John Davidson's Economic Comments

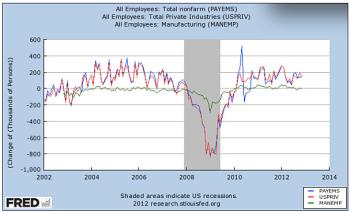

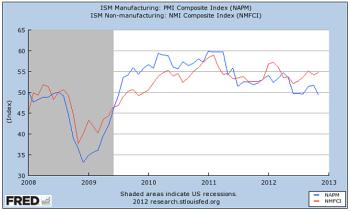

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

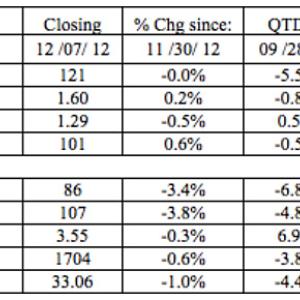

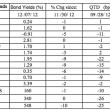

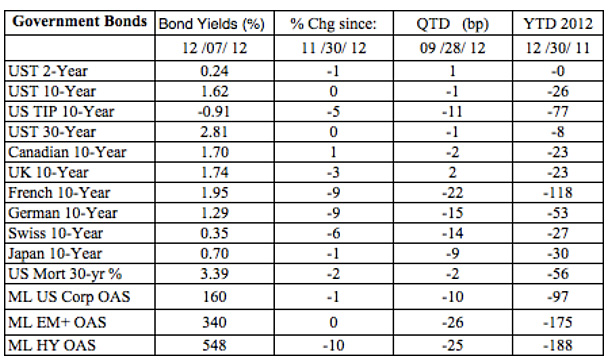

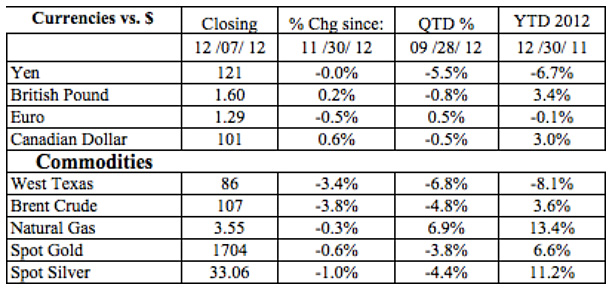

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

John W. Davidson CFA; jwdbond@gmail.com; 207-701-1321.

John W. Davidson CFA; jwdbond@gmail.com; 207-701-1321.

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

Chart Source: Federal Reserve Bank of St. Louis FRED database

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

Data Source: Bloomberg Applications for iPhone and iPad

John W. Davidson CFA; jwdbond@gmail.com; 207-701-1321.

John W. Davidson CFA; jwdbond@gmail.com; 207-701-1321.

US economic releases were better than expected with hurricane Sandy having very little impact on early November data. Europe's releases confirmed that the EU remained in contraction. These reports were all but ignored as investors awaited the outcome of negotiations in Washington. Both stocks and bonds prices inched higher this week while energy and metals commodity prices declined, and the US dollar was mixed.

Perspective:

With all eyes focused on the fiscal cliff negotiations what are we not seeing? While we are frustrated with the inability of our elected officials to reach a agreement, we may be missing the threat from elsewhere, like the Middle East, the source of OPEC-controlled oil reserves. The uprisings in Syria and Egypt, the Israeli and Palestinian conflict, and the Iranian nuclear bomb all threaten more than just our economic well being.

To learn more about those threats I commend to you this year's Camden Conference, The Middle East--What Next? Next year's Conference will be held next February 22-24. Click on the link imbedded in the topic to learn more about the program. Tickets are now being sold on the web site for both seats at the Camden Opera House as well seats in the live streaming venues at the Strand in Rockland and the Hutchinson Center in Belfast. Conference videos will be available on the web site for viewing after the event.

Economic Releases:

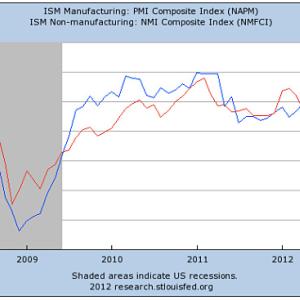

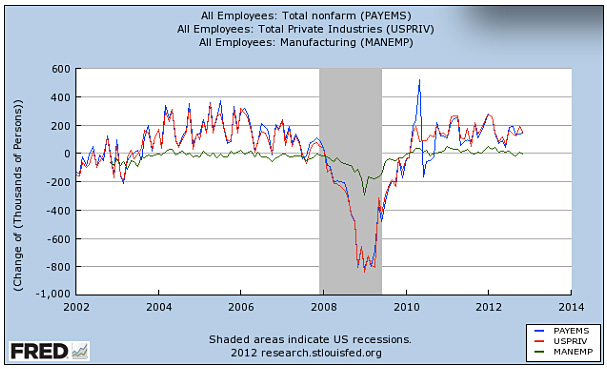

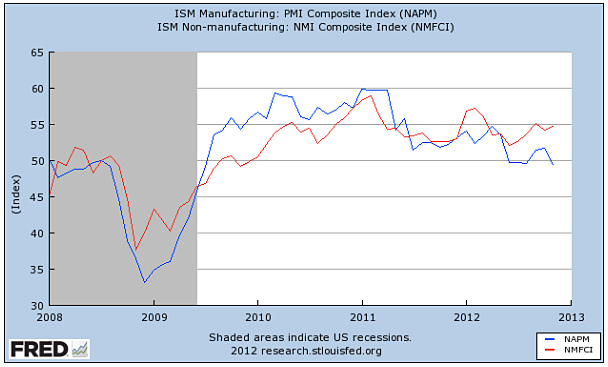

The US Employment Report and the Purchasing Managers' Surveys were the first indications of economic activity in November. The impact of hurricane Sandy added uncertainty in anticipation to these releases, but Sandy's influence on November releases appeared to be minor. The PMI and employment reports show that although the rebound in manufacturing was a significant factor in the early stages of recovery, now the recovery leadership has shifted to other components of the US economy.

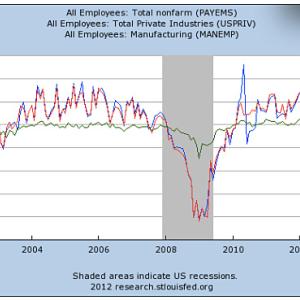

The November US Employment report was good, especially considering Sandy, but not as good as the headline numbers suggest. Non-farm Payrolls (blue in the chart below) increased 146,000 in November--at the high end of the range of expectations; September and October non-farm payrolls were revised 49,000 lower. Private Payrolls (blue in the chart below) were 147,000. Manufacturing payrolls (green in the chart below) fell -7,000. In other employment news, the Unemployment Rate dropped two ticks to 7.7% due to a drop in the participation with 350,000 leaving the workforce. The Average Hourly Earnings increased +0.2% while the Average Workweek remained unchanged at 34.4 hours. For the week of December 1st, the Initial Jobless Claims dropped 25,000 to 370,000; the 4-week moving average, though, increased to 408,000.

The Purchasing Managers Index (PMI) for Manufacturing (blue in the chart below) in the US, at 49.5, slipped back into the contraction zone below 50. The PMI for Services (red in the chart below) increased to 54.7.

Europe's PMI's remained in the contraction zone in November. In the EU, the PMI for Manufacturing increased a point to 46.2; Germany's PMI for Manufacturing increased to 46.8; UK's PMI increased almost 2 points to 49.1. The UK's PMI for Services slipped, but, at 50.2, remained in the expansion zone. China's PMI for Manufacturing increased to 50.5.

Other Economic Releases:

In other US releases, the University of Michigan's Consumer Sentiment Index dropped over 8 points to 74.5 in December. October Factory Orders increased +0.8%. In the 3rd quarter, US Non-farm Productivity increased 2.9% while Unit Labor Costs decreased -1.9%.

The Bank of Canada met and left its benchmark rate at 1.0% where it has been since September of 2010.

The European Central Bank met and, as expected, made left its benchmark rate unchanged at 0.75%, but revised growth expectations lower for 2012 and 2013. The Bank of England also met and made no change in either their benchmark rate, at 0.5%, or asset purchases, at 375 billion pounds. 3rd quarter EU GDP contracted -0.1% from the previous quarter. EU's Retail Sales fell -1.2% in September. In Germany, October Industrial Production fell -2.6%, but October Manufacturing Orders increased 3.9%. The French Unemployment Rate increased 2 ticks to 9.9%. In the UK, Industrial Production fell -0.8% in October.

China's Industrial Production increased +0.86% in November. Japan's GDP contracted -0.8% in the 3rd quarter.

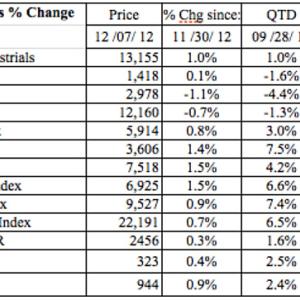

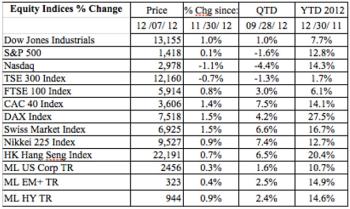

Equities Markets:

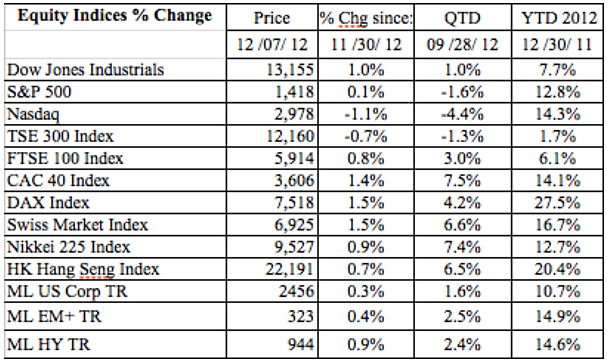

Equity markets added hesitantly again to the previous two week's gains in hopes that an agreement to avoid the fiscal cliff would emerge to spur stock prices higher. Only the tech-heavy Nasdaq and the Toronto exchanges posted negative results on the week.

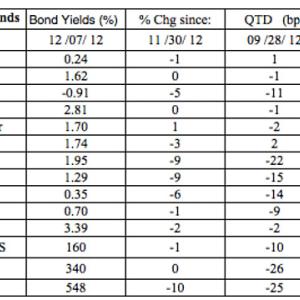

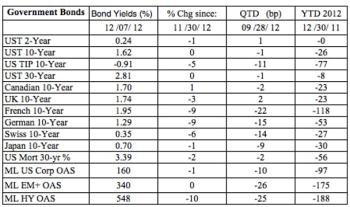

Bond Markets:

Again this week, bond markets gained (in price) while stock markets edged higher. Credit spreads declined providing better returns in the spread markets.

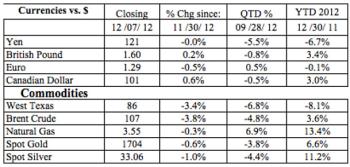

Currencies & Commodities:

The US Dollar was mixed on the week, gaining against the Euro, but falling against the Pound and Looney. Energy and Metals Commodity prices declined on the week.

Event Date

Address

United States