Rockport property revaluation increase estimated at 14.84 percent

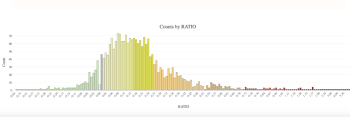

This bell curve represents the recent revaluation of properties in Rockport. '“It tells me that the tax burden is distributed evenly,' said Rockport Assessor Kerry Leichtman.

This bell curve represents the recent revaluation of properties in Rockport. '“It tells me that the tax burden is distributed evenly,' said Rockport Assessor Kerry Leichtman.

Rockport Assessor Kerry Leichtman speaks to the Rockport Select Board July 28 about progress of the town's revaluation process. Taxpayers should be receiving notice of their revised valuations this week.

Rockport Assessor Kerry Leichtman speaks to the Rockport Select Board July 28 about progress of the town's revaluation process. Taxpayers should be receiving notice of their revised valuations this week.

This bell curve represents the recent revaluation of properties in Rockport. '“It tells me that the tax burden is distributed evenly,' said Rockport Assessor Kerry Leichtman.

This bell curve represents the recent revaluation of properties in Rockport. '“It tells me that the tax burden is distributed evenly,' said Rockport Assessor Kerry Leichtman.

Rockport Assessor Kerry Leichtman speaks to the Rockport Select Board July 28 about progress of the town's revaluation process. Taxpayers should be receiving notice of their revised valuations this week.

Rockport Assessor Kerry Leichtman speaks to the Rockport Select Board July 28 about progress of the town's revaluation process. Taxpayers should be receiving notice of their revised valuations this week.

ROCKPORT — Letters to Rockport property owners are arriving this week from the Town Office, informing them about their recently revised assessments. The anticipated townwide increase is 14.84 percent, but that is a number that will adjust according to any tweaks made during the hearing process, when property owners are able to appeal, and possibly change, their new assessments.

Rockport Assessor Kerry Leichtman informed the Rockport Select Board at its July 28 regulary scheduled meeting about the revaluation progress — the first full revaluation of property since 2005.

In 2017, 2022 and 2023, the town made statistical updates using in-house data ((Read this 2021 story: Hot real estate market drives Camden, Rockport property assessment update), but a full revaluation is different and involves in-person assessments. That could have involved measuring each building on the parcel, inspecting the interior of the dwelling and taking pictures.

The 2025 revaluation was completed by KRT Appraisals, based in Haverhill, Massachusetts, a company that conducts multiple revaluations throughout New England. KRT has started to list Rockport value information at its website, krtappraisal.com.

At the Select Board meeting, Leichtman said he felt comfortable that the revaluation smoothed out inconsistencies in assessments, and referenced a bell curve graphic (see above) that reinforced his conclusion.

“It tells me that the tax burden is distributed evenly,” he said.

Leichtman continued: "One of the advantages of doing a full revaluation is that we go out and look at the properties and catch all kinds of things we were not aware of just by doing [statistical] updates. Some of the properties went up a great deal, but that is because they were getting a great deal before."

Many of the high-value increases include large land parcels, many of which are owned by land trusts and are exempt; parcels that were bought as raw land but were built on during the two-year study period (the new buildings greatly increasing their value); and a small number of them are properties that were under assessed but were brought into alignment with the rest of the town, he said.

Hearings with property owners will begin Thursday, August 7, "if everything times out well," he said.

Rockport property owners will have 10 business days to make hearing appointments, but Leichtman said he will conduct hearings for those who may have addresses not in Rockport, "and the mail does not catch up them."

"Everybody will get heard," Leichtman said.

"Not until that [hearing] process is done will the final number be in," he added. "At this point we have to listen [to conversations presented at the revaluation hearings] and make changes."

Select Board member John Viehman said: “Can you connect the dots? When you see a 14.84 percent increase in valuation [it] does not mean that 14.84 increase in taxes, average across the board."

Leichtman responded: "It is an increase in value. What determines the mil rate are the three main appropriations: the town, county and schools. And those budgets make up how much we have to spend."

The mil rate is the math equation used to calculate how much to tax a piece of property to fund those municipal, public school and county budgets, all approved by voters at annual town meeting, which occurred in June.

"In a perfect world, it comes out exactly even," Leichtman told the Select Board. "We grow 14 percent and we reduce the mil rate 14 percent and everybody is kind of happy. What happens, of course, is that the ones who are underpaying pay more, and the ones overpaying, it works out better for them.... But budgets being as they are, we do not get that even tradeoff. People will not see, on average, a 14 percent increase in their taxes. The mil rate will go down, not a lot, but some."

"If your value goes up 25 percent and if the mil rate goes down down 10 percent, then you are looking at a 15 percent increase [in property taxes],” said Leichtman.

After the revaluation is complete and hearings are finished, Leichtman is responsible for adding up the various municipal appropriations approved by voters, as well as Rockport's share in supporting Knox County government, the Five Town CSD (Appleton, Camden, Hope, Lincolnville and Rockport ownership of Camden Hills Regional High School), the School Administrative District (Camden and Rockport shared ownership of their K-8 schools) and the Mid-Coast Solid Waste Corporation (Camden, Hope, Lincolnville and Rockport).

Those combined numbers then are divided by the town’s total taxable valuation ,along with calculating in other fiscal information, such as state revenue sharing and tax increment financing numbers. With that figure, Leichtman sets the 2025 mil rate and then sends the files to the tax bill printer. Bills are then sent to Rockport taxpayers.

The 2025 numbers that Rockport taxpayers are to shoulder, according to the Rockport municipal budget, are:

Municipal budget: $13 million

Rockport's share of the SAD 28: $8 million

Rockport's share of the Five Town CSD: $4.78 million

Rockport's share of the Knox County budget: $1.7 million

Leichtman said at the meeting that he did not know yet what the mil rate would be.

"While I have an idea of where I think it is going to be, it is only an idea," he said.

He said in a premeeting memo to the Seelct Board that given the budget incrases of this year, he did not expect the mil rate would decrease by very much.

Select Board Chair Denise Munger said the overall net budget increase was 7.8 percent, a number that incorporates the schools, county and town budgets.

She said establishing the mil rate should be a matter of taking the total budget number and dividing it by the valuation.

“That’s basically it,” said Leichtman.

"If there valuation is going up 14 percent, almost 15 percent, and the budget went up 7.8 percent, then somewhere in there is a 7 percent decrease in the mil rate,” said Munger.

“That would be nice,” said Leichtman.

“What is missing out of that,” asked Munger.

“The real estate market,” said Leichtman. “The strength of the market, more than anything, drives the valuations up. What drives the mil rate up are the budgets. So you are talking about the gap between the two."

He said the county and school numbers are net numbers. The municipal number, he said, is a gross number. It does not take away and revenue sharing, which is what the State of Maine returns to municipalities based on its own formula, and legislative politics.

This year, Rockport is anticipating $750,000.

"If that happens, great," said Leichtman. "If it doesn’t, that is another driver of the mil rate."

He noted that Rockland valuation's went up 82 percent this year. Camden's went up 44 percent in 2024.

"We’re talking about, on average, 14 percent," he said. "People should relax a little bit. It does not mean everybody’s taxes are going down."

“They are going up,” said Munger.

“They have risen in the past few years,” said Leichtman. “And I am a taxpayer, too, and not too happy with it.”

“But that is an independent process from the revaluation,” said Munger. "That [setting budgets] has already happened and the people voted for it.”

Rockport's total valuation over the years:

In 2023, it was $1,525,038,997, up 31.88 percent from 2022.

In 2022, it was $1,139,925,129, up 21.44 percent over 2021.

In 2021, it was $924 million.

In 2020, $966,450,000.

In 2019, it was $989,550,000.

In 2018 it was $920,847,007.

Going back over the decades, in 2001, it was $436,154,800.

Leichtman observed that the hot real estate market is holding steady, albeit with fewer properties and higher pricetags, with values increased almost 68 percent over the last three or four years.

"It’s huge, without a doubt, cumulatively," he said. "But at last it seems to be slowing down. While sales are reduced, prices have not lessened."

Reach Editorial Director Lynda Clancy at lyndaclancy@penbaypilot.com; 207-706-6657