City tries to demystify the TIF

Mayor Walter Ash, left, and City Councilor Mike Hurley during a discussion of Belfast's Tax Increment Financing districts, Tuesday night at City Hall.

Mayor Walter Ash, left, and City Councilor Mike Hurley during a discussion of Belfast's Tax Increment Financing districts, Tuesday night at City Hall.

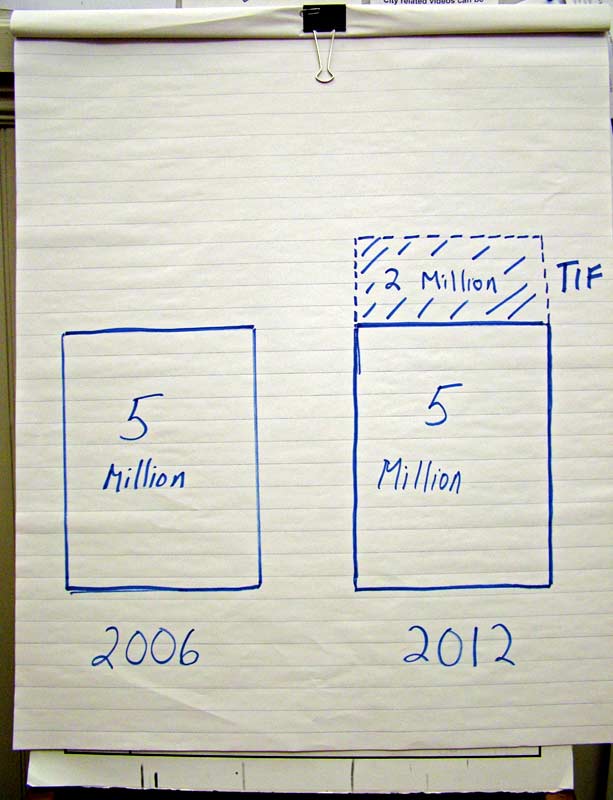

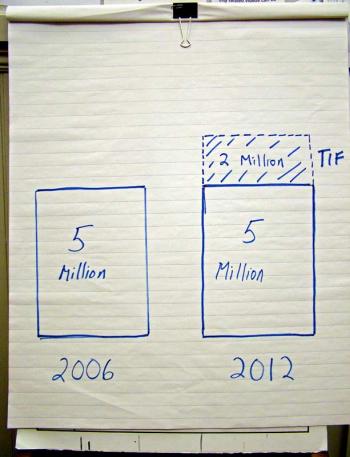

An illustration of a hypothetical Tax Increment Financing scenario presented by city officials Monday night. In the example, taxes from an increase in valuation (shaded area top right) go into a TIF fund for public improvements.

An illustration of a hypothetical Tax Increment Financing scenario presented by city officials Monday night. In the example, taxes from an increase in valuation (shaded area top right) go into a TIF fund for public improvements.

Mayor Walter Ash, left, and City Councilor Mike Hurley during a discussion of Belfast's Tax Increment Financing districts, Tuesday night at City Hall.

Mayor Walter Ash, left, and City Councilor Mike Hurley during a discussion of Belfast's Tax Increment Financing districts, Tuesday night at City Hall.

An illustration of a hypothetical Tax Increment Financing scenario presented by city officials Monday night. In the example, taxes from an increase in valuation (shaded area top right) go into a TIF fund for public improvements.

An illustration of a hypothetical Tax Increment Financing scenario presented by city officials Monday night. In the example, taxes from an increase in valuation (shaded area top right) go into a TIF fund for public improvements.

BELFAST - City Councilor Mike Hurley prefaced remarks on tax increment financing districts Tuesday night by saying that he’d discussed TIF in his various roles in city goverment for 13 or 14 years but thought an explanation by city officials, preferably several of them, might be useful to the public.

The city manager had just finished an overview of the tax clause that allows municipalities to earmark certain proceeds for public improvements while sheltering the money from state assessors. Belfast's economic development director and city planner stood behind him ready to weigh in.

There are two TIF districts in Belfast — covering a portion of Northport Avenue, and the downtown and waterfront area. Hurley, who was was mayor when both were created in 2005, said the districts had turned out to be examples of smart planning.

"Creating tools for the future is something critical that Councils do," he said. "Sometimes it doesn't pay off on your watch, but six years later it's sure paid off."

In August, the Council approved a 20-year $800,000 capital improvement bond to partially fund the Belfast Harbor Walk waterfront recreation path on the calculation that about half the TIF money from the area would be needed to make the annual bond payments. Public comment on the bond and the Harbor Walk prompted the Council to put the topic on Monday night's agenda. The city is also considering a revision to include personal property — equipment in the case of most commercial developments — in the TIF districts, according to City Planner Wayne Marshall.

Current TIF districts in Belfast:

Northport Avenue (est. 2005)

The Rationale: Belfast-based window manufacturer Mathews Brothers wanted to expand [relocate?] on Perkins Road where there was no city water or sewer. The city created the TIF on the calculation that the increased value would be enough to make annual payments on a 20-year bond to extend to pay for the work, while extending the utilities to an area that includes residences.

The Wild Card: The new Coastal Farms Food Processing Facility, which opened in August falls within the Northport Avenue TIF district, which was established specificallly for the sewer expansion, which is covered by taxes on the Mathews Bros. property. Whatever money is added to the TIF fund by Coastal Farms would be extra, Marshall said, but coud be diverted to a different TIF district, like the Downtown Waterfront district. Marshall, the property is not expected to be assessed until April, so the amount of TIF revenue is unknown.

Downtown and Waterfront (est. 2005-06)

The Rationale: Unlike the Northport Avenue district, the Downtown and Waterfront district was not created with a specific goal in mind, but rather in anticipation of increasing waterfront values and a desire to bring public infrastructure up with the rising tide. At the time it a development group, Belfast Bridge LLC, was proposing to turn the former Stinson Seafood sardine cannery into a $10 million complex with condominiums, retail shops] and a marina. The project stalled shortly after and the property lay idle for several years, but with the arrival of Front Street Shipyard in early 2011, the anticipated revenue is coming in. Marshall said improvements by the Shipyard currently add around $100,000 in taxes, and will add an estimated $15,000 more with the completion of so-called Building 1 at the north end of the property.

The Wild Card: If the city amends the terms of the TIF to include personal property, Marshall estimated that Shipyard equipment like the travel lift would add between $9,000 and $17,000 to the pot.

The math of Tax Increment Financing is fairly straightforward as illustrated in the drawing above, which was used as a hypothetical example during the Tuesday meeting.

The total value of all property in an area is calculated at the time the TIF district is created. After that, any increase in value becomes the "increment" from which taxes are set aside, typically for public improvements within the same area.

The money generated from the TIF district does not count in the overall valuation of the municipality with regard to the state’s school funding formula, which generally directs more money to towns with lower valuations. Towns have an incentive to keep new value off the books, and TIFs do this.

Where they become fuzzy is in how the money can be spent and who benefits.

"Like any tool, it can be used appropriately or inappropriately," said Belfast's Economic Development Director Thomas Kittredge. "... But it's one of the few [tax benefits] we have that can really help stimulate ecomonic development if it's used appropriately."

Examples of TIFs that only benefit those companies contributing to increased values are common and often contentious. "Credit enhancement agreements" as they are known, allow TIF revenue to be given to a company as an incentive to come to a community or expand operations. Marshall described Belfast's two TIF districts as "more traditional" in that they use proceeds for public improvements. Because the TIF money is used within the TIF district, they often benefit the companies, he said, but indirectly.

"The TIF is a tool that can be used at the local level to try and help direct and implement public policy, [based on] what it is you'd like to accomplish," he said.

One of the major things Belfast has been trying to accomplish is the proposed Harbor Walk, which would connect Steamboat Landing to the footbridge via a waterfront pedestrian and biking path. The project is seen by some as an amenity that would boost the local economy and bring more visitors to Belfast. But others have opposed it at previous meetings as a tax-funded project that would only benefit residents and businesses near the water.

City officials countered that argument Tuesday night noting that the bonded portion of the Harbor Walk would be funded by growth in the immediate vicinity (the Downtown and Waterfront TIF district) and not by taxpayers outside of the downtown area. Likewise, those residents — all residents, actually — would pay slightly less in taxes toward the school district because the value of improvements in the TIF districts would not be counted in the state's school funding formula.

In the spirit of Hurley's comment that understanding a TIF might take multiple explanations, an overview of Belfast TIFs can be found in the Sept. 18 City Manager's report.

On Sept. 18, the Council also:

• Heard a request from the Bicycle Coalition of Maine to use Steamboat Landing on September 9, 2013 as a one-night campground for 350 riders traveling through Belfast.

• Amended an agreement with Ed Powers to allow him to replace his septic system, which currently lies within the rail easement owned by the City near the former Upper Bridge off City Point Road.

Event Date

Address

United States