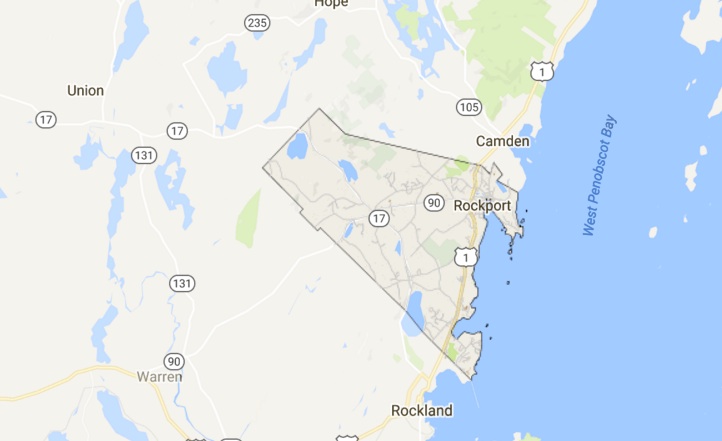

Rockport property taxes to climb with 3.9 percent mil rate increase

ROCKPORT — Rockport taxpayers will note another increase in taxes this year, as the town records another drop in collective property valuation. The mil rate (the tax levy against per $100,000 of valuation) is climbing from to 14.61 from 2015’s mil rate of 14.05.

This 3.9 percent increase means that taxpayers will be levied $1,461 for every $100,000 of property value they own.

To calculate one’s own tax bill, the formula is: Take the total value of the property (land and buildings), divide it by $1,000, and then multiply that by the mil rate.

For example, Rockport property owners with holdings valued at $250,000 can anticipate paying $3,652 this coming year in property taxes.

According to the town office, the increase in the mil rate is attributed to two factors: The loss in valuation due to the reversion of the 116-acre unbuilt Brewster Point subdivision from 45 lots to one lot, coupled with the increase in the statewide Homestead Exemption program exemptions for qualifying individuals.

Tax bills are due to be in the mail by the end of August. Taxpayers will receive one tax bill with the option of making two installments. The first payment is due October 17, and the second payment is due April 17. There will be a 7 percent interest rate on unpaid taxes, per the public’s vote at annual town meeting.

Why the mil rate has increased in Rockport

Rockport’s mil rate has increased from 11.38 in 2009 to this year’s 14.61. The biggest leap, however, was from 2014 to 2015, when the mil rate went from 12.99 to 14.05.

Rockport Assessor Kerry Leichtman attributed that jump to the 2014 town-wide property revaluation, which determined that Rockport’s waterfront properties, in general, were overvalued in relation to recent market forces and sales history. That process of reassessing properties reduced Rockport’s total valuation by $40 million.

In 2011, Rockport’s valuation, according to the state, was just over $1 billion.

In 2015, it was $971 million.

It is now at approximately $932 million, and heading to valuation levels of 2007-2008.

Meanwhile, the municipal budget approved at annual town meeting in June for the 2016-2017 year is $3.37 million, up approximately 3 percent from 2015. The school and county budgets have increased between 1 and 2 percent from 2015.

This year, the town’s property valuation is decreasing again by $25,763,651, primarily because of the Brewster Point Subdivision reversion to one parcel. (Read Brewster Point subdivision reversion to single residence, and what that means for Rockport's tax rolls).

That land, which includes underground power and subdivision roads, had been assessed at $33 million. It is now being assessed at $8.3 million, and is owned by one landowner who bought the Glen Cove parcel and went through the planning office to remove it from subdivision status.

The town lost another $2 million from the increase in the Homestead Act, a tax relief program for certain qualifying individuals. The state program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence. Property owners would receive an exemption of $15,000. That latter amount increased from $10,000 to $15,000 this year.

If the Brewster Point subdivision had stayed intact at 45 lots, with no new structures constructed there, the town’s taxable income from it would hover around $390,000. Since it was sold and converted to one lot, the taxes on it will be significantly reduced.

According to Leichtman, had the Brewster Point subdivision remained as such, and the Homestead program had not increased, the mil rate in Rockport would have likely stayed at the 2015 level.

Construction activity in Rockport has remained “mired in the recession,” he said, with little new growth, either in the residential or commercial markets.

Reach Editorial Director Lynda Clancy at lyndaclancy@penbaypilot.com; 207-706-6657

Event Date

Address

United States