Just before an all-day retreat for the Board of the Camden Conference on Saturday, a friend approached me asking about my view of the market. What narrative could support valuations of 17.4 times forward earnings for the S&P 500? I thought for a few minutes and then came up with the following:

1) The forward P/E ratio only considers earnings for the next 12 months. The equity market could be discounting higher earnings beyond the next 12 months.

2) The Trump rally from just before the election to year-end 2016 added 7.4% to the S&P 500. Year-to-date 2017 the S&P 500 is up another 6.8%. Forward Earnings are up 5.0% and valuations have increased from 16.0 times at the beginning of November 2016 to 16.9 times at year end, to 17.5 times at quarter end, but slipped to 17.4 times forward earnings at the end of this week.

3) These high valuations (relative to 14.0 times average over the past 10 years or 15.2 times earnings average over the past 5 years) could be driven by expectations that lower personal income tax rate proposed by the Republicans could spur spending beyond what would otherwise be expected and that lower corporate tax rates could generate higher corporate earnings than currently forecast.

4) If so, recent ease in valuation, 17.4 times at this week's end versus 17.5 times at quarter end, could be driven by reduced expectations for #3 above. Recent White House activity may suggest a reduced focus and ability to achieve the proposed lower tax rates. And, the equity markets have reacted accordingly.

5) Or, not...

Other US Releases: Retail Sales increased +0.4% in April following a 3 tick upward revision in March to +0.1%; even without the move volatile automobile sector, Core Retail Sales rose +0.3%. This bounce back from March was on the low end of the range of expectations. The University of Michigan's preliminary Consumer Sentiment Survey for May rose less than a point to 97.7. Consumer Prices (CPI) rose +0.2% from March and 2.2% from a year ago; without the more volatile food and energy component, Core CPI rose only +0.1% in April and 1.9% from a year ago. Source: Econoday and the Wall Street Journal |

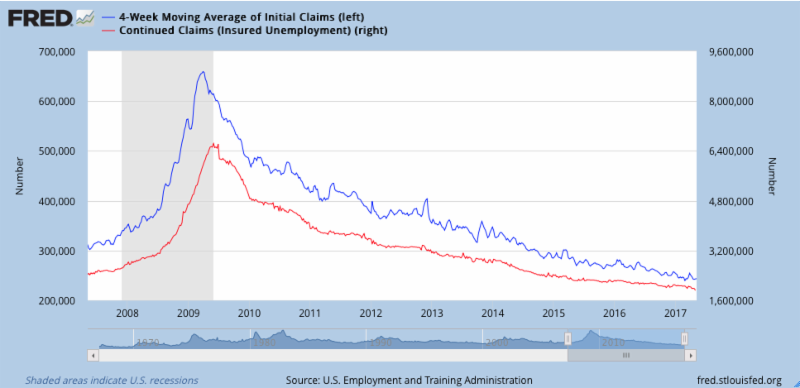

Economic Releases: US Employment Initial Claims for Unemployment Benefits inched lower to 236,000. The 4-week Average of Claims (blue in the chart below) increased 500 to 243,500. Continuing Claims (red in the chart below and reported on a 1-week lag) dropped 61,000 to 1.918 million, a 29 week low. Also, confirming tightness in the labor market, the Labor Department's JOLT (Jobs Openings and Labor Turnover) rose to 5.743 million in March, a sign of lack of qualified candidates to fill the jobs. These measures suggest that future wage pressures are likely in the jobs market. Source: St Louis Federal Reserve, FRED, Econoday via WSJ.com |

Economic Releases outside the US Eurozone Industrial Production fell -0.1% in March, matching February's upward revised decrease. In Germany, March's Manufacturers' Orders increased 1.0%, but Industrial Production (IP) fell -0.4%. Germany's 1st quarter GDP rose +0.6% from the previous quarter. Note: European GDP's are not annualized as they are in the US. The Bank of England met and made no change in monetary policy, interest rates remained at 0.25% and no increase in the Asset Purchase Level. In March, UK's IP fell -0.5%; Manufacturing Output fell -0.6%. Source: Econoday and the Wall Street Journal |

Equity and Bond Index Returns The tech-heavy Nasdaq managed a gain, but other North American Indices fell on the week. Elsewhere the CAC slipped, but other European and Asian markets managed a gain. The high valuation of the S&P 500 eased a tick to 17.4 since quarter end; Factset forward earnings increased 1.7% while the Index increased 1.2%. The Bloomberg Bond Indices rose on both declining interest rates and narrowing credit spreads on the week. Equity Indices % Change | Price | Week | QTD | YTD | '08-'16 | since: | 05 /12/ 17 | 05 /05/ 17 | 03 /31/ 17 | 12/30/16 | 12/31/08 | Dow Jones Industrials | 20,897 | -0.5% | 1.1% | 5.7% | 125.2% | S&P 500 Index | 2,391 | -0.3% | 1.2% | 6.8% | 147.9% | Nasdaq | 6,121 | 0.3% | 3.5% | 13.7% | 241.3% | S&P/TSX Composite | 15,527 | -0.4% | -0.3% | 1.6% | 70.1% | FTSE 100 Index | 7,435 | 1.9% | 1.5% | 4.1% | 61.1% | CAC 40 Index | 5,405 | -0.5% | 5.5% | 11.2% | 51.1% | DAX Index | 12,770 | 0.4% | 3.7% | 11.2% | 138.7% | Swiss Market Index | 9,123 | 1.2% | 5.4% | 11.0% | 48.5% | Nikkei 225 Index | 19,884 | 2.3% | 5.2% | 4.0% | 115.7% | HK Hang Seng Index | 25,156 | 2.8% | 4.3% | 14.3% | 52.9% | Shanghai CSI 300 | 3385 | 0.1% | -2.0% | 2.3% | 82.1% | Bond Indices % Total Return | | | | | | Bloomberg Treasury Index | 125.6 | 0.1% | 0.5% | 1.2% | 19.5% | Bloomberg Corporate Index | 147.2 | 0.4% | 1.2% | 2.5% | 72.1% | Bloomberg High Yield Index | 177.3 | 0.3% | 1.4% | 4.4% | 167.4% | S&P 500 Valuation | | | | | | Factset forward Earnings | $137.20 | | $134.91 | $132.79 | 5-Year Ave | % Change in Earnings | | | 1.7% | 4.5% | 15.2 | | | | | | 10-Year Ave | Price/Earnings Ratio | 17.4 | | 17.5 | 16.9 | 14.0 |

Data Source: Bloomberg app for the Iphone; Earning Estimates from Factset |

Bond Yields and Spreads: Government bond yields slipped and credit spreads narrowed on the week. The yield curve steepened, reversing some of the flattening that has occurred since quarter- and year-end. In another sign of easing of inflationary pressures, the TIPS spread narrowed a tick on the week and 12 ticks since quarter-end. Government Bonds | Bond Yields (%) | bp chg | QTD | YTD | '08-'16 | since: | 05 /12/ 17 | 05 /05/ 17 | 03 /31/ 17 | 12/30/16 | 12/31/08 | UST 2-Year | 1.29 | -2 | 4 | 10 | 42 | UST 10-Year | 2.33 | -2 | -6 | -11 | 23 | US TIP 10-Year | 0.46 | -1 | 6 | -0 | -163 | UST 30-Year | 2.99 | 1 | -2 | -8 | 39 | Canadian 10-Year | 1.54 | 0 | -8 | -17 | -97 | UK 10-Year | 1.08 | -3 | -6 | -15 | -179 | French 10-Year | 0.84 | 0 | -12 | 16 | -273 | German 10-Year | 0.39 | -2 | 7 | 19 | -275 | Swiss 10-Year | -0.11 | -1 | 4 | 15 | -236 | Japan 10-Year | 0.03 | 2 | -3 | -1 | -113 | Bloomberg Credit Spreads | | bp chg | bp chg | bp chg | bp chg | Corp OAS BUSC | 109 | -12 | -15 | -19 | -445 | HY OAS BUHY | 363 | -17 | -31 | -66 | -1374 | Rates | | bp chg | bp chg | bp chg | bp chg | US Mort 30-yr % | 3.97 | 0 | -5 | -12 | -117 | Spreads | | | | | | 10-Year TIPS Spread | 1.87 | -1 | -12 | -11 | 185 | Yield Curve (2's to 10's) | 1.04 | 0 | -10 | -21 | -20 | Yield Curve (10's to 30's) | 0.66 | 3 | 4 | 3 | 17 | Yield Curve (2's to 30's) | 1.70 | 3 | -6 | -18 | -3 |

Data Source: Bloomberg app for the Iphone |

Currency and Commodity Markets: The US dollar strengthened against the Yen, Pound, Euro, and Loonie this week; only the RMB managed to eek out a gain against the greenback. The biggest driver of changes in currency is interest rates; this week is unusual because the falling interest rates this week ought to lead to a falling US dollar. Energy commodity prices rebounded on the week. Gold commodity prices were little changed while Silver and Corn commodity prices gained. Currencies vs $ | Closing | Week | QTD | YTD | '08-'16 | since: | 05 /12/ 17 | 05 /05/ 17 | 03 /31/ 17 | 12 /30/ 16 | 12 /31/ 08 | Yen | 88.28 | -1.8% | -1.7% | 3.2% | -22.5% | British Pound | 1.29 | -0.7% | 2.7% | 4.6% | -15.5% | Euro | 1.09 | -0.6% | 2.6% | 3.9% | -24.7% | Canadian Dollar | 72.91 | -0.5% | -2.9% | -2.1% | -9.5% | China Renminbi | 14.49 | 0.1% | -0.2% | 0.7% | -1.6% | Commodities | | | | | | West Texas Interm. | $47.88 | 3.0% | -5.7% | -11.1% | 20.7% | Brent Crude | $50.89 | 3.0% | -3.7% | -10.4% | 58.6% | Natural Gas | $3.41 | 4.2% | 7.0% | -8.7% | -35.6% | Spot Gold | $1228 | 0.0% | -1.7% | 6.7% | 32.4% | Spot Silver | $16.45 | 0.7% | -9.9% | 3.2% | 40.7% | CBOT Corn | $371.00 | 0.1% | 1.9% | 5.4% | -2.1% | Spreads | | | | | | Brent-WTI | $3.01 | $2.96 | $2.03 | $2.98 | -$8.78 |

Data Source: Bloomberg app for the Iphone |

Equity Index Gains in US dollar terms: The equity table above shows the percent change of different stock indices in terms of its local currency. To calculate the return to the US dollar investor one must combine the change of each index with the change in the applicable currency. The following table shows the 5-day, quarter-to-date and year-to-date results of investments made in each index in US dollar terms: Return to USD Investor | | % Chg | QTD | YTD | | 05 /12/ 17 | since: | 05 /05/ 17 | 03 /31/ 17 | 12/30/16 | '08-'16 | S&P 500 Index: | USD | -0.3% | 1.2% | 6.8% | 147.9% | Nikkei 225 Index: | Yen | 0.4% | 3.4% | 7.4% | 67.3% | FTSE 100 Index: | Pound | 1.1% | 4.3% | 8.8% | 36.0% | DAX Index: | Euro | -0.2% | 6.4% | 15.6% | 79.7% | CAC 40 Index: | Euro | -1.1% | 8.3% | 15.5% | 13.7% | S&P/TSX Composite: | CAD | -0.8% | -3.2% | -0.5% | 54.0% | Shanghai CSI 300: | Yuan | 0.1% | -2.2% | 2.9% | 82.1% |

The FTSE was the best place for US dollar investors to have been invested last week. This quarter and year-to-date, the DAX and CAC were the best place for US dollar investors to have been invested. |

|

Who is John Davidson?

John W. Davidson, CFA, started writing these Comments more than a decade ago as a personal discipline when he was promoted from portfolio manager to chief investment officer and CEO.

Most recently, he was the president of PartnerRe Asset Management Corporation, responsible for the management of PartnerRe's invested assets, which grew from $4 billion to $12 billion during his tenure. After joining PartnerRe in the fall of 2001, he hired the staff, built the trading floor and created the infrastructure to manage both fixed income and equity assets internally. He retired from PartnerRe at the end of 2008 and moved to Maine, where he focused on board work.

He has more than 35 years of industry experience, including positions with investment management responsibility for separate institutional accounts, mutual funds, trusts and insurance assets. Prior to joining PartnerRe, he served as president and chief executive officer of two other investment management companies. For various companies he has held positions as chief investment officer, chief economist, head of fixed income and portfolio manager. As a portfolio manager, Davidson managed and traded U.S. Government Securities as well as futures and options on fixed income instruments.

His real world experience is backed by a strong academic foundation, which includes earning a Master of Business Administration in finance and a Master of Arts in mathematics from Boston College, as well as a Bachelor of Arts, cum laude, in economics from Amherst College. He holds the professional designation of chartered financial analyst.

His experiences and credentials have brought him to the public as a television commentator and conference speaker. In addition to his frequent past appearances on CNBC, CNNfn, Bloomberg TV and Yahoo FinanceVision, he appeared as a special guest on Wall $treet Week with Louis Rukeyser. Reuters, Bloomberg and other business press services have quoted his views on the market. He has taught CFA preparation programs, as well as other courses offered by the Stamford and Boston CFA Societies, and the National Graduate Trust Officers' School.

Davidson is a natural leader in both his professional and personal life, having developed those skills early in his career as a naval officer. He spent three years on active duty, which included a year on the rivers of Vietnam, and 24 years in the Naval Reserve, from which he retired as a captain in 1994.

Davidson is treasurer and board member of the Camden Conference. He is also on the investment committee of the Pen Bay Health Foundation. He serves as an independent trustee for mutual funds.

In his leisure time, he is an active sailor, tennis player and skier. With his wife, Barbara, he renovated a 100+-year-old home in Camden, where they enjoy spending time with their two golden retrievers and having visits from their five children. He can be reached at jwdbond@me.com.