John Davidson's Economic Comments

Central Bankers have been noticing that the global economy has been picking up. This "good news" has had a "bad news" reaction from the capital markets. The good news had raised the fear that the Central Bankers will start to taper or stop the quantitative easing that has encouraged investors to assume more risk. This week's releases added to those fears and the equity markets declined and credit spreads widened. The U.S. dollar declined and oil and metals prices closed a bit higher. Government bonds rallied across the globe as interest rates dropped.

Perspective:

Last month, after two weeks of battling the seas, winds and rain I was relieved to finally arrive in our home port of Camden from the Chesapeake Bay, where our boat spent the winter. We traveled up the Chesapeake, through the C&D Canal and down the Delaware Bay. The antenna on top of the mast had tickled the rafters of a 55-foot bridge at Cape May. We had carefully plotted out the route with way-points, but changed the routes when the weather dictated. Although we planned to travel through New York City's Hells Gate, we took the open-sea route south of Long Island from New Jersey. But, as we approached Long Island heading to the Cape Cod Canal, we experienced some heavy seas with swells that reached 13 feet. When the winds were forecast to reach 35 knots we found shelter, first at Shinnecock Inlet and then at Block Island. When we could, we sailed around the clock initially four hours on watch and four hours off till we picked up a third watch-stander in Long Island. Adverse winds forced us to motor most of the way and we had to worry about running out of gas. With an hour of fuel in our tanks, we picked up a mooring at Monhegan Island. Finding no gas on the Island, we decided to cast our fate on our sails on the final leg of the trip to Camden. Despite the rain, that last leg was one of the most pleasant parts of the voyage.

When I expressed my relief at being in port to a close friend, he sent me the following quote from retired Rear Admiral Grace Murray Hopper: "A ship in port is safe, but that's not what ships are built for." Our sailboat, like a U.S. Navy ship, is made for being underway. So it is for our boat as it also is for our investment portfolio. Investing starts with a plan with routes and way-points. As forecasts dictate, we trim and, sometimes, reef the sail to reduce the exposures. We sometimes need to find a hurricane hole to allow a storm to pass, but we never abandon the voyage. To re-phrase Admiral Hopper, "A portfolio in cash is safe, but that's not what investment portfolios are built for."

Economic Releases:

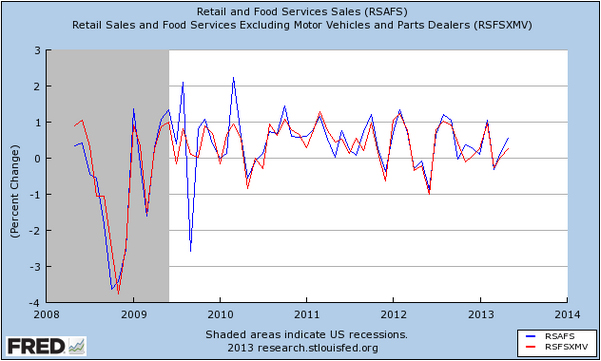

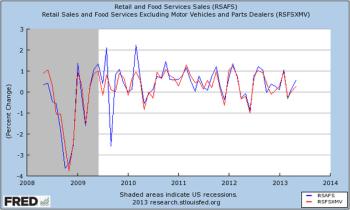

The driver of the U.S. recovery has changed from manufacturing back to the consumer. May's Retail Sales was further evidence of that. May's Retail Sales (blue in the chart) increased +0.6 percent. Without the more volatile automobile sector, Sales still rose +0.3 percent.

Other Economic Releases

Improvements in the employment situation have supported the consumer. This week's Initial Jobless Claims dropped to 334,000; the four-week average dropped to 345,250. Continuing Claims, reported on a one-week lag, inched 2,000 higher, but the four-week average of Continuing Claims dropped to a post-recovery low of 2.967 million. The University of Michigan's mid-June Consumer Sentiment slipped two points to 82.8, but the expectations component remained strong. On the softer side, Industrial Production was flat and Capacity Utilization eased a tick to 77.6 percent in May.

In the EU, April's Industrial Production increased +0.4 percent from the previous month, but fell -0.6 percent from a year ago. France's Industrial Production increased +2.2 percent in April, surprising most forecasters. In the UK, Industrial Production increased only a tick and Manufacturing Output slipped -0.2 percent.

When the Bank of Japan met this past week, its monetary board left its interest rates, asset purchase, and JGB purchase programs unchanged pointing to a pick-up in the economy.

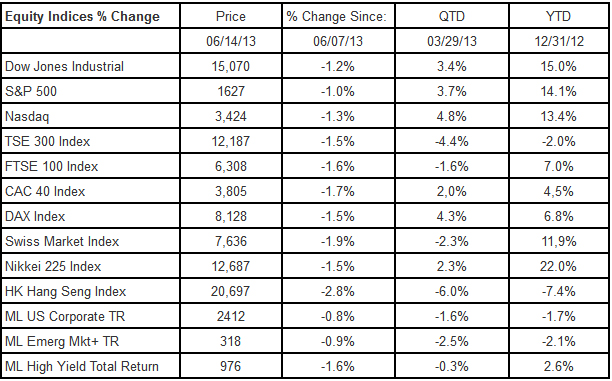

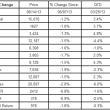

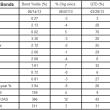

Equities Markets:

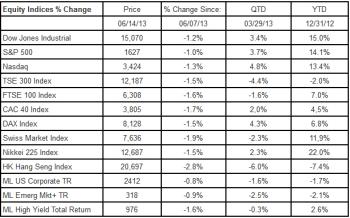

Equities fell across the globe and credit spreads rose as investors sold securities to lower the risks in their portfolios. The widening of the credit spreads was sufficient to cause the Merrill Lynch credit indices below to generate negative returns for the week in spite of the rising prices of Government Bonds. (Note: I am trying a new format for these tables. Comments welcome)

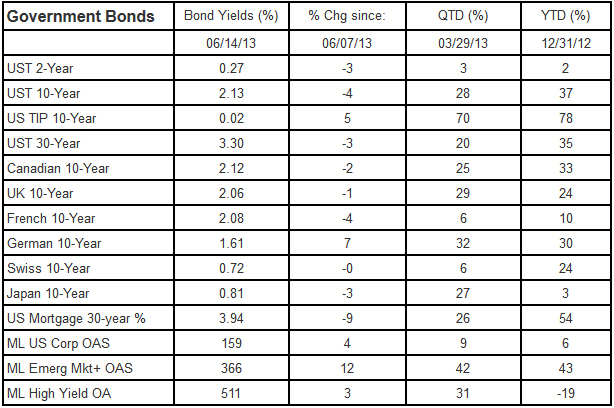

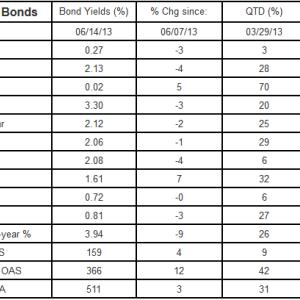

Bond Markets:

Government bond yields fell and prices rose on the week. TIPS were one exception where the yield on the 10-year TIP turned positive for the first time since December 2011. Credit spreads widened again this week as noted above.

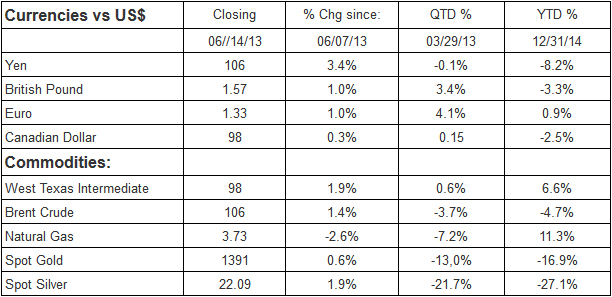

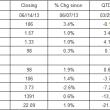

Currencies & Commodities:

The U.S. dollar fell against the other four currencies listed below. Oil and metal commodity prices rose on the week, but Natural Gas prices fell.

-----------------------------------------------------------------

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States