John Davidson's Economic Comments: Week ending Jan. 10

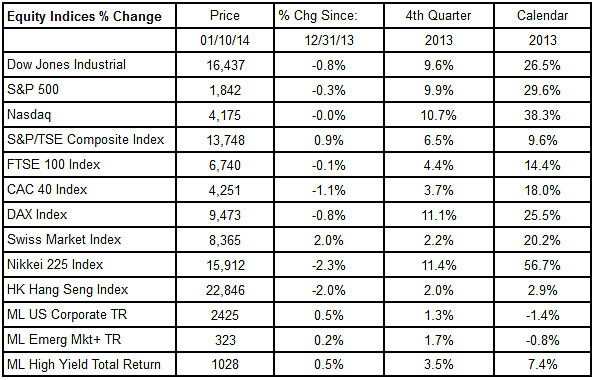

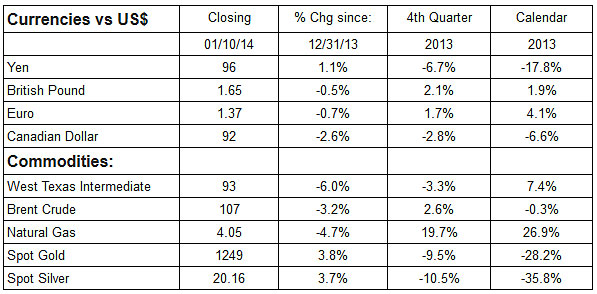

Economic releases were mixed in the first days of 2014. Most Purchasing Managers Surveys remained in the expansion zone; yet, the softness in the U.S. Employment Report was such a surprise that it had just a modest impact on the markets. Nonetheless, for the start of 2014, most equity markets fell and bond markets rose (due to falling interest rates and narrowing credit spreads). In the first 10 days of the year, the U.S. dollar rose against the Pound, Euro and Looney; energy commodity prices fell; and metals commodity prices rose.

Perspective:

I was reminded of the importance of reviewing forecasts and making adjustments this past weekend. I had planned to go skiing in Vermont with our friends, Charlie and Meg, this weekend. The forecasts called for warm weather and rain, probably the worst forecast for a ski weekend. We switched plans to meet in Connecticut and arranged a brunch with our children in Brooklyn, N.Y. Plan B worked out great. I got to see our friends, hold their new grandchild (in practice for our first granddaughter coming in April), and see our kids and their spouses.

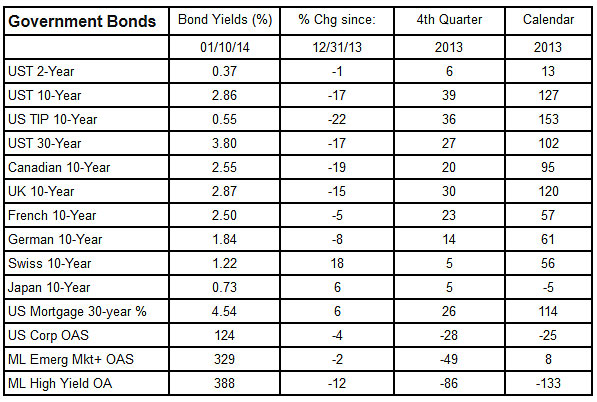

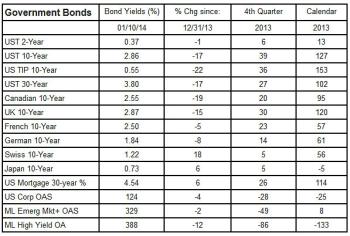

On the investment side it does not always work out so well to switch investments based on forecasts. Many forecasters had predicted rising interest rates for 2014. Yet, the start of the new year produced the best returns in the bond markets since both yields fell and credit spreads narrowed. Had you sold your bonds at year-end you would have missed out on positive returns in the bond and credit markets, which would have off-set the initial losses in the equity markets.

Economic Releases:

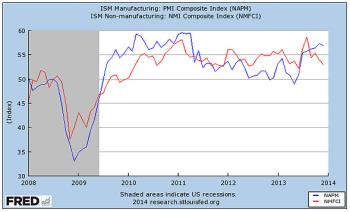

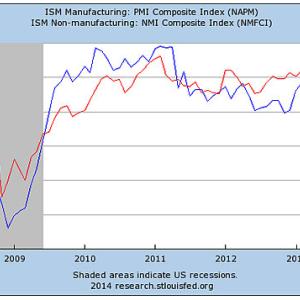

The Purchasing Managers' Indices remained in the expansion zone in December. These Indices are the results of surveys of Purchasing Managers. Measures above 50 indicate that most of the purchasing managers see an expansion of activity within the month; measures below 50 indicate that the purchasing managers see a contraction of activities. ISM has been conducting these surveys in the U.S. for many years; other organizations have been conducting the surveys in other countries. In recent years Markit has been conducting these surveys around the globe. The ISI Manufacturing Index (blue in the chart) slipped three ticks to 53; the Non-manufacturing (Services) PMI (red in the chart) dropped almost a point to 53. Not shown, the Markit Manufacturing PMI rose three ticks to 55.

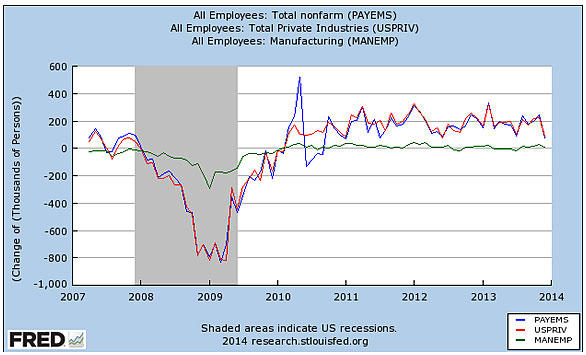

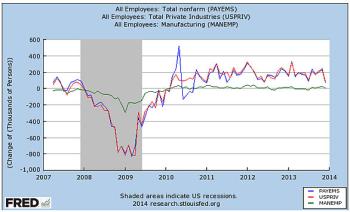

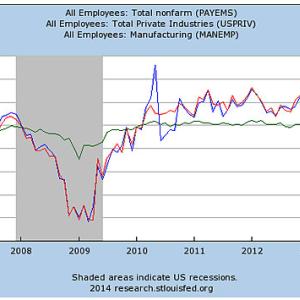

The U.S. Employment report for December surprised on the downside. One source of the surprise was the earlier release by ADP of 238,000 private sector jobs that were created in December. Non-farm Payrolls (blue in the chart) increased by 74,000, well below the range of expectations. Prior months revisions added 38,000 to the prior releases. Private Payrolls increased only 87,000, also below the range of expectations. Manufacturing Jobs (green in the chart) rose 9,000. Some suggest the the seasonal factors may have affected this month’s Payrolls and that future upward revisions will be forthcoming.

Not shown: Average Hourly Earnings increased only +0.1%. The Average Work Week slipped a tick to 34.4 hours. The Unemployment Rate decreased three ticks to 6.7% due to a 347,000 drop in the labor force. Initial Jobless Claims slipped to 330,000 the week of Jan. 4 and the four-week average of Claims dropped to 349,000.

Other Economic Releases

The Euro-zone Manufacturing PMI rose a point to 52.7 in December. The Markit PMI Composite rose to 52.1, while the Markit Services PMI slipped 2 ticks to 51.0. Germany's PMI for Manufacturing rose over a point to 54.3; the German Markit Composite PMI fell to points to 53.5 and Services PMI fell over a half point to 55.0. The French Manufacturing PMI fell over a point to 47.0; the French Markit Composite PMI fell a point to 47.3 and Services PMI slipped two ticks to 47.8, all further into the contraction zone. The UK CIPS/PMI Manufacturing Index fell a point to 57.3; the CIPS/PMI slipped two ticks to 58.8.

The Japanese Composite PMI remained unchanged at 54.0; its Services PMI rose to 51.3. The Chinese CFLP Manufacturing PMI slipped a half point to 51.0; the HSBC Manufacturing PMI for China slipped to 50.5; the Composite PMI dropped a point to 51.2 and Services PMI dropped to 50.9.

The European Central Bank met and, as expected, kept its key refinance interest rate unchanged at 0.25%. Similarly, the Bank of England met and left its rates and bond purchases unchanged. German Unemployment remained unchanged at 6.9% in November; German Industrial Production rebounded 1.9% in November. French Industrial Production increased 1.3% in November. British Industrial Production and Manufacturing Output were both flat in November.

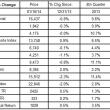

Equities Markets:

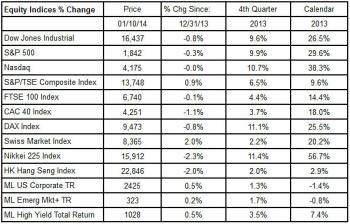

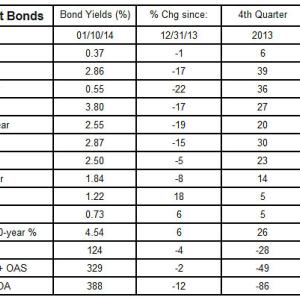

Equities started the new year on a negative note. Only the Swiss and Canadian markets posted positive returns for the first 10 days of the new year. Bond markets posted positive returns as shown in the Merrill Lynch credit indices; both falling interest rate and narrowing credit spreads contributed to the positive returns in the credit markets. Note that the last two columns in the table shows the returns for the final quarter and calendar year of 2013.

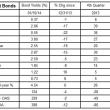

Bond Markets:

Government bond yields fell and credit spreads narrowed in the first days of 2014. The Japanese and Swiss 10-year were the exception in posting higher yields in the new year.

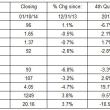

Currencies & Commodities:

The U.S. dollar rebounded against the Pound, Euro and Looney, but fell against the Yen in the first 10 days of 2014. Energy prices commodity prices fell and metals commodity prices rose.

Event Date

Address

United States