State warns consumers about unlicensed Rockport CPA, Warren businesswoman

AUGUSTA — The state Department of Professional and Financial Regulation is warning consumers that a Rockport resident, doing business on Route 90 in Warren, is not licensed to provide the accounting services she advertises and promotes.

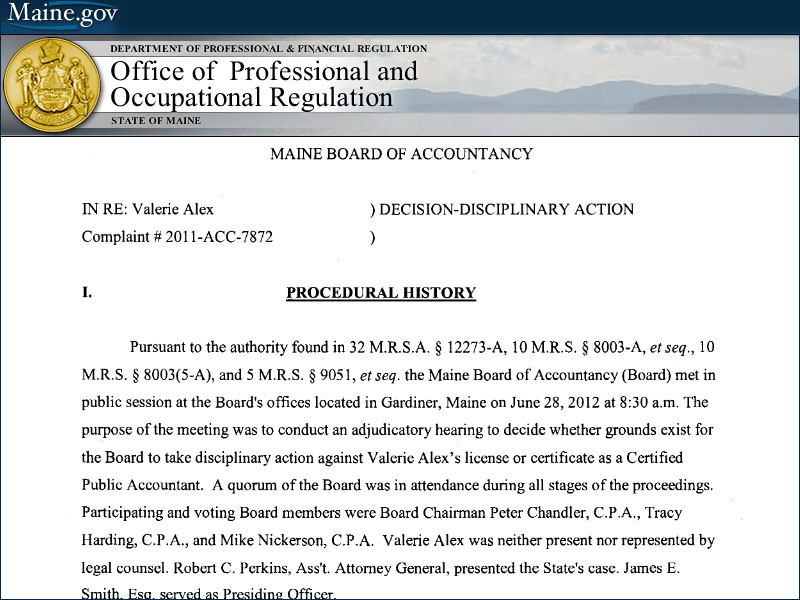

Valerie Alex of Rockport has not held a license to practice as a certified public accountant in Maine since 2010, and her certificate as a CPA was revoked more than a year ago by the state Board of Accountancy, according to state officials in a news release.

According to a Board of Accountancy Decision-Disciplinary Action signed and filed Sept. 19, 2012, Alex was found to have been holding herself out to the public as a CPA long after the expiration of both her individual and firm's certified public accounting licenses, according to Commissioner Anne L. Head.

The Board's order/action also found that Alex had failed to comply with a prior Board order, issued in February 2012, resulting from her failure to properly file an income tax return, failure to follow up with the IRS to resolve that matter on her client's behalf and failure to provide documents requested of her by both her client and the state Attorney General's Office.

In the September disciplinary action, Alex was ordered to remove her office signage in Warren and to shut down her website, valeriealexcpa.com, which as of Wednesday night was still accessible on the Internet. According to the release, Alex has also not removed the office signage in Warren.

"Consumers should be aware that Valerie Alex's certificate as a Certified Public Accountant has been revoked. She is not a Certified Public Accountant," Head said in the release. "Her certificate has been revoked because of a history and pattern of misconduct and failure to comply with orders of the Maine Board of Accountancy. Although she has continued to advertise herself as a Certified Public Accountant, consumers should not hire her to perform work as a certified public accountant."

The state Board sanctioned Alex last year for failing to respond to any Board correspondence or make payment of previously ordered fines. The sanctions also were imposed because Alex has individually remained without a license since September 2010 and her firm has been unlicensed since December 2009, all the while continuing to maintain a website and holding herself and her firm out to the public as licensed.

The sanctions included notifying federal and state tax authorities of the Board's information and action, and referring the matter to the state Attorney General's Office.

In addition, the Board unanimously imposed two fines, a $1,500 fine for "flaunting by Valerie Alex of her unlicensed practice" and a $1,500 fine for "her unresponsiveness to the Board's several communications.

Alex's certificate authorizing her to act as a certified public account was also revoked, and the Board ordered Alex to cease and desist any and all advertising, both as a CPA and accounting firm.

According to online state disciplinary documents, Alex previously signed a consent agreement with the state Board of Accountancy effective Dec. 14, 2005, and admitted, among other things:

- she "failed to promptly and adequately perform the work that she understood she had agreed to undertake for the client;"

- she failed to clearly arrive at, and confirm with a client, an adequate understanding of the scope of the services that she agreed to provide to the client, which resulted in an apparent misunderstanding between her and the client concerning responsibility for his quarterly tax filings;

- she also failed to promptly return all documents to the client upon his request at the termination of the relationship.

As a result of these consent agreement violations, Alex was issued a warning and ordered to pay a civil penalty of $1,000.

Subsequently, another complaint was brought against Alex and adjudicated by the Board, which resulted in a decision and order dated Feb. 7, 2012 in which:

- Alex was issued a reprimand for three violations.

- Alex was ordered to pay a civil penalty of $1,500 for each violation, totaling $4,5000.

According to the document, the February 2012 adjudication was the result of Alex's failure to file federal and state 2008 income tax returns for a client and her failure to contact the IRS to attempt to resolve the issue of whether the client would have to pay interest or penalties for the late filing after she agreed to do so and after receiving a power of attorney from the client thereafter to handle the matter.

During this time, Alex also failed to produce documents requested in an August 2011 letter to her from the state Attorney General's office.

This led to a complaint being filed by Accountancy Board Administrator Cheryl Hersom against Alex for continuing to act in a capacity requiring a license after the expiration of that license.

Specifically, Alex continued to maintain an office at 2970 Camden Road (Route 90) in Warren with a sign identifying the location as "Valerie Alex, CPA." The Board also determined that Alex continued to offer her services to the public through her website, which referred to Alex as a CPA and advertised that Alex's business involved the preparation of tax returns and/or a complete business audit.

In addition, the Board found that Alex has thus far failed to pay the $4,500 fine and has also failed to respond to multiple letters from the Board informing her of the outstanding fine and her obligation to pay it.

• Consumers can check the license status of accountants and licensees in nearly 40 other professions by visiting maine.gov/pfr.

Editorial Director Holly S. Edwards can be reached at hollyedwards@penbaypilot.com or 706-6655.

Event Date

Address

United States