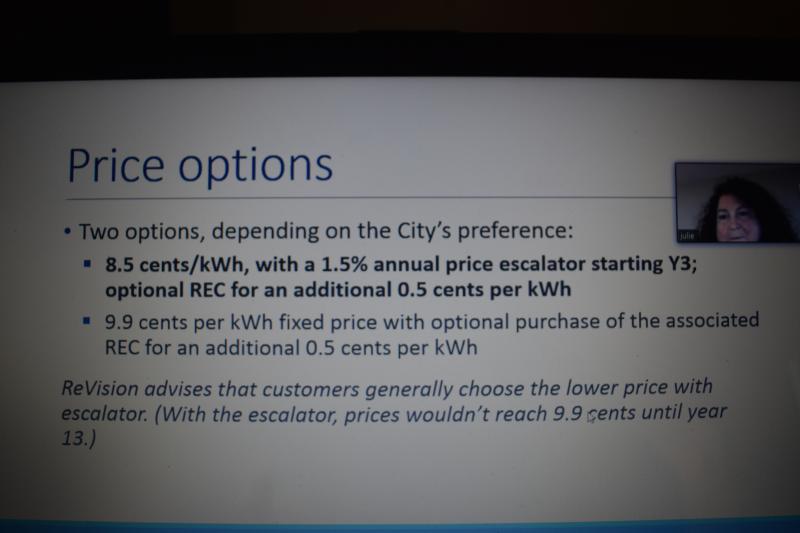

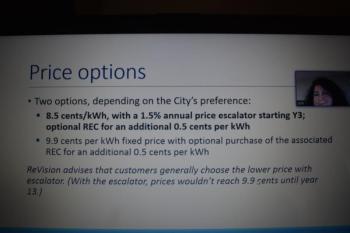

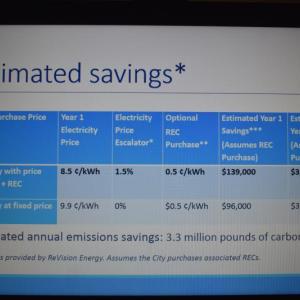

Rockland would purchase solar for 8.5 or 9 cents per kilowatt hour, depending on whether the City wanted to add a renewable energy certificate for the additional half cent. The City would then get a credit worth roughly 50 percent more than what’s on its electric bill at today’s prices, if that project were operational today, according to Hashem.

In turn, the City will have a year to redeem their credits, allowing the electricity generated in the summer months to be used in the winter.

What drives the cost savings under net metering?

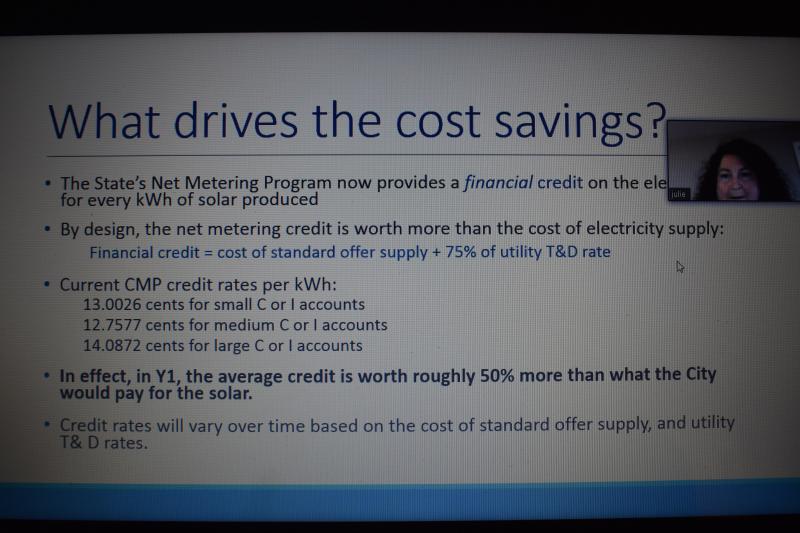

“There’s some misunderstanding about the estimated savings,” said Hashem. “It looks like 8 or 9 cents is more expensive than what we would buy power for in the market place. And it is, but it doesn’t matter. That’s not what drives whether there are savings associated with this contract.”

Instead, there’s a financial credit on the electric bill for every kilowatt hour of solar that is produced in Rockland’s name.

By design, that financial credit is worth more than the cost of electricity supply on the market. A CMP bill has two parts to it: Supply is the competitively bid’s standard offer determined by the PUC. And then there’s the cost of delivering that electricity.

The financial credit is what Rockland is eyeing. This credit is set administratively by the PUC, and it’s equal to the cost of that standard offer – that market price for power – and 75% of the delivery rate. And that incentive financial credit varies by the size of the account.

For a medium customer, it’s 12.75 cents per kilowatt hour. For a large customer, like Rockland’s Wastewater Treatment Plant, it’s 14 cents.

Rockland would purchase solar for 8.5 or 9 cents per kilowatt hour.

If that project were operational today, with these incentives payments, that worth about $140,000 in savings, according to her.

Authorizing Power purchase agreement (the lawyers are still negotiating)

If approved, the City Manager would be authorized to negotiate and enter into a 5-year Power Purchase Agreement, automatically renewable for 20 years, with Aligned Climate Capital (investor) to purchase solar power from ReVision Energy’s Skowhegan solar power project, in substantial conformance with the following terms:

The initial price structure shall be 8.5 cents per net energy billing credit, with a 1.5 percent escalator beginning in year three; and the optional purchase of associated renewable energy certificates for an additional .5 cents per kilowatt hour.

“It’s not the only opportunity out there,” said Hashem.

Tom Luttrell and Hashem happened to have been talking with ReVision about different opportunities from this one when they learned of this new project.

What’s in it for Rockland?

In a power purchase agreement, there’s zero upfront capital investments for the City.

ReVision would develop, construct, and maintain the project. And ReVision uses an investor because they are an employee of the company and they don’t have an appetite for the tax credit. And the federal tax credit and depreciation are a part of what make the numbers work on projects like this. So, ReVision is working with Aligned Climate Capital, and they are kind of a matchmaker in between folks who want to invest in green projects and pension funds and endowments who wish to invest.

“This one caught our attention because it’s half a cent lower than the recent deal that was announced for the Camden area schools, and some other projects we know of that are out there,” said Hashem.

As a benefit in this project, ReVision would also do a 12-panel demonstration project on a City building of choice.

Assumptions

There are some assumptions embedded in the savings estimate, according to Hashem.

One is financial credit under net metering will increase on average 2 percent annually. I think it’s important to remember, that financial credit is set based on market electricity prices, she said. It’s akin to assuming that the delivered cost of electricity from CMP will increase at least 2 percent on average over time. That’s the delivered cost of electricity, not just the cost of electricity supply.

Data that Rockland Energy Committee member Davis Saltonstall found showed that in the past 10 years, delivered electricity prices in Maine increased on average 2 percent.

There other major assumption embedded in the savings estimate is that the City will try to offset 85 percent of its electricity costs.

Rockland would be starting at a point after the lighting projects that are planned are already accomplished. And would still give us some room for being wrong about Rockland’s energy usage. The trick is, you don’t want to leave money on the table, because it’s a financial credit, and that financial credit is only good for a certain period of time.

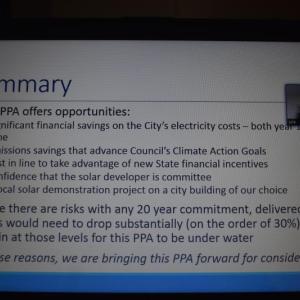

Risk

The way a net-metering program is designed though, the risks really are mitigated. That financial credit is set by the market price of electricity plus 75 percent of the DMV rate. So, if the price of electricity goes up over time, and that spread between what Rockland’s paying for solar and the credit it gets on its bill, increases, that’s all increased value for the City, said Hashem. That’s all increased savings.

“So, if you believe that the price of electricity is going to go up more than 2 percent over time, the savings are much larger than what is estimated here,” she said.

In order for this contract to be under water, the price of electricity would have to drop on the order of 30 percent, in order for there to be no value in this contract for Rockland, according to Hashem, because the incentive rates include an incentive.

It is possible that there could be some sort of supply disruption and the price would drop. But if that happens, the risk is mitigated because your electric bill would also drop. Rockland is still paying an electric bill. It’s still buying power through CMP. But, Rockland will also have a side deal for solar, and that side deal for solar creates a financial credit, that helps pay the CMP bill. So, in the event that the bottom drops out of the market price for electricity, the electric bills will be much lower than they are today.

Now, the risk may be is on the downside. What if the financial credit doesn’t increase as expected? What if that spread is actually smaller, or goes down to zero?

What’s the rush to sign on?

The timeline is really for signing the agreement itself in order for the investors to commit to Rockland, according to ReVision representative Kurt Penney.

The company is already moving forward with the building of the project.

“It’s not as though we are waiting for anyone to sign on before we move,” he said. “We are pushing in order to lock you in to what will be our very first project to come on line, and a project that we anticipate will come on line in the year 2020. The push really is somewhat – and I’m not looking to sound this way – but somewhat of a competitive push against other municipalities that have been offered the same deal.”

Why not create a farm in Rockland?

Why not a rooftop solar, or develop a Rockland solar farm? Rooftop can be a lot more expensive depending on the application, according to Hashem.

“We don’t have enough roof space or appropriate acreage for developing our own project,” she said. “And even if we did, we’d be taking property off the tax roll to do it. You’d really need 10-15 acres in order to cover this much electricity for us.”

And, according to Penney, costs of solar farm development are not going down: permitting, legal, labor, insurance.

“While we do still see some small rate reductions in modules from overseas, we’re looking at structural steel for instillation and racking systems,” he said. “That cost of has actually gone up. And inverter costs have also gone up.”

Reach Sarah Thompson at news@penbaypilot.com

Event Date

Address

United States