John Davidson's Economic Comments: Week ending Dec. 20

This week's economic releases showed strength in both the U.S. and Europe. The Federal Reserve’s announcement that it would reduce (ie "taper") the monthly bond purchases was balanced by the forward guidance that it would continue accommodative monetary policies, even after the U.S. Unemployment Rate reached the 6.5% threshold. Equity markets rallied across the globe and credit spreads (the additional yield demanded by bond holders to assume default risk) narrowed. Energy prices rose, but metals commodity prices fell on the week. The U.S. dollar rose against the Euro, Yen and Looney, but slipped against the Pound.

Perspective:

The Wall Street Journal reported (DJIA Sets Inflation-Adjusted Record High) that for the first time in 14 years, the record-setting close of the Dow Jones Industrial Average exceeded the previous record when adjusting for inflation. That means that if you had the poor timing as to have purchased the Index at its previous record high, you would have not equaled the return of the rate of inflation until Friday's close. This does not include the additional return you would have experienced with dividend payments. On the other hand, suppose you had purchased the Index at its trough in March of 2009, you would have gained 145% plus dividends through Friday's close; inflation would have had little influence over the last four-plus years. Performance reporting is highly sensitive to the starting and ending points. The celebration of this record has little investment or economic impact.

Economic Releases:

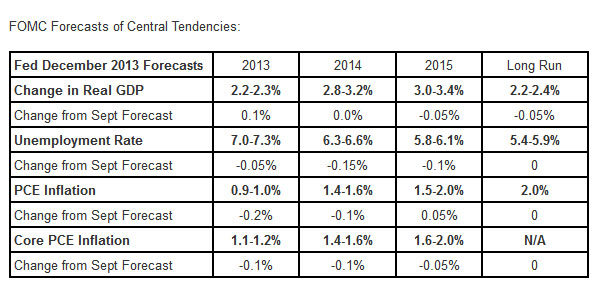

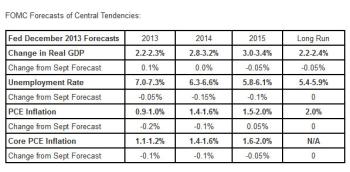

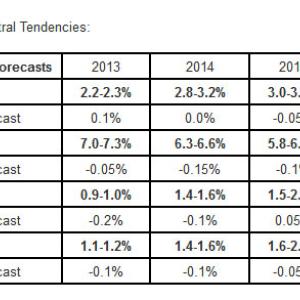

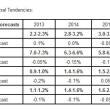

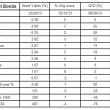

The Federal Open Market Committee met, kept the Federal Funds Rate unchanged in the range of 0-0.25%, and commenced tapering of the bond purchases. The Fed reduced monthly purchases of Mortgage Backed Securities and U.S. Treasuries from $85 billion per month to $75 billion. The Fed balanced this move with assurances that the Target Fed Funds rate would remain low, even as the Unemployment Rate fell below 6.5%. The table below of the Fed Forecasts is consistent with the Fed's stance. As compared to its September forecast, Growth is a little stronger near term, but weaker longer term; Employment is better; Inflationary pressures are well contained.

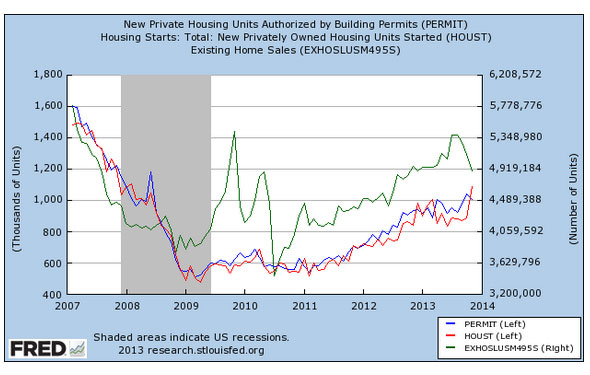

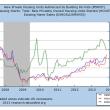

U.S. Housing is in recovery even though demand for existing homes has fallen. Existing Home Sales (green in the chart) fell 4% to 4.9 million in November, down over 1% from a year ago. Lack of supply and higher mortgage rates were blamed for the decline. On the other hand, Housing Starts (red in the chart) surged over 22% to 1.091 million, above the range of expectations. Starts for September and October were 873,000 and 889,000 respectively (reported late due to the government shutdown). Housing Permits (blue in the chart) slipped to 1,007,000 in November after a strong October.

Other Economic Releases

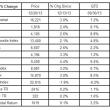

U.S. Gross Domestic Product was revised up from 3.6% to 4.1% in the third estimate for the third quarter; this represents an acceleration from the second quarter's 2.5% and is higher than the range of expectations. This revision was driven by higher demand numbers; final sales rose 2.5%. In November, Industrial Production rose 1.1%; October's IP was also revised from a -0.1% contraction to a 0.1% expansion. Capacity Utilization rose to 79.0%. Both IP and CU were above the range of expectations. On the softer side, Initial Jobless Claims rose to 379,000; Continuing Claims rose to 2.884 million; this year's seasonal adjustments may have contributed to the increase in Claims.

Markit's flash Purchasing Managers' Indices for Composite, Manufacturing and Services rose to 52.1, 52.7, and 51.0 respectively in December, remaining in the expansion zone above 50. Germany's PMI's also rose to 55.2, 54.2, and 54.0 respectively. Germany's Ifo Surveys for Economic Conditions and Business Expectations rose, but Current Conditions slipped; Germany's Zew Surveys for Current Conditions and Business Expectations rose in December. On the softer side, France's PMI's slipped over a point to 47.0, 47.1, and 47.4 respectively. UK's Labor Market Report showed improvement in November; the ILO Unemployment rate fell two ticks to 7.4% while average earnings rose +0.9%. UK's Retail Sales rose +0.3% in November. Third quarter UK GDP was unrevised at +0.8%.

The Bank of Japan left its interest rates (0% to 0.1%) and its bond purchases unchanged when it met this week.

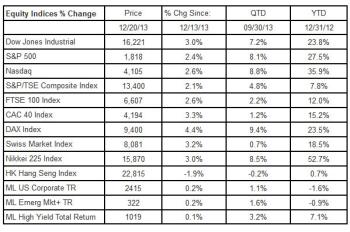

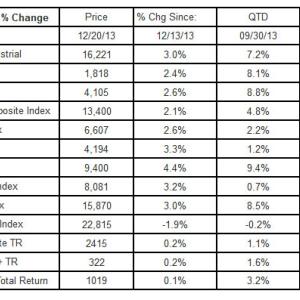

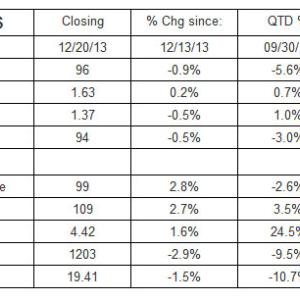

Equities Markets:

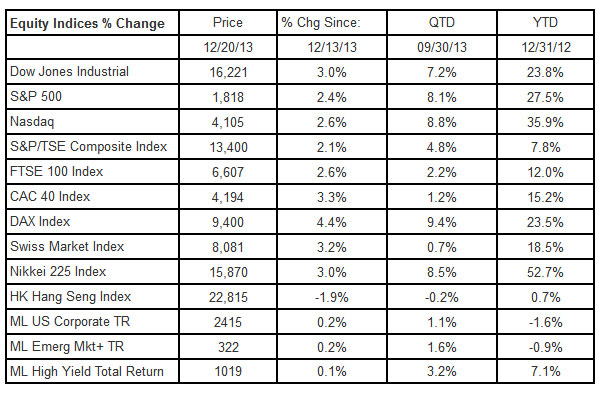

Equity markets rallied on the week with the Dow reaching new "inflation-adjusted" heights. Of the indices in the table, only the Hang Seng posted a negative result on the week and QTD. Narrowing credit spreads generated a positive return for the Merrill Lynch bond indices shown below.

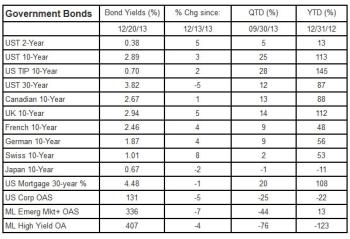

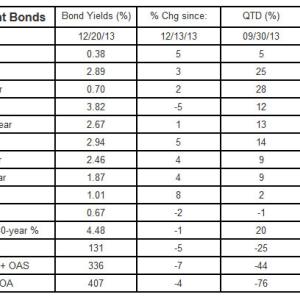

Bond Markets:

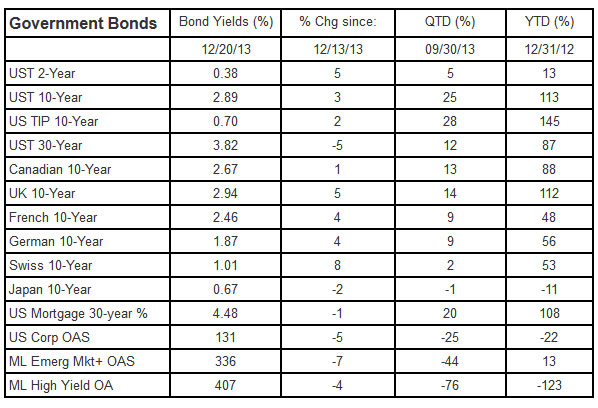

Government bond yields were mostly higher on the week. Yet the yield curve flattened, meaning that short term rates rose on the two- and 10-year bonds while the long term yield on the 30-year bond fell on the week. Credit spreads narrowed as investors demanded less yield for taking on credit risks.

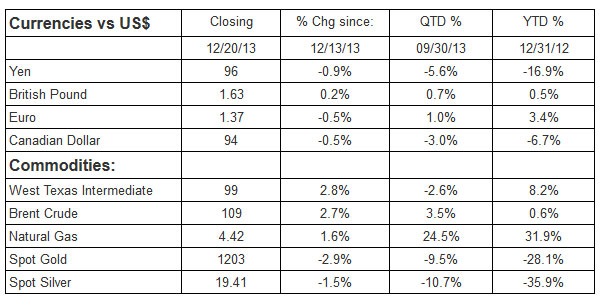

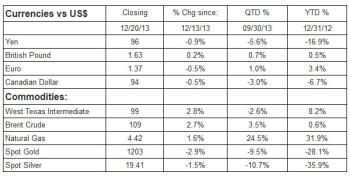

Currencies & Commodities:

The U.S. dollar rose against the Yen, Euro and Looney (the Canadian dollar is called this because it has a picture of a loon on the currency), but slipped against the Pound.

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments more than a decade ago as a personal discipline when he was promoted to from portfolio manager to chief investment officer and CEO.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine, where he focused on board work.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services have quoted his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a naval officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserve, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is also on the investment committee of the Pen Bay Health Foundation. He serves as an independent trustee for mutual funds.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.

Event Date

Address

United States