John Davidson's Economic Comments

After four consecutive weeks of softer economic releases, this week's economic reports proved a relief to concerns about a slow-down in the U.S. Stronger U.S. employment, firming housing and re-assurances of flexibility from the Federal Open Market Committee meeting more than offset declining U.S. PMI's (which still remained in the expansion zone). Elsewhere, economic reports showed that the EU's economy remained soft and Asia's economic growth slowed. Bond yields rose after Friday's release of the U.S. employment report. Credit spreads narrowed as investors reached for yield and were willing to assume greater risks to get the yield. The yen and the U.S. dollar declined. Oil and metals commodity prices rose on the week.

Perspective:

A few of the retired financial executives in Camden have been getting together monthly for breakfast at Boynton's for some steel-cut oatmeal and a discussion about the economy. This past week one of the significant contributors to the discussion made a couple of points worth repeating here. Bear in mind this discussion happened before this week's good news on the U.S. employment. We discussed recent reports of 46% and 39% defaults of those whose mortgages were re-negotiated in the third and fourth quarter of 2009 under the loan modification HAMP program. We had acknowledged four consecutive weeks of softening U.S. economic data four years after the official end of the recession. Why has recovery taken so long?

One of our breakfast colleagues pointed out a Financial Times article by Chris Giles, "Bankers say they are flying blind." The article reported on the mood of the IMF spring meeting, where economists said, "We don't fully understand what is happening in advanced economies." One of the three legs of Ed Hyman's anti-sell-in-May thesis is Central Bankers' easing policies. Yet, Central Bankers don't know what they are doing?

Economic forces have a way of adjusting to find equilibrium. A second reason for the slow recovery was that political forces have not allowed for those adjustments. Except for Lehman, the government did not let the banks fail; the government stepped in with mortgage modifications for those whose mortgages exceeded the value of their homes; the government extended unemployment benefits for those who have not found work. Those of us at the Boynton breakfast were not arguing against these policies, but we acknowledged that the consequence of helping many of those in need is a longer period of time of adjustment.

Finally, instead of addressing the problems and causes, we have responded to the symptoms and served the needs of constituent groups. We have not addressed the tax code and we have not put in place policies that would avert another financial crisis. We have not really done anything about the underlying issues.

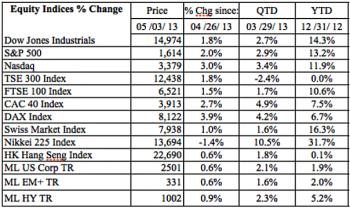

Yet, in the face of this, the good news on the U.S. economy at the end of the week lifted the Dow and S&P to record highs. Are they too high? As of Friday, the Dow Jones Industrials and the S&P 500 closed at 16.4 times and 18.5 times trailing earnings; they closed at 13.3 and 14.4 times estimates of earnings for the next 12 months. The P/E ratios on the indices are a bit high, but have not reached the level of "irrational exuberance." The slowness in the recovery has restrained the equity markets sufficiently that when this week's positive employment report was released, the equity markets rose.

Economic Releases:

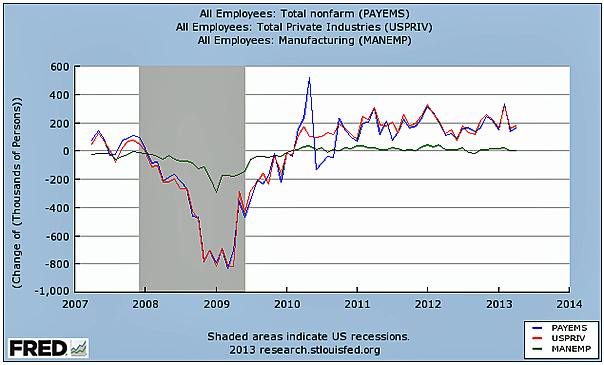

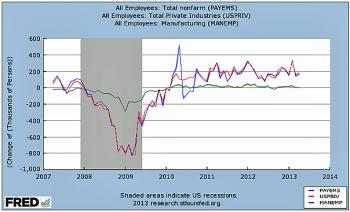

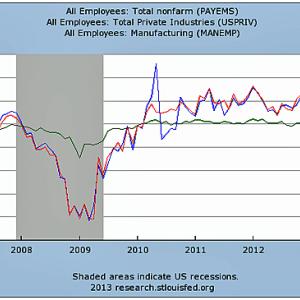

The U.S. Employment Report for April reassured the capital market participants that the U.S. was not slipping back into a contraction. The headline unemployment rate unexpectedly slipped a tick to 7.5%. Non-farm Payrolls (blue in the chart) rose 165,000, better than the consensus, but within the range of expectations. Yet, this increase was on top of net revisions of 114,000 for February and March. Private Payrolls (red in the chart) increased 176,000, in line with expectations; but, again, this increase was in addition to a 59,000 upward revision in March. Manufacturing Payrolls (green in the chart) were unchanged. Average Hourly Earnings increased 0.2%; The Average Workweek slipped two ticks to 34.4 hours, a negative component to the otherwise positive report. In other positive employment news, Initial Jobless Claims fell to 324,00, the lowest level in over 5 years; the four-week average dropped to 342,250; Continuing Claims rose 12,000, but the four-week average of Continuing Claims dropped 18,000 to a new five-year low of 3.056 million.

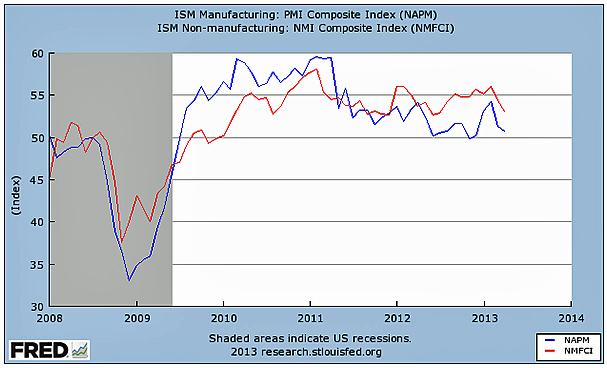

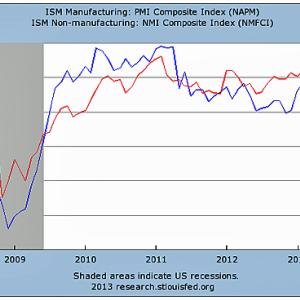

The Purchasing Managers' Reports for April slipped, but remained in the expansion zone, above 50. ISM's Manufacturing PMI (blue in the chart) for the U.S. fell a half point to 50.7; ISM's Services PMI (red in the chart) fell a point to 53.1. Markit also surveys Purchasing Managers; the Markit PMI for Manufacturing fell over 2 points to 52.1.

Other Economic Releases

The U.S. FOMC met this week and, as expected, kept rates and bond purchases unchanged. The new element of the accompanying statement was explicit reinforcement of the Fed's flexibility about the amount, timing, and composition of asset purchases. A single dissenter among the voting members expressed concerns about the impact of the high level of policy accommodation. The European Central Bank cut rates 25 basis points to 0.50% at their meeting this week to try to address the contraction in the EU economies.

U.S. Personal Income and Spending both rose 0.2% in March, which brought the YOY increases to 2.5% and 3.5% respectively. U.S. Housing also showed improvement in this week's releases. In February, the Case/Shiller Home Price Index rose 1.2% SA and 0.3% NSA in February; the YOY rate was 9.3%, the highest since May of 2006. Pending Home Sales rose 1.5% in March. The Conference Board's Consumer Confidence Index rose almost 9 points to 68.1, above the range of expectations. The U.S. Trade Balance narrowed to -$38.8 billion in March.

The EU PMI for manufacturing slipped a tick to 46.7 in April. EC Economic, Industrial and Consumer Sentiment all declined in April. Germany's PMI for Manufacturing fell a point to 48.1. Germany's Unemployment Rate remained unchanged at 6.9% in April and Retail Sales slipped -0.3% in March. France's PMI for manufacturing rose four ticks to 44.4, but remained well into the contraction zone. The UK's PMI rose to 49.8, just below the demarcation between contraction and expansion in April; UK Services Markit PMI rose a half point to 52.9 climbing further into the expansion zone.

China's PMI for manufacturing fell a point to 50.4 according to Markit; the CFLP Manufacturing PMI slipped 3 ticks to 50.6. Both indicators remained in the expansion zone. Japan's Markit PMI Manufacturing INdex rose a point to 51.1. Japan's industrial production rose 0.2% and unemployment rate slipped two ticks to 4.1% in March.

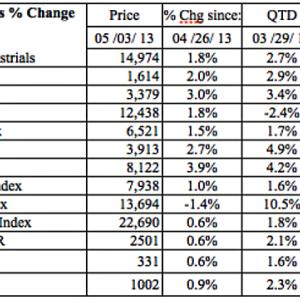

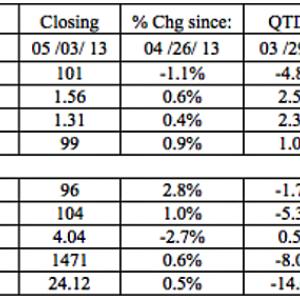

Equities Markets:

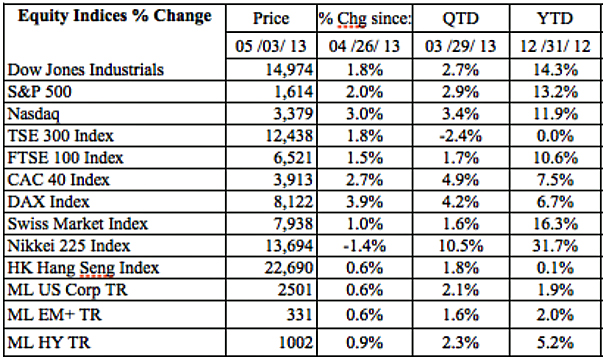

Except for the Nikkei, equity markets rose across the globe in reaction to stronger than expected readings on the U.S. economy. Both the Dow and S&P reached new historic highs during the week. Note that the positive returns in the ML bond indices below closed Thursday prior to the release of the U.S. employment report.

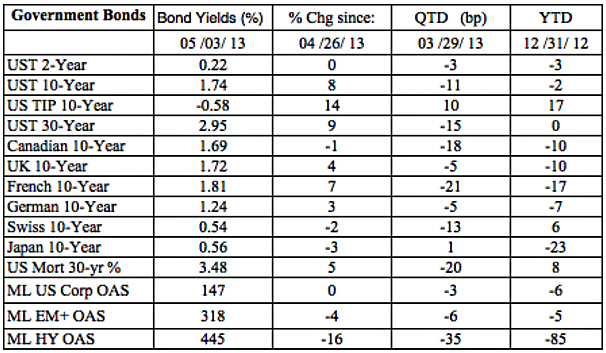

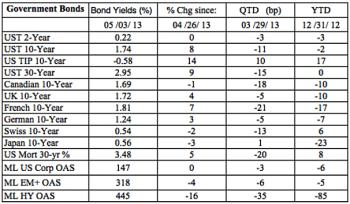

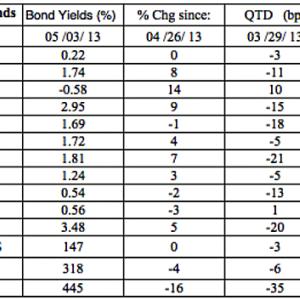

Bond Markets:

Government bond yields were mostly higher, particularly in the U.S. where the economic releases were stronger this week. Credit spreads narrowed in the riskier asset classes during the week.

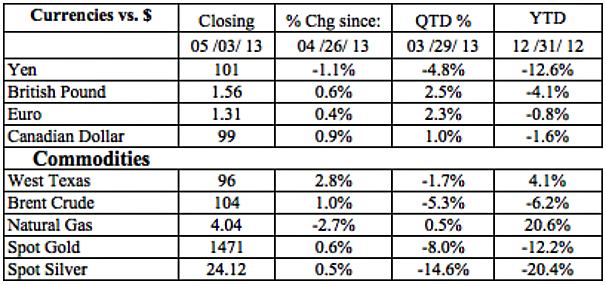

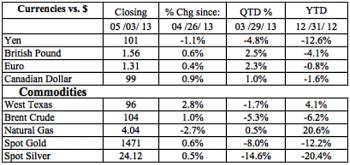

Currencies & Commodities:

The U.S. dollar fell against the pound, euro, and looney on the week. Efforts by the Japanese officials to push their currency lower were successful this week. Oil and metals commodity prices recovered some of what they have lost in previous weeks.

-----------------------------------------------------------------

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments over a decade ago as a personal discipline when he was promoted to chief investment officer from portfolio manager.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts, and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income, and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he has appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services often quote his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and courses at the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a Naval Officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserves, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is treasurer of the Maine Conference of the United Church of Christ, serving on the executive committee and the coordinating council, the governing board of the conference. He is also on the investment committee of the Pen Bay Health Foundation.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States