John Davidson's Economic Comments

The details of the January U.S. Employment Report were particularly encouraging even though the headline numbers appeared soft. Those details were sufficient to overcome a surprising decline in fourth quarter GDP to give U.S. equity markets a boost on a week when equity markets elsewhere were lower. Bond yields were lower and credit spreads were wider. The U.S. dollar was mixed on the week. Oil and metals commodity prices were higher.

Perspective:

After this week's FOMC meeting, the Fed released a statement that affirmed that it will keep accommodating interest rates and asset purchases in tact until the labor market "substantially" improves; the statement acknowledged the fourth quarter pause, but attributed it to transitory factors that are not likely to continue. The monthly purchases of $40 billion of agency-backed Mortgage Backed Securities and $45 billion of Treasuries are likely to continue at least through this summer; the rate of growth has not been sufficient to reduce unemployment to the 6.5% target. Yet, the indicators of growth in the U.S. has been too strong to expect an increase in QE. The easing of the sovereign debt crisis in Europe and the resurgence of growth in China are possible positive factors for 2013. Most signals on U.S. growth are positive, but the potential lack of cooperation in Washington could derail the U.S. fragile recovery.

The signals for Davidson family, on the other hand, have all been positive; 2013 has had a robust start. This week our daughter was admitted to the Society of Actuaries in the UK (she has added the initials FIA after her name) and our son was ordained as a minister. We look forward to celebrating the marriage of our son this year; this is the third of our five children to marry in as many years. We are blessed with these additions to our family.

Economic Releases:

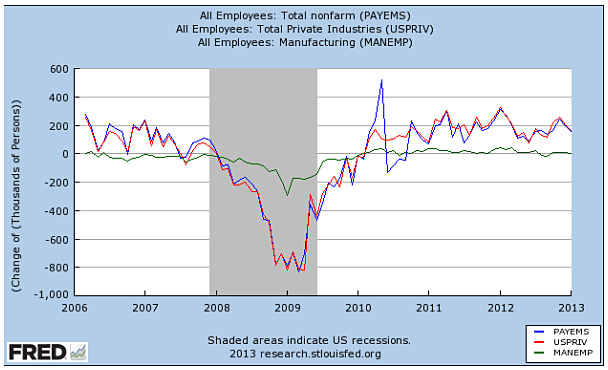

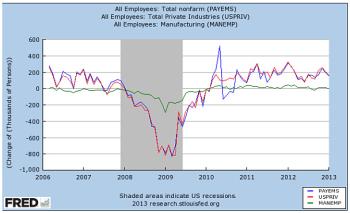

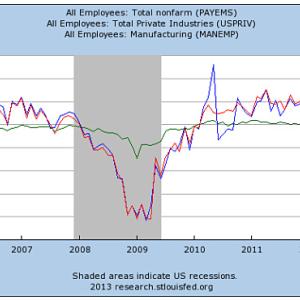

The U.S. Employment Report was stronger than suggested by the headline increase of 157,000 Non-Farm Payrolls (blue in the chart and tick up in the Unemployment Rate to 7.9% in January. Net revisions of November and December Payrolls were 156,000, showing that job growth had been stronger than previously reported. Average monthly employment gains in 2012 were 181,000, an increase of 28,000 prior to the revisions. Average Hourly Earnings increased +0.2%; the Average Workweek remained at 34.4 hours. Private Payrolls (red in the chart below) totaled 166,000; Manufacturing Payrolls (green in the chart increased 4,000. For the week of Jan. 26, Initial Jobless Claims increased to 368,000, making the four-week average little changed at 352,000. While the job growth was better than previously reported, the job creation was not sufficient to prevent the fourth quarter GDP decline in the U.S.

Other Economic Releases

Surprisingly, the first quarter U.S. GDP contracted -0.1%, well below the range of expectations. Since the decline was largely due to the slowing of inventory and drop in government purchases, most believe that this contraction is a temporary event and is unlikely to feed into the technical definition of recession, two successive quarters of GDP contraction. The FOMC meeting Statement acknowledged the slowdown, but attributed the slowdown to special factors such as "weather-related disruptions." The Fed Governors made no change in the fed funds rate or in their monthly asset purchases. In contrast to the weaker Q4 GPD report, Durable Goods Orders increased 4.6% in December, up 1.3% ex-transportation. The ISM Purchasing Managers Index for Manufacturing rose to 53.1, further into the expansion zone in January. In December Personal Income increased 2.6%, well above expectations, but Consumer Spending increased only +0.2; accelerated dividend and bonus payments contributed to the Income boost. The University of Michigan's Consumer Sentiment rose 2 points to 73.8, but the Conference Board's Consumer Confidence Index declined 8 points to 58.6 in January.

The EU's PMI for Manufacturing rose over a point to 47.9 in January, but still remained in the contraction zone below 50. December's EU Unemployment rate remained unchanged at 11.7%. The EU inflationary forces remained in control in January with a 2.0% YOY increase in the Harmonized Index of Consumer Prices. On the positive side, the EU Economic, Industrial, and Consumer Sentiment Indices all rose in January. Germany's Unemployment Rate ticked down to 6.8% in January. Germany's PMI for Manufacturing rose to 49.8 keeping it just inside the contraction zone in January; Retail Sales, on the other hand, fell -1.7% in December.

China's PMI for Manufacturing, as published by HSBC/Markit rose a point to 52.3, but its CFLP PMI for Manufacturing slipped two ticks to 50.4 in January.

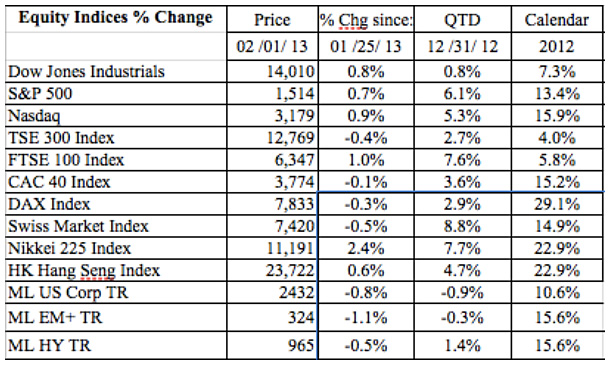

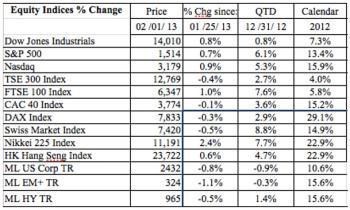

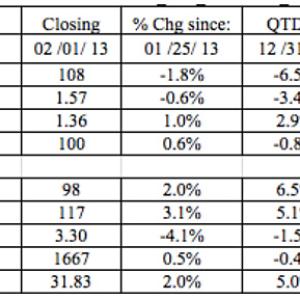

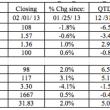

Equities Markets:

Equity markets were mixed across the globe, but higher in the U.S. after the release of the January Employment Report this week.

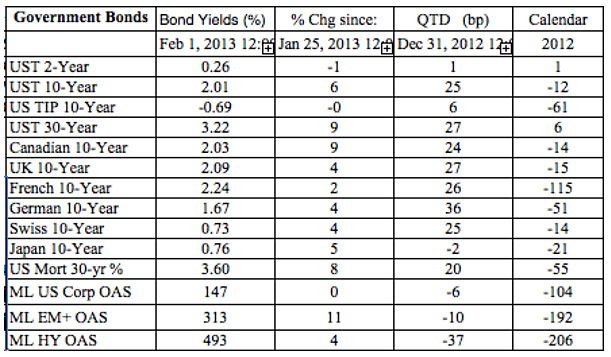

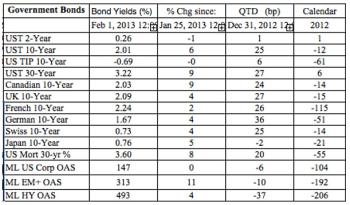

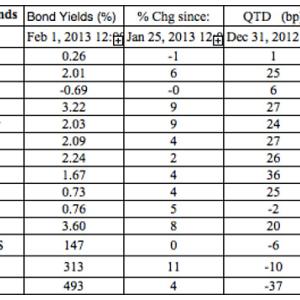

Bond Markets:

Government Bond yields were mostly higher and credit spreads were wider, which generated negative returns for the bond indices.

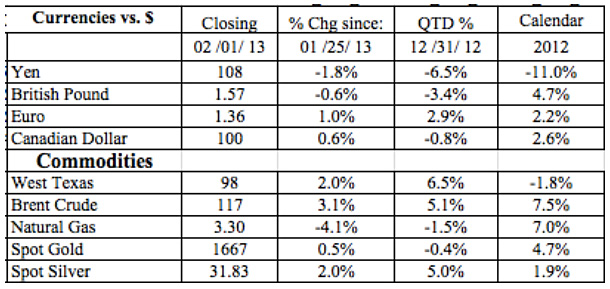

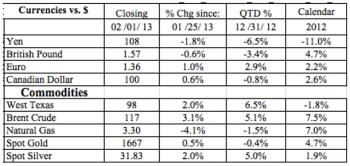

Currencies & Commodities:

The U.S. dollar gained against the Yen and Pound, but fell against the Euro and Looney this week. Oil and Metal Commodity prices rose while Natural Gas prices fell on the week.

-----------------------------------------------------------------

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States