John Davidson's Economic Comments

Economic releases were mixed again this week. The U.S. Employment report came in on the low end of expectations, and, as such, eased concerns that the Central Bankers were going to taper their purchases of bonds (QE) in the near term. Equity markets rose, but bond markets were mixed. The U.S. dollar and oil prices strengthened, but metals prices declined on the week.

Perspective:

As I was enjoying my muffin and coffee and reading my morning papers at the Bagel Cafe, a fellow investor approached me to ask what I thought of the economy. I told him that I thought that the U.S. recovery has had some recent signs of softening, but it was still growing. This quarter's earnings season was strong, but, as reported last week, the amount by which companies exceeded estimates was less than it had been. This week, FactSet reported that analyst estimates for the third quarter have been coming down, but the S&P and Dow has been hitting record highs. That exchange and report prompted me to check on the PE ratios. As of Friday's close the S&P 500 was selling at 18.6 times historic earnings; but, using forward earnings expectations, it is selling at 15.1 times (WSJ, Market Data Center Source: Birinyi Associates). On an earnings basis, stocks appear to be fully valued, not cheap, but, also not priced with irrational exuberance.

Economic Releases:

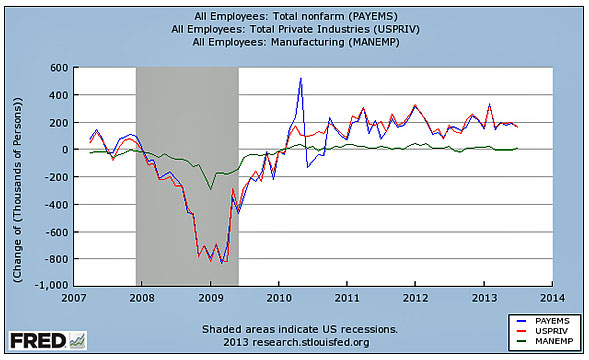

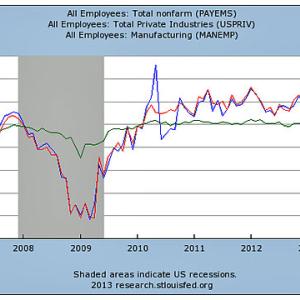

The U.S. Employment report for July came in on the soft side of expectations, which had been boosted by the ADP report of an increase of 200,000 new private sector jobs. Non-Farm Payrolls (blue in the chart) increased by 162,000; Private Payrolls (red in the chart) increased by 161,000; Manufacturing Payrolls (green in the chart) gained by 6,000. Average Hourly Earnings fell -0.1%; the Average Workweek slipped a tick to 34.4 hours. On the positive side, the Unemployment Rate fell two ticks to 7.4%, with a fall in the labor force as well as the number of the unemployed reported in this household survey. The weekly Initial Jobless Claims had a positive surprise 19,000 drop to 326,000; the four-week average of Claims fell to 341,250.

Other Economic Releases

The lack of robustness of the economic releases has not been lost on the Federal Reserve. The FOMC met this week and made no changes in interest rates or QE; the Fed declined to provide a timetable for the expected tapering of the bond purchasing program. The changes in the statement released after the meeting acknowledge the increases in home mortgage rates and characterized the pace of economic activity expansion as "moderate." second quarter GPD increased 1.7%, near the high end of expectations; first quarter GDP was revised down over a half point to 1.1%. While above expectations, this year's growth slow-down has been of concern to the U.S. Central Bankers.

Both ISM's and Markit's Purchasing Managers' Manufacturing Surveys for July rose further into the expansion zone; ISM's rose more than four points to 55.4; Markit's rose two points to 53.7. The Case Shiller Home Price Index rose 1% in May and posted at 12.2% YOY increase. The index of Pending Home Sales slipped -0.4% in June. In spite of the strong gain in the present conditions component, the Conference Board's Consumer Confidence fell a point to 80.3 in July. June Personal Income and Consumer Spending rose by +0.3% and +0.5% respectively; both were on the high end of expectations. June Factory Orders, at +1.5%, were below consensus.

Similarly to the Fed, the European Central Bank met and left its rates unchanged this week; President Mario Draghi provided forward guidance in that the ECB expects to keep interest rates low for an extended period of time. He noted that unlike other Central Bankers, the ECB Board of Governors serve on a "personal" not "national" capacity and are independent of the policies of their respective countries. The Bank of England also met and left its policy interest rates and asset purchases unchanged.

The EU's PMI Manufacturing Index crossed into the expansion zone to 50.3 in July. Expansion signals by Germany (50.7), Italy (50.4), and the Netherlands (50.8) overcame contraction signals from France (49.7), Australia (49.1) and Greece (47.0). EU Inflation remained in check at 1.6% YOY in July. The German Unemployment Rate remained unchanged at 6.8% in July, but German Retail Sales fell -1.5% in June.

Japan's Markit PMI for Manufacturing fell in July, but, at 50.7, remained in the expansion zone. In contrast Japan's Industrial Production fell -3.3% in June. China's Markit PMI for Manufacturing slipped to 47.7 in July; yet, the government-sponsored CFLP PMI for Manufacturing increased two ticks to 50.3.

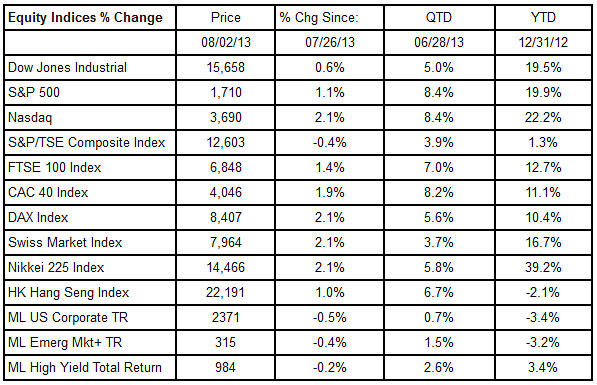

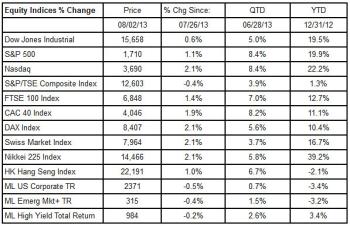

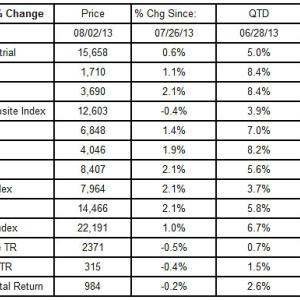

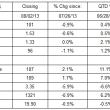

Equities Markets:

With the exception of the Canadian TSE, equity markets were higher on the week. The Dow and the S&P rose to new record highs. Credit markets fell on the week ending Thursday prior to the release of the softer U.S. Employment Reports. Note that the ML Bond Indices and spreads are reported on a one-day lag.

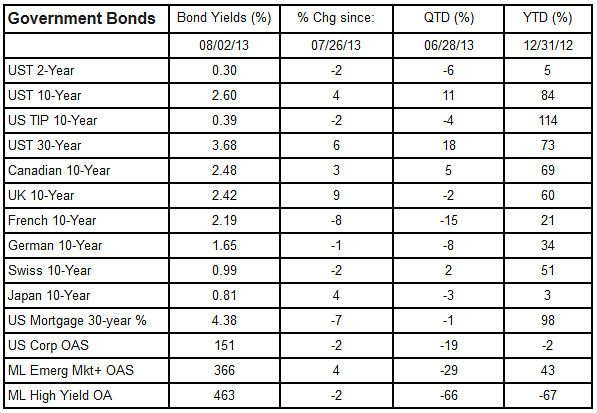

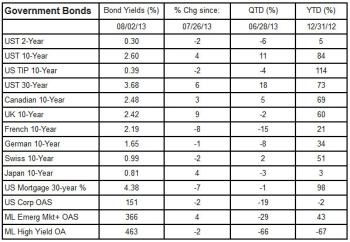

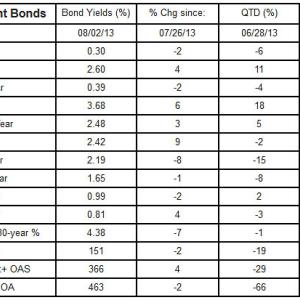

Bond Markets:

Bond yields and spreads were mixed in the week.

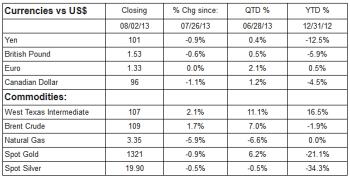

Currencies & Commodities:

The U.S. dollar rose on the week with the softer employment report. Oil commodity prices rose, but Natural Gas and metals prices fell on the week.

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments more than a decade ago as a personal discipline when he was promoted to from portfolio manager to chief investment officer and CEO.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine, where he focused on board work.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services have quoted his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a naval officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserve, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is also on the investment committee of the Pen Bay Health Foundation. He serves as an independent trustee for mutual funds.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States