John Davidson's Economic Comments

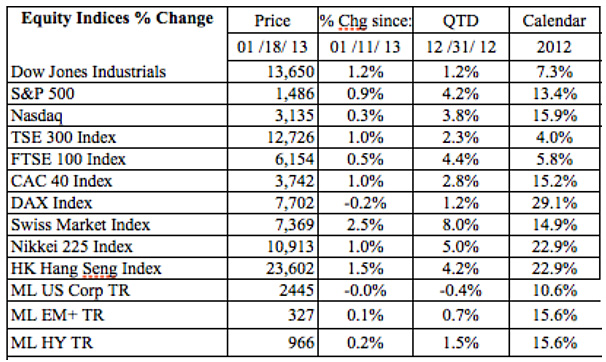

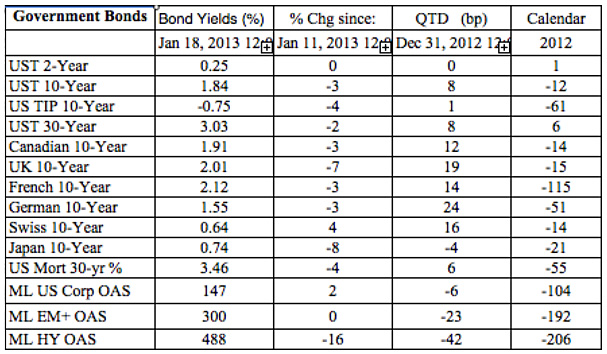

Economic releases this week portrayed recovery of the economies of the U.S. and China, but softness of those in Europe. Equity prices were higher shaking off any worry about the inability of Washington to address its fiscal budget deficit issues. Government bond yields were lower on the week, but remained higher on the year. Credit spreads on lower quality issues were narrower on the week and on the year to date basis. Commodity prices and the U.S. dollar were higher on the week.

Perspective:

In today's NY Times, former vice chair of the Federal Reserve, Alan Binder, wrote, "Financial Collapse: A 10-Step Recovery Plan." He offers a sensible outline on how to move forward to manage the risk of another financial crisis. His article starts, "Hegel once wrote, 'What experience and history teaches us is that people and governments have never learned anything from history.' Actually I think people do learn. The problem is that they forget--sometimes amazingly quickly."

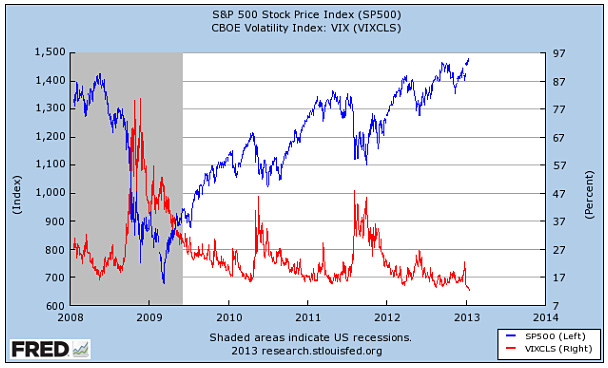

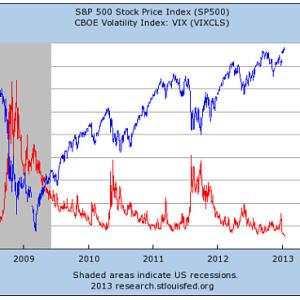

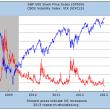

This week's record close of the S&P 500 was evidence that U.S. investors were not worried about the U.S. falling into a second recession or the partisan divide in Washington causing another crisis and downgrade of U.S. debt. The chart below shows that the S&P 500 (blue in the chart below) closed at the highest level since the Great Recession. The VIX is the implied volatility of option prices; it is a measure of what investors are paying for options which would provide insurance against movement in the S&P 500 Index. The VIX (red in the chart below) closed at the lowest level since the Great Recession. Meanwhile, the stocks in the S&P appear to be fairly valued, closing the week at 17.46 times historic earnings and 13.27 times forward 12 months earnings by Birinyi Associates as reported by the on-line Wall Street Journal.

Economic Releases:

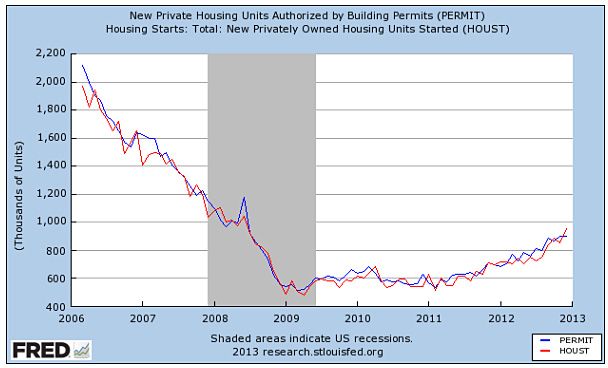

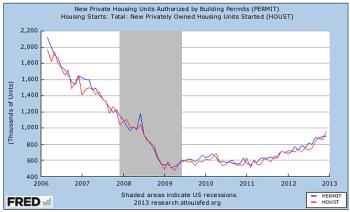

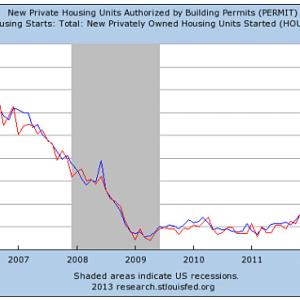

U.S. housing continued to show signs of recovery this week. Housing Starts (red in the chart below) increased to 954,000 in December, the highest level in over five years. Similarly, Housing Permits (blue in the chart below) inched higher to 903,000. These numbers were part of a continued recovery in housing, but still pale in comparison to the 2 million per month peaks in 2005 and 2006. In other housing news, the National Association of Home Builders Housing Market Index remained unchanged at 47 in January after several months of significant improvement, but remained short of 50, the demarcation where more builders would describe conditions as good.

Other Economic Releases

Amid this U.S. recovery, inflation has yet to rear its ugly head. In the month of December Producer Prices fell -0.2 percent; even without the more volatile food and energy components Core PPI rose only +0.1percent. Similarly, CPI was flat in December while the Core CPI rose only +0.1 percent. Also in December, Retail Sales rose +0.5 percent; less auto's Retail Sales still rose +0.3 percent. Industrial Production rose +0.3 percent in December while Capacity Utilization ticked up to 78.8 percent. Initial Jobless Claims fell -37,000 to 335,000 in the week of Jan. 12, bringing the four-week average down to 359,250. On the softer side, the University of Michigan's Consumer Sentiment slipped to 71.3 and the Philadelphia Fed Survey fell back into negative territory in January.

European Union Industrial Production fell -0.3 percent in November. In December, Consumer prices rose +0.4 percent after a -0.2 percent decline in November. In Germany CPI rose +0.9 percent in December, which contributed to a 2.1 percent YOY increase. In the UK, December CPI rose +0.5 percent, 2.7 percent YOY; UK's PPI fell -0.1 percent for Output and -0.2 percent for Input.

News from China was strong this week. China's GDP rose +2.0 percent in the 4th quarter, up 7.9 percent from a year ago. China's Industrial Production increased +0.87 percent, up 10.3 percent from a year ago. December's Retail Sales increased 1.53 percent, up 15.2 percent from a year ago.

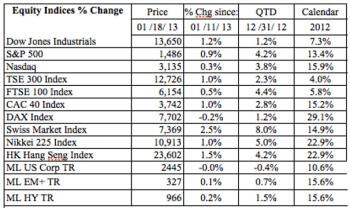

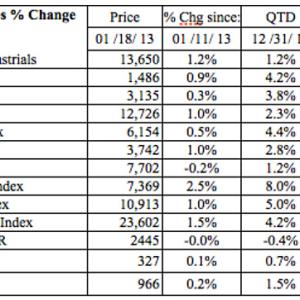

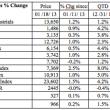

Equities Markets:

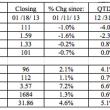

Most equity markets were higher again this week. Only the DAX below experienced a loss on the week and all of the equity markets below have posted a gain for the start of the new year. Several indices reached post recession highs. The higher quality bond markets like the Merrill Lynch U.S. Corporate Investment Grade Index have experienced losses to start the year due to rising interest rates that have overcome falling credit spreads.

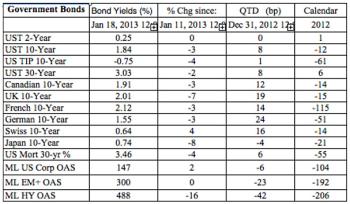

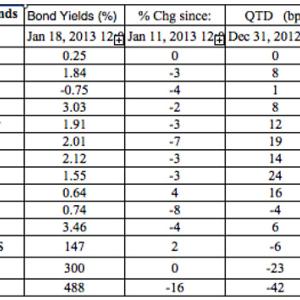

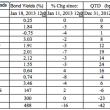

Bond Markets:

Government Bond yields were a touch lower with the exception of the Swiss 10-year. On a year-to-date basis, yields are higher (and prices are lower) for most Government bonds. Credit spreads for lower quality issues were lower this week and YTD.

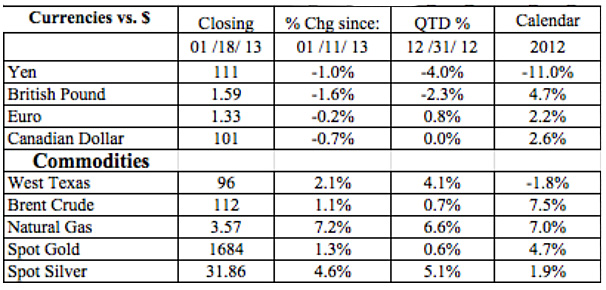

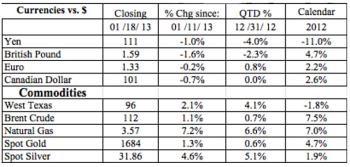

Currencies and Commodities:

The U.S. dollar gained against the other currencies this week. Monetary and fiscal easing policies in Japan continued to put pressure on the Yen. Energy and Metal Commodity prices increased this week and are up from their values at year end.

-----------------------------------------------------------------

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States