Midcoast needs creativity, collaboration and outside-the-box thinking from town leaders

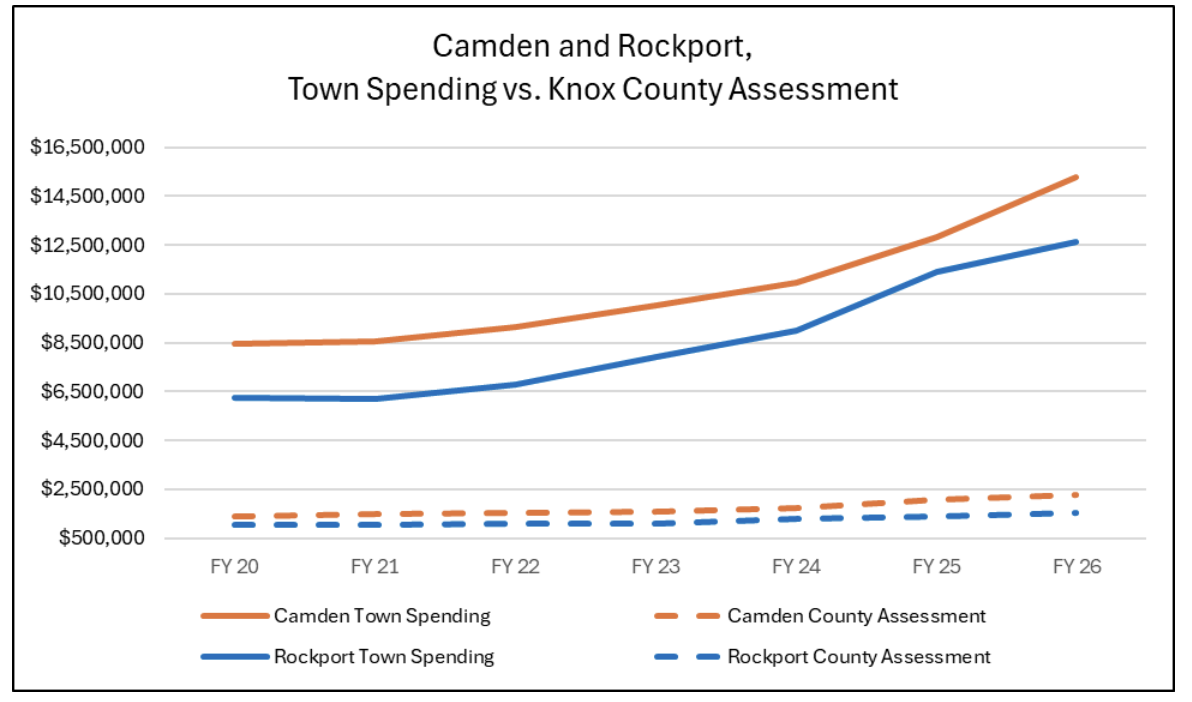

Rockport’s town spending doubled over the last six years, while its county assessment only increased 44 percent. Camden’s county assessment increased 64 percent, but its town spending grew 81 percent. In dollar terms, the county is not even close to being the primary driver of local property tax hikes. (Chart courtesy Stephen Bowen)

Rockport’s town spending doubled over the last six years, while its county assessment only increased 44 percent. Camden’s county assessment increased 64 percent, but its town spending grew 81 percent. In dollar terms, the county is not even close to being the primary driver of local property tax hikes. (Chart courtesy Stephen Bowen) Rockport’s town spending doubled over the last six years, while its county assessment only increased 44 percent. Camden’s county assessment increased 64 percent, but its town spending grew 81 percent. In dollar terms, the county is not even close to being the primary driver of local property tax hikes. (Chart courtesy Stephen Bowen)

Rockport’s town spending doubled over the last six years, while its county assessment only increased 44 percent. Camden’s county assessment increased 64 percent, but its town spending grew 81 percent. In dollar terms, the county is not even close to being the primary driver of local property tax hikes. (Chart courtesy Stephen Bowen)As a member of the one of the area’s “increasingly angsty” budget committees, I read with interest Audra Caler’s recent opinion piece calling for “comprehensive tax reform.”

Ms. Caler’s complaint is that Maine “relies too heavily on a single revenue source-the property tax.” This is almost certainly true. Maine’s property taxes were recently rated the fifth worst in the nation, contributing mightily to an overall tax burden in that is one of the highest in the country.

Her proposed solution, though, would make that overall burden even worse.

She suggests that we shift “a greater share of clearly state-driven costs, particularly county jails and other court-related functions, to stable state funding sources.” What that means in practice is having the state raise income or sales taxes (or both) in order to free up room for municipalities to consume more property tax revenue. The state would increase its taxes so she and other municipal leaders can then raise their taxes.

The problem, in other words, is Maine people simply aren’t taxed enough.

But that isn’t the problem. Property taxes keep climbing because municipal spending continues to grow at unsustainable rates.

Readers may already be familiar with my alarm over Rockport’s mind-boggling levels of spending growth, but Camden is little better. From Fiscal Year 2020 to Fiscal Year 2026, Rockport’s town spending (not including schools and county assessments) more than doubled, increasing 102 percent.

As near as I can determine, Camden’s municipal spending grew 81 percent during that same period, rising from $8.4 million to 15.2 million in just six short years.

Ms. Caler complains that, “Knox County towns are absorbing a county budget increase approaching 14 percent,” but she neglects to mention that Camden’s current budget grew its own spending by 19 percent from the year before.

Camden and Rockport combined now spend $27.9 million on municipal government. In Fiscal Year 2020, the two towns spent $14.6 million combined, meaning that they now spend a staggering $13 million more than they were just a few short years ago.

Rockport’s entire municipal spending for this year is $12.6 million, less than the increase in spending by the two towns since 2020.

If Ms. Caler is sensing that voters “cannot absorb more” in property taxes, this is almost certainly why.

Ms. Caler, though, aims much of her fire at the counties, saying they are “proposing unusually large budget increases.” County government has its issues, to be sure, and county assessments for both Camden and Rockport have risen in recent years, but not at the rate that their own town spending has.

While Rockport’s town spending doubled over the last six years, its county assessment only increased 44 percent. Camden’s county assessment did increase 64 percent, but its town spending grew 81 percent. And as the following chart makes clear, in dollar terms, the county is not even close to being the primary driver of local property tax hikes.

It isn’t county spending that is forcing property taxes to the unendurable levels that Ms. Caler describes, it is municipal spending. And in Camden, as well as Rockport, municipal spending growth is driven in no small part by the fact that rather than working together to contain costs, our towns increasingly opt to provide municipal services on their own, creating endless duplication and driving up costs.

The recent debacle related to the provision of EMS coverage is a good example.

In FY23, Camden spent $170,000 on an EMS contract with Northeast Mobile Health. Rockport budgeted $93,000 that year for the same, resulting in a combined cost of just over $260,000.

For this current fiscal year, Camden will spend $365,000 on its EMS contract, while Rockport, now on its own, has budgeted $860,000 to provide EMS services (or more, if budgeted revenues from the service don’t materialize).

From $260,000 in combined costs to $1.2 million in combined costs in just three years. That means a million dollars more in property taxes from the pockets of area taxpayers for just this one service.

And yet somehow the state has to step in here and do something about this?

No, the EMS fiasco represents a failure of municipal leadership. Period.

I have no doubt many people in both towns worked hard to find a better solution here, but the ultimate outcome was that the towns walked away from a shared model for EMS and we’re all paying the price.

So, what to do? The solution here is not, as Ms. Caler argues, to subsidize the lack of cooperation at the town level with massive tax increases at the state level.

The answer is an unprecedented level of creativity, collaboration, and outside-the-box thinking from town leaders, and a willingness to move beyond age-old parochial interests so we can provide services to these communities in a sustainable and affordable way.

This will require, among other things, leaders who are prepared to be forthright with residents about the real drivers of property tax increases, and who are willing to say, for example, that perhaps we can no longer afford to have two separate police departments, one costing $1.8 million a year and the other costing $1.4 million a year, in two separate buildings 3,200 yards from each other.

And we don’t have time to waste. Ms. Caler noted in her budget message that Camden has a backlog of nearly $50 million in various capital and infrastructure needs, including a new Public Works building.

Not to be outdone, Rockport’s new Capital Improvement Plan details a whopping $75 million in pending needs, including—are you sitting down?—a new Public Works building.

Oh, and those two Public Safety buildings 3,200 yards from each other? Rockport is anticipating it will need to spend $4.7 million on its Public Safety building, at the same time Camden’s Public Safety building is getting $1.2 million in renovations.

We can’t keep doing this, folks.

Let’s make a commitment for 2026 that we’ll craft a new way forward. Let’s acknowledge that getting the property tax burden under control requires getting municipal spending under control, let’s insist that our leaders acknowledge that as well, and let’s work together to tackle this challenge head on.

There will be hard work and hard decisions ahead, but the “warning sirens,” as Ms. Caler notes, are indeed ringing. Let’s respond in meaningful way while there is still time.

Stephen Bowen lives in Rockport and sits on the town's Budget Committee