John Davidson's Economic Comments: Week ending Sept. 29

Economic releases were mostly positive, but not robust this week in an economic environment that International Strategy and Investment's Ed Hyman characterized as a "synchronized global expansion." Europe appeared to return to recovery in spite of political divisions in Italy; Asia generated positive, but not spectacular, growth. Silliness of politics in Washington trumped the positives of the selection of a new Federal Reserve chairperson and the ease of tensions in Syria for the Capital Markets. Most equity markets were lower; government bond yields fell, and credit spreads for the riskiest securities widened on the week. Oil prices fell, but metals commodity prices rose on the week. The U.S. dollar was lower against the Yen and the Pound.

Perspective:

On Sunday night, many of the readers will have watched the final episode of Breaking Bad. To do so, they had to forgo the season premier of The Good Wife, the Patriots/Falcons football game, and a new episode of Boardwalk Empire. Those watching Breaking Bad will want to be the first to see what happened to Walter, the initially sympathetic school teacher, who turned into a meth cooker, drug dealer and killer, all the while insisting that he was driven to do so in order to provide for his family. Not having seen the finale, I don't know what is in store for Walter, but it can't be good.

Our elected officials in Washington remind me of Walter in their actions. They were elected to Congress and the White House to govern to the benefit of their constituent families. They get caught up in the powerful drugs of spending other people's money and political power-struggles of the competing gangs. They use the leverage of the debt limit to inflict damage on the Affordable Health Care Act instead of proposing alternatives that might better serve our nation's healthcare needs. This conflict is not about spending; they failed to reach mandated spending cuts earlier this year and that led to sequester. This conflict is not about taxes; leadership on both sides failed to embrace serious tax reform when they rejected the Simpson/Bowles Commission's recommendations years ago. Similar to Walter's Achilles heel, they seek revenge, not compromise or government. This is "Breaking Bad" for all of us.

Economic Releases:

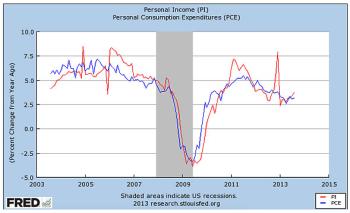

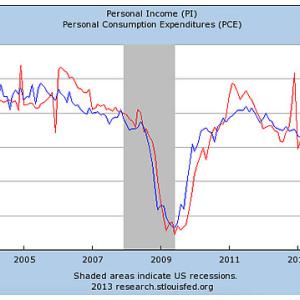

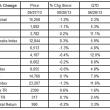

In the U.S., Personal Income (red in the chart) rose +0.4% in August, and 3.7% year-over-year; Consumer Spending (blue in the chart) rose +0.3%, and 3.2% YOY. The YOY chart of Personal Income and Spending below shows that, with the exception of some PI spikes, those rates remained well below the 5%+ levels prior to the Great Recession.

Other Economic Releases

The Bureau of Economic Analysis released its third estimate of second-quarter GDP in the U.S., unchanged from the first revision at 2.5%, but above the initial estimate of 1.7%; its price index slipped two ticks to +0.6% SAAR. New Home Sales rose to 421,000 in August, but July's Sales were revised 4,000 lower to 390,000. The Case-Shiller Home Price Index rose +0.6% in July and 12.4% YOY in the 20 cities the index tracks. The Conference Board's Consumer Confidence Index slipped 2 points to 79.7 in September; the University of Michigan's Consumer Sentiment Index rose a point to 77.5. The Markit PMI Manufacturing Index Flash reported a point drop to 52.8. On a positive note, the Initial Claims for Unemployment dropped 5,000 to 305,000 the week of Sept. 21; Continuing Claims rose 35,000 to 2.823 million; the four-week average of Continuing Claims dropped to 2.843 million, a recovery low.

The Markit PMI Composite Flash for the European Union rose a half point to 52.1; Manufacturing slipped 2 ticks to 51.1, but Services rose a point to 52.1. The European Commissions Indices for Economic Sentiment, Industrial Sentiment and Consumer Sentiment all improved in September. The Markit PMI Composite Flash for Germany mirrored that for the EU; the Composite and Services improved to 53.8 and 54.4 respectively while the Manufacturing slipped to 51.3. Germany's IFO Surveys for Economic Sentiment and Business Expectations improved, but the Survey for Current Conditions slipped in September. UK's 2nd quarter final GDP increased +0.7% from the previous quarter, as expected, ending in a 1.3% YOY increase.

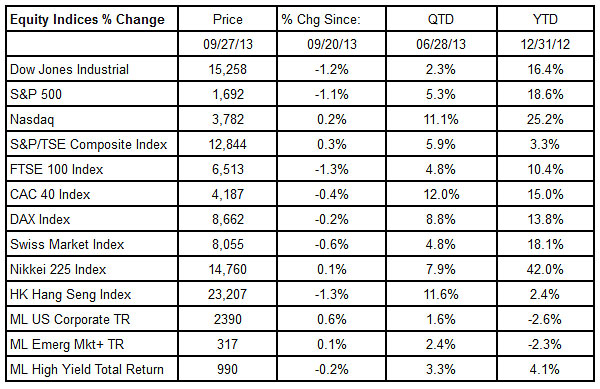

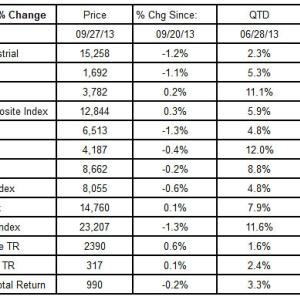

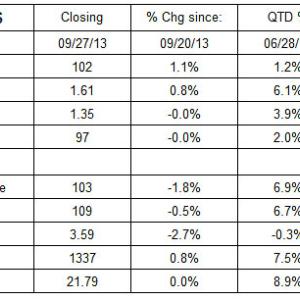

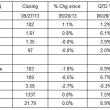

Equities Markets:

Silliness in Washington weighed on most equity markets, especially in the U.S., in the face of the "synchronized global expansion."

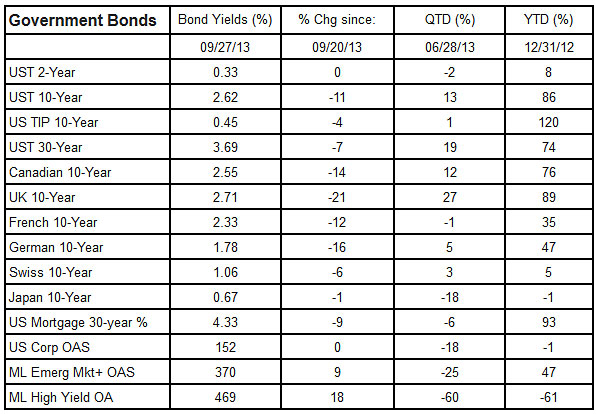

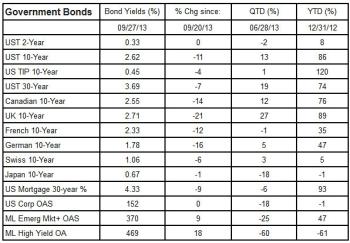

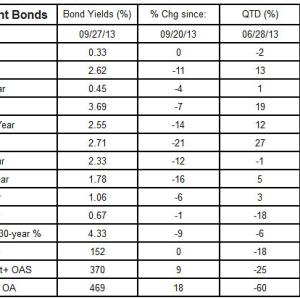

Bond Markets:

Bond yields fell across the globe in realization that the Central Bankers have the will and the way to keep rates low for an extended period of time since the growth rates and inflationary pressures have been low.

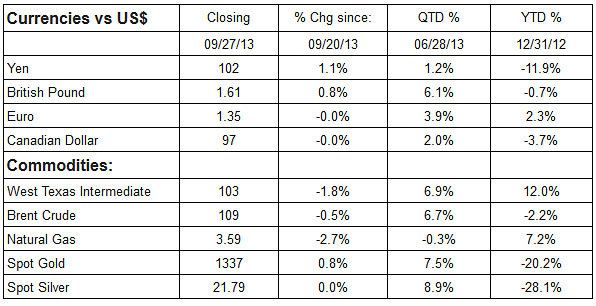

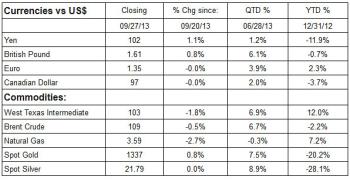

Currencies & Commodities:

The U.S. Dollar slipped against the Yen and Pound, but was little changed against the Euro and Looney this week. Oil prices slipped, but metals prices firmed on the week.

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments more than a decade ago as a personal discipline when he was promoted to from portfolio manager to chief investment officer and CEO.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine, where he focused on board work.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services have quoted his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a naval officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserve, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is also on the investment committee of the Pen Bay Health Foundation. He serves as an independent trustee for mutual funds.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States