Hot real estate market drives Camden, Rockport property assessment update

CAMDEN/ROCKPORT — This week, the tax assessor for Camden and Rockport will put his head down and begin a week’s worth of local real estate sales analysis, hoping to even out any increased disparities between what properties have been assessed at, and what they may have sold at over the past two years.

With the help of Rob Tozier, Vice President with KRT Appraisal, the Haverill, Mass.-company that has been doing revaluations for the two towns since 2014, Camden-Rockport Assessor Kerry Leichtman intends to equalize municipal valuations placed on properties, “so everyone is paying an equal share of their property’s value into property taxes,” he said, Nov 23.

It won’t be a full revaluation, with visits to all properties in the towns. That will come later, in 2025-27, and both towns are tucking away money for that lengthy and in-depth exercise.

This statistical update will involve a review of all property sales, applying to each a formula to determine the ratio between market value and assessed value, and updating the towns’ spreadsheets.

It will, said Leichtman, be “a lot of hands-on Excel and math, and applying statistical analysis to sales data we have.”

Then, if the individual values of each property increase, a letter will be sent to the property owner with notification of the adjusted assessment, and providing a schedule of hearings for any disputes.

A statistical update was last done in Camden in 2017, but with the surging real estate market of the last two years, and a rapid increase in property sales prices, Leichtman estimated that the Maine State Revenue Services would, by 2023, conclude that the two towns would be assessing properties at but 76-78 percent of their value.

And in that case, “the state says you can only give 76 percent of Homestead Exemption,” he said.

The Homestead Exemption is a state program that provides Maine citizens reduction of up to $25,000 in the value of their primary residence for property tax purposes.

Leichtman wants to make sure this equalization effort closes the percentage difference between the fair market value of a home and the local assessed value establishes a ratio of 92-93 percent, bringing the homestead exemption back up for qualified property owners.

In April, the ratio assigned by the state for Camden and Rockport was 88 percent, said Leichtman.

“I project for 2023 that they will tell us our ratios will be at 76-78 percent,” he said.

“We do our own studies to make sure state is getting it right,” he said.

Likewise, the towns also want to keep the state revenue sharing flowing to them in the correct amount. As with Homestead Exemption, if the ratio falls to 76 percent, then the towns would receive but 76 percent of their annual revenue sharing from the state.

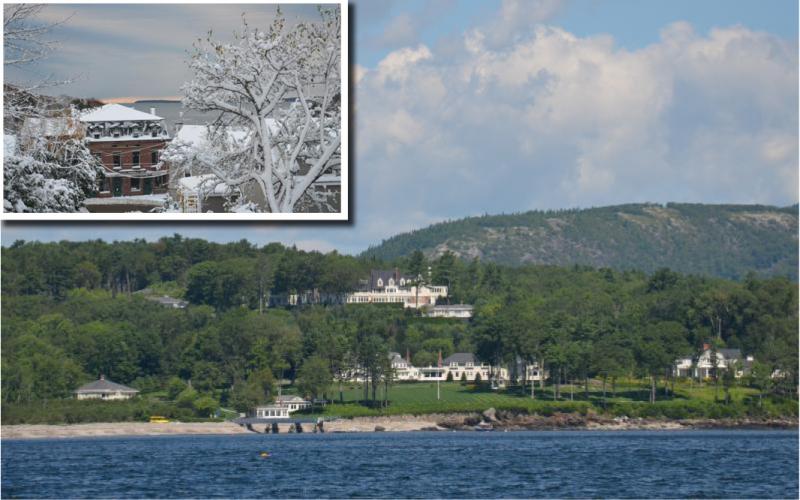

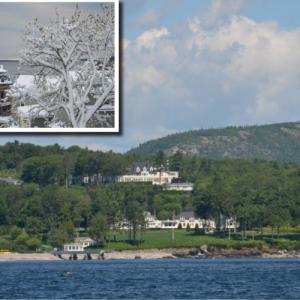

During its 2017 statistical update, Camden determined that different segments of town held disparate ratios. The waterfront property assessments then were running at 62 percent of their value, whereas homes along Pearl Street were at 85 percent.

“They were paying a larger percentage of their value than oceanfront [property owners],” Leichtman said.

Since then, and especially during the pandemic, real estate sales prices have increased as the supply of properties dwindled, especially over the past summer.

“The last two years, the real estate market was extremely high, which drives ratio downs,” said Leichtman.

At one point during the late summer, Camden had but seven properties left on the market, and Rockport had 15. And as listings diminished, prices continued to rise. The market segment experiencing the largest turnover have been homes assessed between $225,000 and $400,000.

“They seem to sell for much more than their assessed value,” Leichtman said. “All other categories have seen growth in value, but that was most.”

Even the properties that held little appeal have sold.

“That which was lingering is no longer there,” he said. “A year ago, properties were on the market for 10-14 months.”

Leichtman is aware that the markets could cool, “so we have to be careful,” he said. “I will try to hit 92 to 93 percent, so that if the market flattens or reverses and weakens we will have room between 92 and 100 percent.”

An equalization does not automatically result in a rise in property taxes, said Leichtman. Nor does it mean the mil rate will increase.

“The fact that the values are going to go up does not necessary mean their taxes will go up,” he said.

Driving forces behind higher taxes are increased spending by the counties, schools, and municipalities, and it is the voters who approve those budgets.

Revaluations, and statistical updates, are the tools that assessors use to attain parity for taxpayers who own property.

“We follow the market,” he said. “We don’t try to lead it.”

Camden’s last revaluation was in 2004; in Rockport, 2005. The statistical update. said Leichtman, is an inexpensive way around revaluation, costing each town approximately $25,000.

Quotes for the 2025-2027 revaluations have already been received by the two towns: $160,000 for Rockport and $180,000 for Camden. Rockport is including money now it is capital improvement plan budget for its revaluation; in Camden, the approach may be to create a reserve account for the project.

With this update, however, the work is anticipated for completion by early winter. After letters are sent to those property owners whose real estate assessments have increased, there will be hearings for appeals.

In Camden, in 2017, and Rockport in 2015, there was, “a full slate of hearings.” said Leichtman. “We made corrections when people brought information that we didn’t have.”

For the most part, he said, taxpayers understood the revised assessments. But they expect fairness in the process.

“They want to know that they are being treated the same as their neighbors,” he said.

Reach Editorial Director Lynda Clancy at lyndaclancy@penbaypilot.com