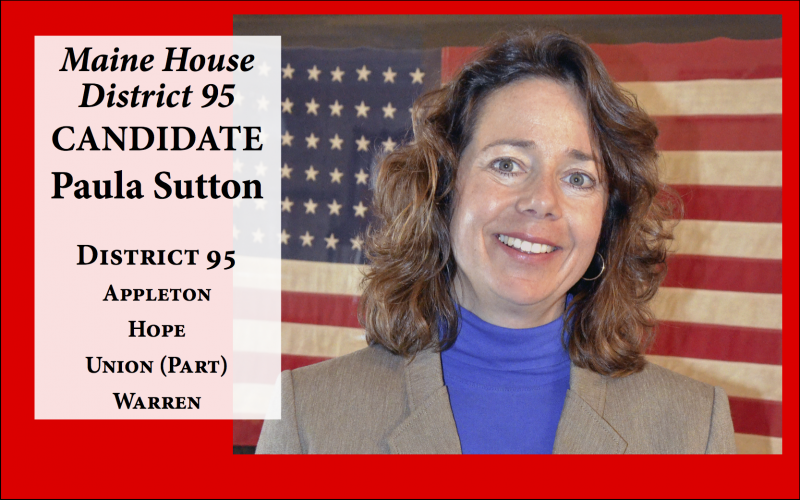

Q&A: Maine House District 95 Candidate Paula Sutton

Paula Sutton, R-Warren: I learned from a young age that success can be the fruit of adversity. With my own personal experience with a childhood disability, I have a unique perspective and can champion for prioritizing Maine’s most vulnerable citizens. I am not one to dwell on victimhood, prefer to put forth a positive can-do attitude, and demonstrate my strong work ethic, love of state and country. I have sponsored and passed legislation to inform voters of fiscal impact when approving new bonds which helps promote sustainable government.

I serve on the Marine Resources and Government Oversight committees, and am the Principal Officer of the Women’s Leadership Fund. Regarding jobs and the economy, I have been involved in the Maine lobster and restaurant industries for many years. I know how important jobs are to the Maine workforce and how vital is to have healthy workers.

I am running for re-election to make Maine a more jobs and family friendly place so our children and grandchildren don’t have to leave to find good paying jobs and a brighter economic future. Very proud to be a Maine native and have a diverse and extensive small business background, which includes two restaurants, a sign company, multiple real estate projects and a wholesale seafood company. Pleased to have been twice named YMCA Volunteer of the Year, active with Warren Day committee and member Warren Planning Board of Appeals. I have spent significant time traveling and living in Central America which gives me a unique perspective and appreciation for our many blessings here in the U.S.

What are the three most pressing issues facing Maine today, and how would you like to see them resolved?

Property taxes are a persistent issue. Whether you are a school district or a town, controlling spending is important; living within our means is the only way to keep taxes lower. The majority of our property taxes pay for our schools, and while some think that increasing the state’s revenue sharing program would help, it’s merely a redistribution of wealth program that does not factor in local spending or voters’ decisions.

Before voting for an expensive new school, there should be a plan on how to pay for it.

Before voting on increasing minimum wage by 60 percent at the ballot box, people ought to realize all implications and consequences.

The best way to honestly have lower taxes is to spend less or to at least keep spending increases to a bare minimum. I am proud that I did not vote for any tax increases in Augusta. Government must live within its means just like Maine families do.

The opioid epidemic touches each and every one of us. It requires a three-pronged approach: Prevention, enforcement and treatment. In some cases, people use drugs to fill a void; community and family members are all called to get involved and be part of the solution. Be a mentor to youth in the area, volunteer at your local school and be supportive of those needing our help.

Our referendum process has been hijacked by out of state special interest groups and I am concerned that is not performing its intended function which is to allow Maine people to utilize their voices. One report shows that 71 percent of money spent opposing/promoting referendum questions originates outside of Maine. To help reform the process I would like to see a requirement that would require proportionate signatures to be gathered from each senate district which would make sure that the proposed measure is a true reflection of the entire state.

Often, the rural areas have their voices overcome by the more populated areas which tend to vote less conservatively. The legislature spent a great deal of time this last session dealing with issues created by the measures passed at the ballot box such as the re-instatement of the tip credit and the confusion and chaos with rank choice voting. Placing a few sentences of a referendum question on a ballot and asking people to vote with no public hearings to flesh out details and to allow experts to testify is not a responsible process. The excessive false and misleading advertisements further complicate the matter and it can be difficult for all voters to find non biased information.

How will you protect the local (municipal) taxpayer as you help shape a state budget?

Many ideas come forth that seem reasonable until the costs are factored in. Often times, initiatives are presented with a small fiscal note requiring either state or local budgets to implement them within existing resources. The reality is, all initiatives take both time and money. Holding State spending to current levels, challenging the efficacy of programs or services to make sure we are getting the best value for your dollars and always being aware that the median income in our state is only about $50 thousand dollars a year is a good reminder that many families and individuals just simply cannot afford to have costs driven down the municipal level which is passed on in the form of property taxes.

I believe elderly and retired homeowners should not have to pay so much property tax and I am exploring ways to make it happen but have not yet arrived at a solid solution and am skeptical with some making grand promises with no plan in place. I am encouraged that Maine was able to conform to the Trump Tax plan and as a result been able to increase the property tax fairness credit to those over 65 years of age from $750 to $1,200.

Scientists have reported that the Gulf of Maine is warming (Gulf of Maine experiences marine heat wave, scientists say and Senators Collins, King push for research into warming of Gulf of Maine). How will you work to ensure that Maine’s fisheries are vital and productive, and that the habitat and marine life are protected?

As a member of the Marine Resource Committee I am proud of the work we have done balancing the health of our natural resources with the harvesting quotas. We have robust protections in place to protect our natural resource and use science and research to guide our policy decisions to ensure healthy sustainable resources that will be accessible for generations to come. Aquaculture is a huge growth opportunity for Maine and provides many jobs which allow us to more fully utilize our abundant clean waters.

What are your positions on energy policies and use of renewable energy (solar, wind, tidal turbine)? Should the state of Maine encourage renewables with tax and policy development?

Penobscot Bay Pilot has posed questions to each candidate running for District Attorney, Maine Senate and Legislature, providing the opportunity for the public to better understand their position on issues important to the state. The candidates have responded with their individual written answers.

All energy sources need to be on the table and yes, including solar. I did vote no the solar bill in the last legislative session however, it was not a vote against solar itself; it was a vote against tying Maine citizens into a long term contract at above market rates which would have had a negative impact on all Maine Rate payers. Our energy portfolio has to be robust and diverse. We should be trying to acquire more hydro and negotiating long term contracts for delivery at below current market rates. As far as tax and policy development for renewables I think we need to be cautious. When a business cannot stand on its merits alone and needs government subsidies and special treatment to exist it runs the risk of costing more than it is worth and encourages alliances that may not have the best interest of taxpayers in mind.

How do you want to see Maine laws governing the commercial growth and sale of marijuana to evolve?

I predict that there will be much fine tuning as we grapple with this enormous change in our way of life here in Maine. I want the laws to keep citizens safe for both users and non-users of recreational marijuana. I especially have concerns about public safety for commercial drivers and the legal liability of transportation companies. Setting policy on when it’s safe and legal to drive commercial vehicles is complex when you factor in that many trucking rules are federal in origin and marijuana is still illegal at the federal level. Some view marijuana as a potential cash cow and wish to highly tax it but we need to be cautious that the new marijuana tax revenues aren’t used unnecessarily to grow government spending just because of a new revenue stream. I am concerned that because marijuana is now legal that some will indulge without fully considering the potential health effects and future complications. There can be a tendency to associate legal and available with safe and harmless no matter how many warnings on the label. I want people to be safe and healthy but recognize personal choice is a fundamental right.

What issues are emerging from your conversations with the public as you go about your campaign, and what solutions do you envision?

People are very optimistic about the vibrant economic environment and are noticing more money in their paychecks and retirement accounts thanks to the Trump Tax plan and commonsense conservative policies. Almost all the business owners I talk to are experiencing booming business trends and are able to see how basic Republican principles of lower taxes help improve their lives. They like that my goal is for them to keep more of their own hard earned money in their pockets because they earned it and know better than government how to spend it. I have been asking people the simple question “are you better off now than you were two years ago?” And nearly everyone says yes. I would like to make sure Republicans and conservatives get out to vote and keep the momentum going forward on November 6.

Most employers are having difficulty finding workers and workforce development is important but I fully recognize that having a workforce with nowhere to work will do us little good and that we must continue to focus on making Maine a more jobs and family friendly environment so businesses will relocate and grow here. In order to do that we need to get our tax policy and spending in order and maintain a predictable regulatory environment. It is very concerning to many that Maine was recently rated the #3 most highly taxed state in the nation by MaineBiz

Voters approved expansion of Medicaid. How do you want to see that implemented and funded?

Passing legislation as complex as health care at the ballot box with only a few sentences to describe and no mechanism to pay for it is irresponsible. Voters did approve the expansion but my position is that we need to take care of our elderly and vulnerable population first before giving free coverage to non-disabled childless adults. To fund the expansion there needs to be a reliable plan to pay that does not use gimmicks. The federal government is currently 21 trillion dollars in debt and cannot be relied upon to repay and I predict the reimbursement rates will drop over time leaving Maine stuck with an increasing responsibility. Passing along large debt to future generations is wrong and will only add to their growing student debt burdens .As a legislator my duty is to look at the long term big picture and prioritize program spending. I would like to see a waiver from the federal government which would allow us to charge a very modest fee for the policy or co-pay to recipients because having a little skin in the game increases chances of a better outcome. Many doctors experience a much greater percentage of patient no shows for appointments for those who do not share in the cost burden for premiums and co-pays as compared to those who do pay. It only makes sense that things have more value when you have to pay for them directly.

What is your position on the proposed 145-mile Central Maine Power transmission line that the company hopes to build from Quebec, through Beattie Township, and the expansion of 92 miles of existing corridor to Lewiston, and another 26.5 miles from Windsor to Wiscasset?

Maine needs less expensive energy, we all agree on that. Finding non biased data can be difficult and I am still in the process of gathering more information on this topic but one concern I have is making sure that Maine people are not being used to satisfy the carbon footprint of other states. I will not have our land being used by others unless there is a substantial long-term and material benefit and reason to do so. We need learn from our rapid wind energy expansion in the past and make we are doing the right thing for the right reasons. Those negotiating the contracts need to make sure they are properly executed for the long term.

Two young Maine children were killed under horrific circumstances in 2017. How would you improve the caliber of DHHS, specifically child protective services?

The tragic deaths of the two young girls are deeply troubling to us all. I sponsored a bill for Governor LePage, LD 1919 which wanted to make the failure of mandated reporters to report suspected child abuse a crime but unfortunately the bill failed. However, I was pleased that we passed another piece of legislation, that directed more funding to foster homes and to direct case workers. My interactions with DHHS workers show me they are a dedicated group of hardworking people who fight to combat the evils that exist in our world. The DHHS workers I know are doing an amazing job given the difficulty of their work. I am glad we were able to give them more money to help compensate them for their dedicated efforts. Ending the fiscal year with a surplus due to fiscally prudent practices, helped provide the much needed resources and we need to continue to prioritize spending so we will have money when it is needed.

What committees would you like to serve on and why?

I will serve where I am needed most but am pleased with my current committees, Marine Resources and Government Oversight.

Maine’s economy relies on small and micro-businesses. How will you help the entrepreneur succeed in this state?

As a person who has owned and operated multiple businesses I understand the difficulty and sympathize with how difficult it can be to comply with increasing mandates, regulations and to navigate multiple government agencies.

Now that I have served in the legislature more fully understand how important tax policy is. I was truly amazed by the number of bills we voted on having to do with tax policy. Sales tax exemptions, income tax deductions, income tax credits, tax incremental financing, the list is endless. As a member of the government oversight committee part of our job is to review tax expenditures. (Tax expenditures are a fancy way of saying tax breaks.) When you create a law it needs to be reviewed to see if it is doing what it was created to do. The problem is it’s often hard to tell if tax breaks are having the intended results because there is lots of confidential data you cannot force people and companies to give up so in the end you don’t even know if your tax code is working. It seems to me if we simplified the tax policy and gave everybody the same break it would save a lot of time and money not to mention it would be fairer and less expensive to administer. Government needs to have a clear and predictable regulatory environment for business and then stay out of the way for business to thrive and grow.

Does Maine have enough mental health care resources? If not, what needs to improve and how?

This is a complex question and worthy of hours of discussion. It may be helpful to know that there are 3 different components of mental health spending-and resources.

1. Intellectual and developmentally disabled (people w/ autism or mental retardation)

2. Substance abuse spending

3. The traditional defined mentally ill population

I reached out to a colleague on the Department of Health and Human Services Committee and was told that Maine leads the nation in mental health spending per capita inn terms of how much of our health care budget goes to the above three issues and they believed that the last time they looked Maine spends approximately 5.9% of our HHS budget on mental health.

As a society we have come a long way towards understanding mental health and are more compassionate to those affected by it. Funding is likely to always be challenging and I am very concerned about the lack of qualified doctors and other specialized health care professionals. Our punitive tax structure hampers our ability to attract qualified health care professionals to live and work here and our reimbursement rates are too low. I support an overall reduction in our income tax burden to incentivize in-migration of much needed workers and to prioritize funding be used to clear waitlists for the above 3 populations who are chronically languishing waiting for needed services.

What is your vision for affordable health care?

Maine was on the path to affordable healthcare insurance with PL 90, a law passed in in the 125th Legislature that corrected the community rating and allowed for the purchase of health care insurance across state lines.

Many business saw significant decreases in the cost of health insurance offered to their employees. Since the passage of the ACA however, insurance rates have skyrocketed.

Opening up the insurance market, much like homeowners or vehicle insurance and allowing folks to shop around to find the plan which best fits their needs would create competition in the market forcing insurance companies to provide a better product at a competitive price.

I wish that people could begin to be more proactive rather than reactive in their approach to health and self-care. Health care starts at home, in the kitchen at the table. I envision a world where families eat healthy meals together, have gardens and exercise regularly. We have a bloated healthcare system that is riddled with fraud, waste, and abuse.

If all of our Washington politicians and public employees had the same health insurance that individuals who earn over 400 percent of FPL are forced to buy, we would have fixed healthcare five years ago.

We should go back to health insurance. Insurance is something you purchase to protect you against the big, bad, awful, unexpected medical events that each and every one of us knows we couldn’t pay for on our own if it happened to us. I would leave in place the Guaranteed Issue provision - as that protects against loss of coverage due to a pre-existing condition; but also requires the continuity of coverage (meaning, everyone that wants to be protected against pre-existing condition, must be able to demonstrate that they have had continuous health insurance.

The concept of affordable healthcare being part of your health insurance that covers everything including preventive care is not practical. This creates a billing and coding nightmare, and introduces many layers of fraud. Implement a system that encourages people to stay on top of their health. For everyone that has a regular annual physical (complete physical), have them receive a “Certificate of Preventive Care”. This certificate will entitle them to take tax deductions on literally every health care treatment, prescription, OTC they purchase. The more they care for themselves, the greater their tax deduction.

When providers can compete, their prices come down based on market demand. This puts the consumer back in the driver’s seat.

I’m a big fan of HSA accounts and would like to encourage HSA Expansion at the state level. My ideas above are along those lines; the only difference with my idea is that people don’t have to go through the difficult process of opening an HSA account. If they get their preventive care certificate, they can deduct from their taxes.

Maine has built up a fiscal surplus. How should it be used?

The fiscal surplus ought to stay right where it is and saved for a rainy day. Economies are cyclical in nature and what goes up goes down and to be ready only makes sense. I think our current reserve is sufficient and if it were to grow any larger the money should be returned to the people.

What are your positions on the following November ballot questions?

Question 1: “Do you want to create the Universal Home Care Program to provide home-based assistance to people with disabilities and senior citizens, regardless of income, funded by a new 3.8% tax on individuals and families with Maine wage and adjusted gross income above the amount subject to Social Security taxes, which is $128,400 in 2018?"

No, I do not support for two basic reasons. One, it creates a new tax and people are being taxed enough already. Two, we can’t even take care of our existing people and programs and to create a new quasi government program when we still have waitlists makes no sense.

Question 2: “Do you favor a $30,000,000 bond issue to improve water quality, support the planning and construction of wastewater treatment facilities and assist homeowners whose homes are served by substandard or malfunctioning wastewater treatment systems?”

Yes, I support this particular bond for wastewater treatment but would prefer in the future to build this type of bond into our budgeting process.

Question 3: “Do you favor a $106,000,000 bond issue, including $101,000,000 for construction, reconstruction and rehabilitation of highways and bridges and for facilities and equipment related to ports, piers, harbors, marine transportation, freight and passenger railroads, aviation, transit and bicycle and pedestrian trails, to be used to match an estimated $137,000,000 in federal and other funds, and $5,000,000 for the upgrade of municipal culverts at stream crossings?”

Yes, I reluctantly support it but wish that pedestrian and bike trails were not included and instead funded by nonprofits and other charitable organizations. These special features are used by such a small fraction of people and it’s unfair to have the cost spread to everyone.

Question 4: “Do you favor a $49,000,000 bond issue to be matched by at least $49,000,000 in private and public funds to modernize and improve the facilities and infrastructure of Maine's public universities in order to expand workforce development capacity and to attract and retain students to strengthen Maine's economy and future workforce?”

No, I do not support this particular bond.

The University of Maine Department has already been allocated a total of $429,194,221.00 for fiscal years 2017-2019 alone and I feel that is sufficient; they need to prioritize their spending.

Also, included in this bond are funds for upgrading heating and ventilation which I would should be included in annual budgeting process and not bonded where we will have to pay 4.25 percent interest. For specific information you may wish to read http://www.mainelegislature.org/legis/bills/display_ps.asp?ld=836&PID=1456&snum=128

Question 5: “Do you favor a $15,000,000 bond issue to improve educational programs by upgrading facilities at all 7 of Maine's community colleges in order to provide Maine people with access to high-skill, low-cost technical and career education?”

No, I do not support this bond and feel current levels of funding are adequate and would like to see community colleges continue to prioritize programs that best reflect the local job market and opportunities here in Maine.

Please feel free to expand or add any thoughts here that we have not touched upon.

I am concerned about the growing popularity of socialism especially with younger college educated individuals. As Margaret Thatcher so famously stated “the problem with socialism is you eventually run out of other people’s money”, I agree with her.

The reason for the rise in socialist tendencies is largely due to a shift in what and how students are taught. It was a mistake to eliminate the history of freedom and liberty from the classroom. Our founding fathers were wise beyond their years in setting up our country as they did. I am concerned that in this increasingly politically correct society we live in that some history on how and why this nation was founded may not be given enough time in our student’s curriculum. As a result we are in great danger of condemning the state of Maine to ever increasing taxation, thus undermining the economy, creating poverty and thus dependency, and the flight of wealth from the state

I would like to thank the Pen Bay Pilot the opportunity to help us publicize our perspectives and political positions. Please feel free to contact me with comments or additional questions: (207) 380 -3406 or pgsutton@hotmail.com

Be sure to like and follow my Facebook page for updates and information.

https://www.facebook.com/Paula-Sutton-for-Maine-State-Representative-1451878161715330/

Event Date

Address

United States