John Davidson's Economic Comments

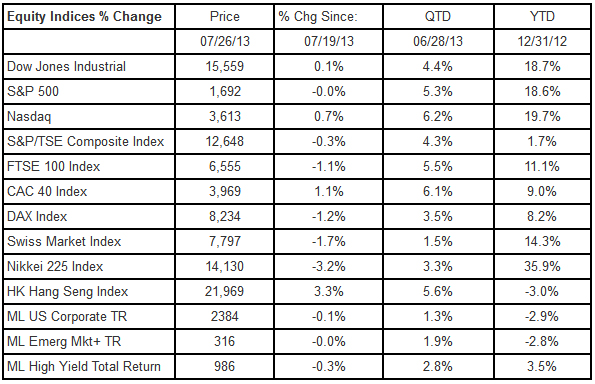

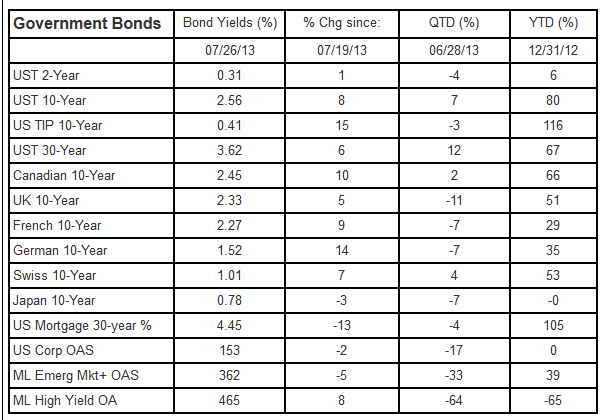

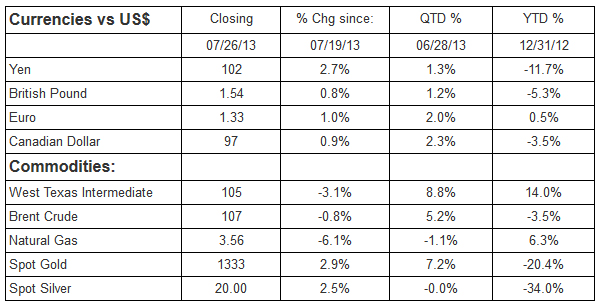

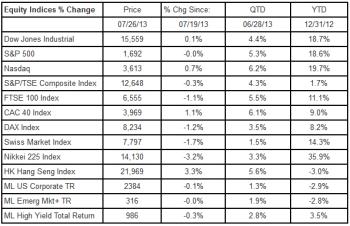

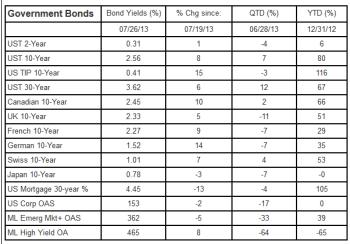

Economic releases were mixed this week. The power of the corporate earnings surprises was less than it has been over the last four years (see Perspective below). U.S. equity markets were little changed, and European and Asian markets were mixed. Bond yields rose; investment grade credit spreads fell, but high yield spreads rose. The U.S. dollar fell. Energy commodity prices fell, but metals commodity prices rose on the week.

Perspective:

This recovery has been powered by corporate earnings. We are mid-way through the earnings reporting season. Factset reported that, at this point, the number of "surprises" in the reported earnings, 73%, equals the average number of surprises over the last four years. Corporations like to surprise shareholders on the upside to booster the stock price. Over a longer period of time, by the end of the reporting season about two-thirds of the S&P 500 companies report earnings that exceed expectations. Since the calendar reporting cycle is pretty stable (ie companies generally report on a consistent basis within the quarterly calendar) comparisons from period to period are reasonable. Although the number of "beats" equals the average of the past four years, the amount by which the companies exceed expectations is less. On average over the last four years those that have beat expectations have done so by 7.3%. This quarter the "beats" have exceeded expectations by only 3.2%. In a subtle way, the earnings engine of the U.S. economy has lost some of its steam.

On a personal matter of beating expectations I must report that my wife and I just returned from our first overnight cruising on the coast of Maine to Buck's Harbor. Sailing our boat from the Chesapeake to Maine in May in some tough weather did not count as a pleasure cruise. We had a beautiful sail to the arbor, joined friends for dinner, slept on the boat, and successfully navigated home through the fog. We had high hopes for the cruise, but the trip still beat expectations!

Economic Releases:

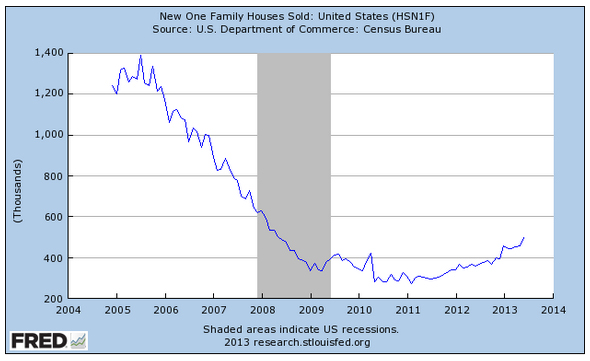

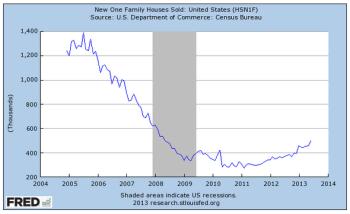

U.S. New Home Sales (blue in the chart) increased to 497,000 in June; this above-expectations release was a welcome positive note for the U.S. housing market, but it pales in comparison to the pre-Great Recession peak of 1.4 million in 2005. In other housing news, Existing Home Sales declined to 5,08 million in June, a 15% increase from a year ago, but on the low end of the range of expectations.

Other Economic Releases

Initial Jobless Claims increased to 343,000 in the week of July 20th. The four-week average of claims dropped to 345,250. Continuing Claims, on the other hand, showed a 119,000 decline to 2.997 million.

The four-week average of Continuing Claims, though is higher than it was a month ago. On a the plus side, Markit's PMI Manufacturing Index Flash report for July rose a point to 53.2. The University of Michigan's Consumer Sentiment for July rose over a point to 85.1.

Canada's Retail Sales rose 1.9% in May — well above expectations.

Markit's Flash PMI Report for the EU rose in July; Manufacturing rose to 50.1; Services rose to 49.6, and the Composite rose to 50.4. Markit's PMI report for Germany also rose: 50.3, 52.5, and 62.8 for Manufacturing, Services, and Composite. Germany's Ifo Survey for Economic Sentiment and Current Conditions were higher, but for Business Expectations were a tick lower. Markit's PMI report for France was also higher, but at 49.8, 48.3, and 48.8, remained in the contraction zone in July. The UK's 2nd quarter GDP report came in +0.6% QOQ and 1.4% YOY as expected.

Markit's PMI Flash report for China unexpectedly dropped less than a point to 47.7 in July.

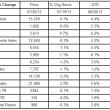

Equities Markets:

With the exception of the Nasdaq and Swiss Market Indices, equity markets continued their upward trend, driven by modest economic data and softer language coming from Central Bankers. According to Factset, 72% of the companies who have reported their earnings so far this quarter have beaten their estimates, but tech companies, like Microsoft, have disappointed; this weighed on the Nasdaq. Typically about two-thirds of the companies beat their earnings estimates. The ML bond indices rallied with lower interest rates and narrowing credit spreads.

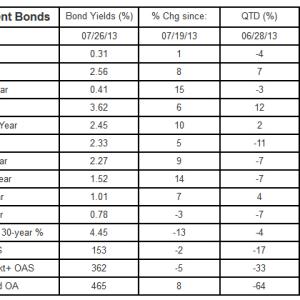

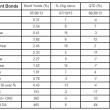

Bond Markets:

Even the bond markets responded positively to the tone of the Central Banks' music. Credit spreads also narrowed in a sign of eased concerns about credit risks.

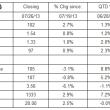

Currencies & Commodities:

The U.S. dollar was stronger against the Yen, but weaker against the other three currencies. The big news was the collapse of the Brent/WTI spread. WTI rose with lower reported inventories and expectations of a pick up of demand with the U.S. recovery.

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States