John Davidson's Economic Comments

Economic releases, particularly the U.S. Employment report, were on the firm side this week. Equity markets responded to the "good news" by rising; bond markets fell in anticipation of tapering of the Fed's bond purchases. Credit spreads narrowed, reversing the direction the several weeks of widening. Confidence in the U.S. recovery boosted the U.S. dollar against other currencies. Oil prices rose with the announcement that the White House approval for the Keystone pipeline was contingent on the determination that it would not increase the world's carbon footprint. Metals prices fell; gold has lost more than a quarter and silver has lost more than a third of its value year-to-date.

Perspective:

For the first time since its inception, this week the European Central Bank gave forward guidance on its medium-term policy outlook. ECB President Mario Draghi pledged to keep rates low for an extended period; in doing so, he joined other central bankers in providing more policy transparency. Banks of England and Canada have provided similar policy road maps. The U.S. Fed, under the leadership of Ben Bernanke, even published quarter economic forecasts. Interest rates have risen in anticipation of ending of quantitative easing (bond purchases) even though Central Bankers have insisted that their QE programs will continue for an "extended period."

I was thinking of the significance of forward guidance as I watched Andy Murray upset top ranked Novak Djokovic to win the Wimbledon title on Sunday. Bud Collins interviewed Fred Perry prior to his death in 1995. Bud reported that Perry, the last Brit to win Wimbledon (1936), said that no other Brit would ever win Wimbledon. A number of years ago, Murray was described as a "pusher." Murray's toughness was questioned when he cried on Centre Court after he lost to Roger Federer in last year's final match. When we hear "forward guidance" we should remember Murray and that things change.

Economic Releases:

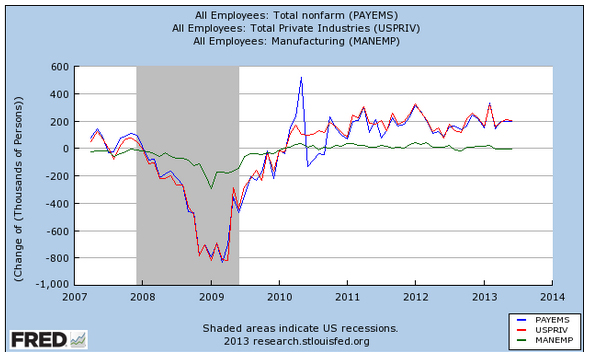

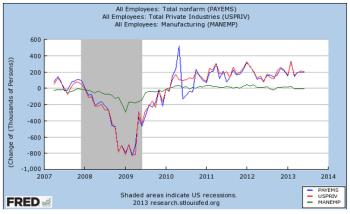

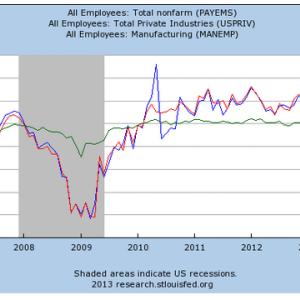

The June U.S. Employment report was positive for growth. Not only were the Non-Farm Payrolls, at 195,000 (blue in the chart), at the top of the range of expectations, but revisions to the prior two months added another 70,000 jobs. Private Payrolls (red in the chart) totaled 202,000, also at the high end of expectations, and experienced upward revisions in the prior month. Manufacturing (green in the chart) lost 6,000 jobs in June. In the household survey, household employment increased 160,000 while the labor force increased 177,000 in June; as a result, the Unemployment Rate increased a tick to 7.6%. The Average Hourly Earnings increased +0.4% while the Average Workweek remained at 34.5 hours. For the week of June 29 Initial Jobless Claims fell -9,000 to 343,0000; the four-week average of claims inched lower to 345,500.

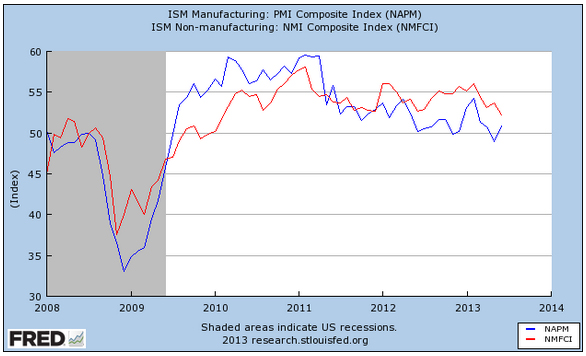

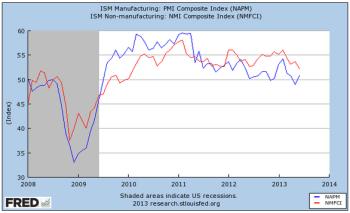

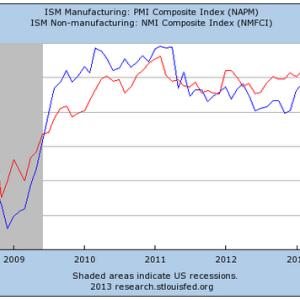

ISM's U.S. Purchasing Managers' Indices are shown in the chart. ISM's Manufacturing Index (blue in the chart) crossed into the expansion zone to 50.9. ISM's Services Index (red in the chart) fell over a point to 52.2, but remained above 50. Not shown, the Markit PMI Manufacturing Index slipped a half point to 51.9.

Other Economic Releases

U.S. Construction Spending rose a half percent and Factory Orders rose 2.1% in May.

The EU PMI for Manufacturing Index rose a half point to 48.8; the Markit PMI Composite rose a point to 48.7 while Services rose a point to 48.3. The German PMI slipped to 48.6, but the Markit PMI's for both the Composite and Services rose to 50.4. The French Manufacturing PMI rose 2 points to 48.4; the Markit PMI's for the French Composite and Services rose to 47.4 and 47.2 respectively. UK's Markit CIPS/PMI Manufacturing Index rose a point to 52.5; UK's Markit CIPS/PMI Services Index rose 56.9; the Markit PMI for Construction inched higher to 51.0. Japan's PMI Composite and Services Index each fell a couple of points to 52.3 and 52.1 respectively in June. China's HSBC Composite fell to 49.8, just into the contraction zone whle the Services Index rose a tick to 51.3. PMI's of 50 and above indicate expansion; below, contraction.

The European Central Bank met this week and, as expected, maintained rates at +0.50%. Yet, for the first time the ECB President Draghi offered the bank's first forward guidance, promising to hold rates low for an extended period of time. The Bank of England's new Chief, Mark Carney, also increased the BOE's transparency in his explanation of the BOE's decision to make no changes in rates or asset purchases.

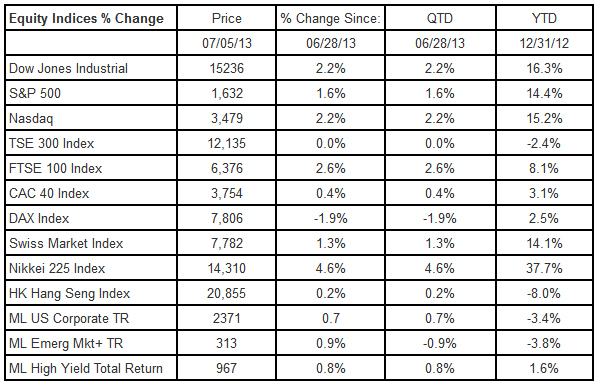

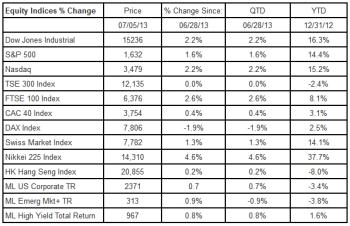

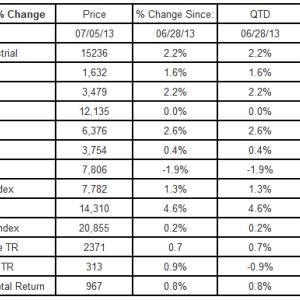

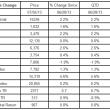

Equities Markets:

Equity markets rebounded with the good economic news, which outweighed the fear of tapering. Note that the positive returns for the ML indices were on a one-day lag so that it included the narrowing of credit spreads, but did not include the increased interest rates in reaction to Friday's positive employment report.

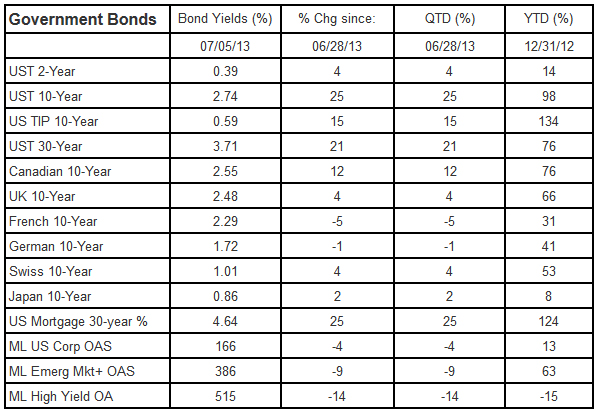

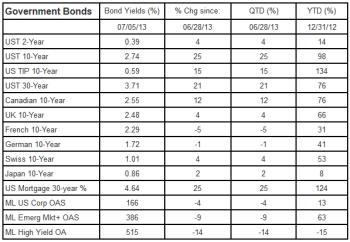

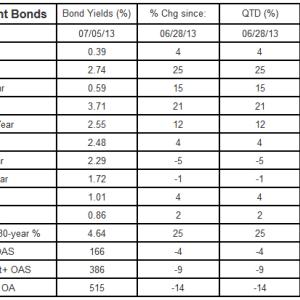

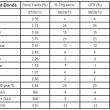

Bond Markets:

Government bond yields increased, but credit spreads narrowed on the first week of the thirrd quarter. European yields were slightly lower on the first-ever promise by the ECB to maintain the easing policy for an extended period of time.

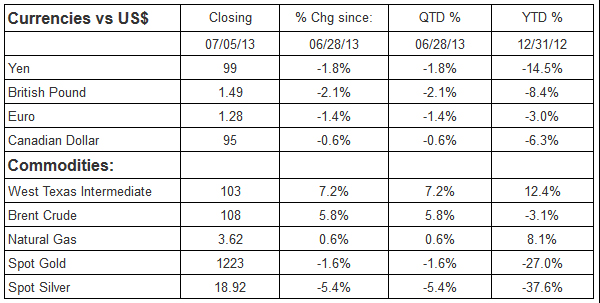

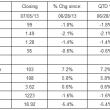

Currencies & Commodities:

The U.S. dollar rose against the other currencies for the third week in a row, based on expectations that the Fed was going to allow rates to trend higher. Oil prices rose, possibly on President Barack Obama's warning that the Keystone Pipeline approval hinged on the pipeline not increasing the world's carbon footprint. Metals prices fell again this week. YTD gold has lost over a quarter of its value; Silver has lost more than a third; so much for the safety of hard assets.

-----------------------------------------------------------------

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States