Rockport’s war against budget transparency

Rockport residents who are still in shock from the property tax bills they received a few weeks back likely welcomed the news that both the town’s Budget Committee, of which I am a member, and its Select Board have signaled an intent to focus greater energy on the budget for this coming year.

Both bodies have set some priorities and are taking steps on that front.

The most important step they can take, though, has nothing to do with the budget itself.

Instead, they should focus their efforts on reversing the trend, accelerated in recent years, of providing Rockport voters with less and less information about the budget.

You can see the town’s budget on the Rockport website, of course, and you can attend, virtually or in person, meetings of both Budget Committee and the Select Board.

But if you were as shocked as I was at the mind-boggling increases in municipal spending over the last three to four years, that is because steps that have been taken to keep you from easily seeing it.

Here’s how.

Hiding the growth

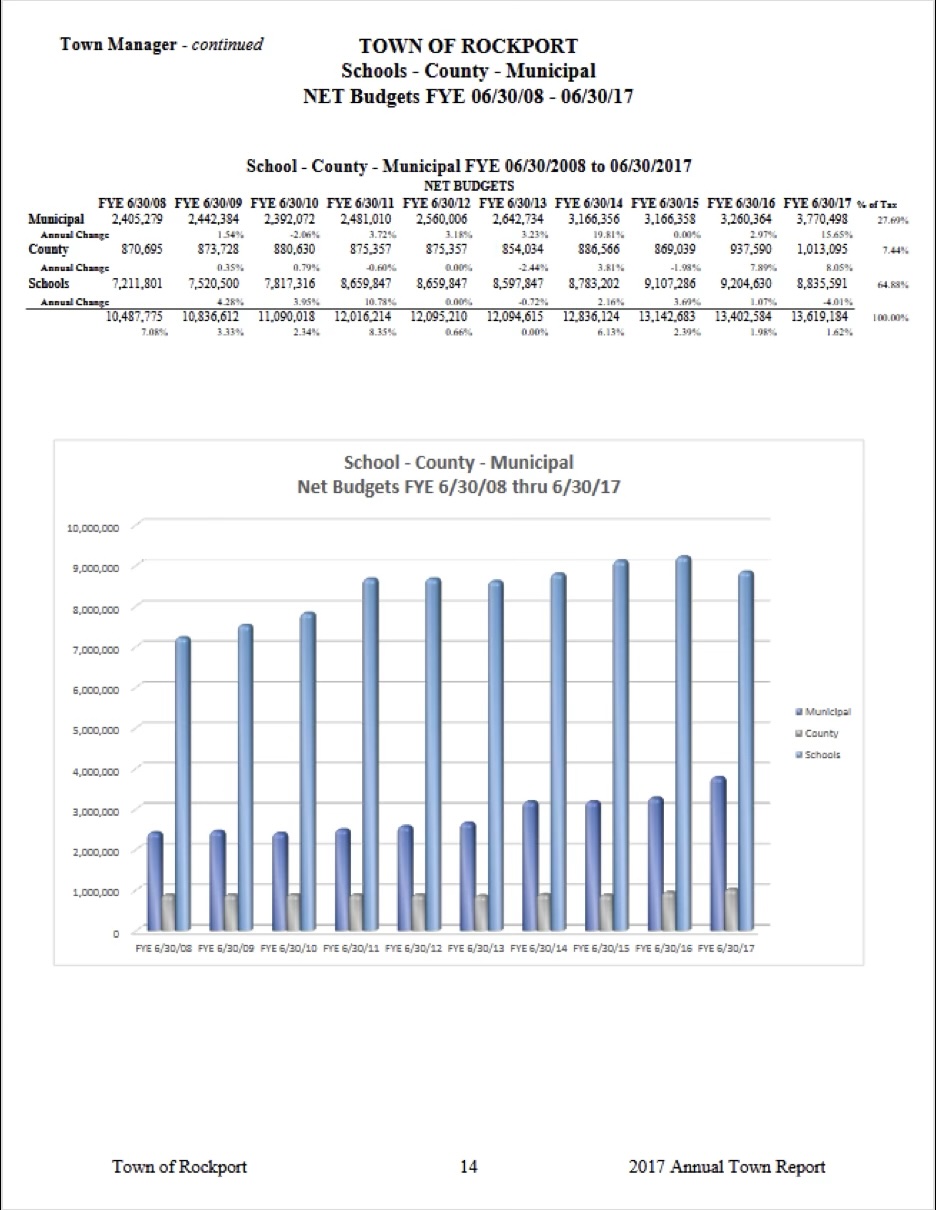

For many years, and as recently as 2017, Rockport’s annual Town Report routinely featured a table and chart showing recent budget trends.

As shown in the example below, voters were given information each year about the growth of the net budget over time, both in dollar terms and percentage increases. An accompanying bar chart showed this information graphically.

This information, by the way, wasn’t buried deep in the Town Report, but appeared on page 14, as part of the Town Manager’s report.

Importantly, this information, as helpful as it was, didn’t tell the whole story. These were net budget calculations, after all, meaning they represented town spending minus revenues from non-property tax sources, such as excise taxes, various fees charged by the town, and so forth.

What it takes some digging into the town budgets to discover is that municipal operating expenses in those years grew from $3.7 million in FY 2008 to $4.9 million in FY 2017. That is a hefty increase – just over a million dollars – but it took 10 years to grow municipal spending by that much.

As we’ll see, we’re now increasing municipal spending by more than $1 million every single year.

As incomplete a portrait of town spending as those tables and charts presented (the 2013 Town Report, by contrast, included three full pages of budget and spending data in the first 10 pages), even that was evidently considered too much information to give town voters. The table and accompanying chart vanished from the 2018 Town Report and never returned.

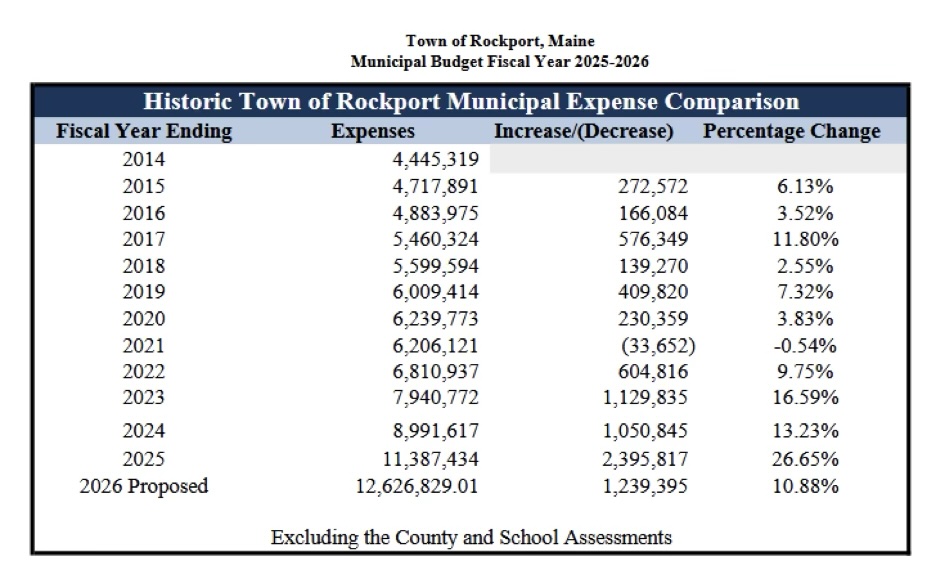

And you are unlikely to see it again. The town’s budget document does contain a helpful table (below) showing the astounding growth of municipal spending, but this last time around, it was tucked away on page 73 of a 543-page document that hardly anyone ever reads.

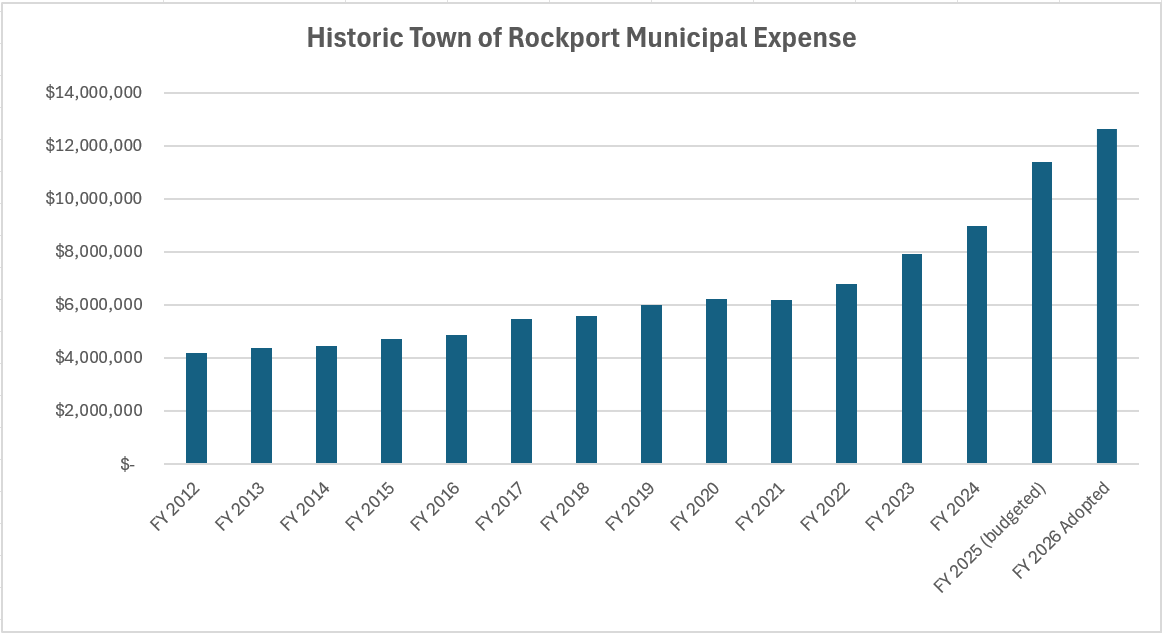

Shown graphically, an accompanying chart (if the town ever chose to generate one and share it with voters) would look like this:

I will leave to readers to reach their own conclusions about why a chart of this kind makes no appearance in the Town Report.

The End of LD 1

When I represented the town in the state Legislature many years ago, property tax relief was major issue. For once, the legislature took some decisive action and in 2005, it passed LD 1. This legislation included a number of elements to address high property taxes, but one of the key components was its introduction of a limit on local property tax levies, anchored to a formula that included personal income and property valuation growth. Towns that exceeded the amount dictated by the formula had to ask voters to go over the cap.

The LD1 formula and resulting calculations typically did not appear in the Town Report, but they were included in the town’s budget document, providing the Budget Committee and Select Board with a helpful spending benchmark.

And it worked. The following table, from the FY 2012 budget, shows the degree to which the town routinely stayed under the LD 1 cap in those days.

Importantly, the cap did allow the budget to grow, but for years, under LD1, Rockport’s budget growth remained at a reasonable rate, which had been the legislation’s intent.

That reasonableness started to erode in FY 21, when the then town manager, in a letter accompanying his proposed budget, thanked “the Select Board and Budget Committee” for embracing his “philosophy” on LD 1, which was that “it doesn’t work” and will “harshly limit” town services. His proposed budget, he was proud to say, was created “without an imposed LD1 limit”.

Mercifully, the result was a budget that only exceeded the LD 1 cap by $51,000, but the door had been opened to far greater budget growth. The very next year, the proposed FY22 budget grew town expenditures by $737,000, exceeding the LD 1 cap by $315,000.

As the Historic Town of Rockport Municipal Expense Comparison table above indicates, the FY23 budget grew town spending by $1.1 million, which was followed in FY24 by another spending increase of just over $1 million.

That was then followed by yet another spending increase of $2.4 million for FY25, and yet one more massive spending increase in FY26. Altogether, from FY21 to FY26, Rockport’s municipal spending doubled, from $6.2 million to $12.6 million.

It is worth saying again: Rockport’s municipal spending doubled in five years.

Is it any wonder that Rockport residents have been staggered by their most recent property tax bills?

As for the LD cap, it vanished from the town’s budget document, making its last appearance in the FY 23 budget. The Legislature repealed the law in 2025, with some legislators claiming that it no longer worked to contain municipal spending. In Rockport, at least in recent years, that was clearly the case.

Silencing the Budget Committee

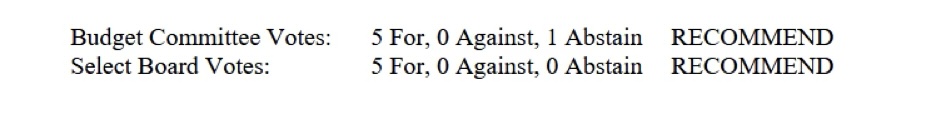

As I noted in a column back in June, Rockport voters wanting to know whether the Budget Committee supported the most recent budget found no answers in the Town Warrant. That is because in 2023, the Select Board decided that the Budget Committee should no longer be allowed to cast an up-or-down vote on the budget and have that vote shared with voters. They pushed through a series of changes to the Town Charter that year to achieve this end.

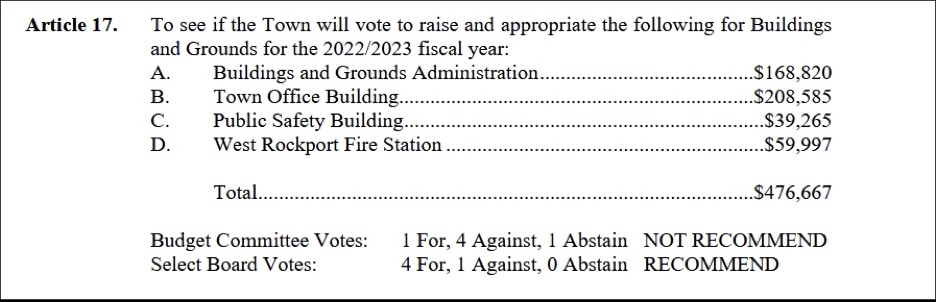

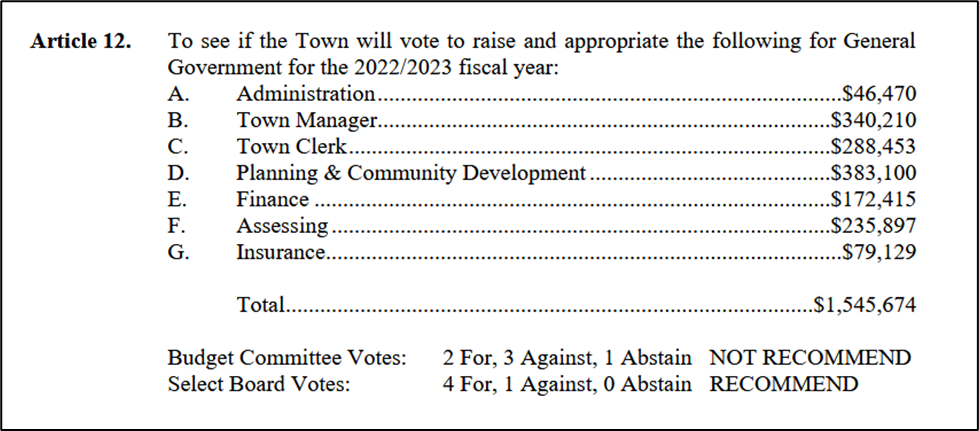

By way of background, for as long as anyone can remember, the Budget Committee always took am up-or-down vote on the final budget and that vote had been included in the Town Warrant. Countless times over the years, we have all seen something like the following:

By 2023 though, the Select Board had decided that providing this level of clarity to voters was no longer tolerable and moved to take away that up-or-down vote. While they were at it, the Select Board also made changes that dramatically limited the power and influence of the Budget Committee, which was, of course, their primary intent.

The original language in the Town Charter (I was part of the committee that drafted it in 2005) described the Budget Committee as, “a committee of citizens, representing all sections of the Town,” that are there to “cooperate with the Select Board, Town Manager, Treasurer, and department heads, in making recommendations concerning articles in the Warrant calling for appropriations.”

“This committee,” the charter continued, “shall submit recommendations for consideration by the voters at the annual Town Meeting” (underline added).

The Budget Committee’s recommendations were to be “reported to the Select Board prior to the final approval of the budget” and “included in the Town Warrant.” The Select Board was to then “publish a general summary of the budget and the recommendations of the Budget Committee in the Town Report.”

Because they felt the need to bring the Budget Committee to heel, the Select Board deleted nearly all of this language in its 2023 charter revision. The responsibilities of Budget Committee were dramatically scaled back to a single role: “provide input to the Select Board prior to the Select Board’s finalization of the budget.” In effect, the Budget Committee, once an independent entity serving voters, now serves only the Select Board, and only in an advisory capacity.

In addition, all of the language about the Budget Committee’s recommendation being included in the Town Report or being submitted for “consideration by voters” were removed. and Those recommendations are to be made to the Select Board. Once that task (which does not include an up-or-down vote on the entire budget) is completed, the Budget Committee is to go home and keep their mouths shut until summoned by the Select Board to do their bidding the following year.

In this way, the Select Board achieved three goals. It narrowed the Budget Committee’s scope and responsibilities to place it more firmly under their control, it closed off avenues for the Committee’s recommendations on the budget to be seen and heard by voters, and most importantly, it silenced dissent from the Budget Committee by removing its up-or-down vote from the Town Warrant.

The question is, why? What would prompt the Select Board to take these drastic steps? Why would they feel the need to dramatically recast the role of the Budget Committee, a role that had remained unchanged and without controversy for decades?

For an indication of the motive here, what follows are a few vote totals that appeared on the 2022 Town Warrant, the year before these changes were enacted. Look carefully at the Budget Committee vote.

The evidence is clear. That year, the newly hired town manager brought to the Budget Committee a proposal that increased municipal spending by $1.1 million, the largest single-year increase in memory (and perhaps in all of Rockport’s history, to that point), and nearly as much of an increase as the preceding four municipal budgets combined.

Clearly, some members of the Budget Committee were deeply concerned about this and signaled their dissatisfaction with “no” votes on various budget elements. Undeterred, the Select Board went ahead and approved the budget anyway, the first of four consecutive budgets they would approve featuring an annual spending increase of more than $1 million.

But what to do about the pesky Budget Committee? Simple. Amend the Town Charter to take away their ability to signal their concerns to voters.

The result? A municipal budget that has doubled in five years, with no end in sight.

Rockport’s current leadership has signaled no interest in reversing these changes to the budget process and allowing dissenting voices to be heard.

In my column back in June, I suggested that I was approaching the coming budget season with some degree of hope, despite my frustrations with the process. I have less hope today.

The simple fact is that there are members of the Select Board who simply don’t think that years of staggering spending increases are a problem. These Board members are smart enough, though, to realize such spending hikes might be unpopular, which is why so many efforts have been undertaken in recent years to keep Rockport taxpayers in the dark and to make sure the Budget Committee behaves itself.

Time will tell, of course, and maybe the Town’s leadership will come to its senses and start making a genuine effort to get the budget under control and help make Rockport a more affordable town in which to live.

They could send a strong message to that effect by no longer hiding the truth about Rockport’s unprecedented, unendurable, and seemingly unending spending spree.

Steve Bowen lives in Rockport and serves on the Rockport Budget Committee