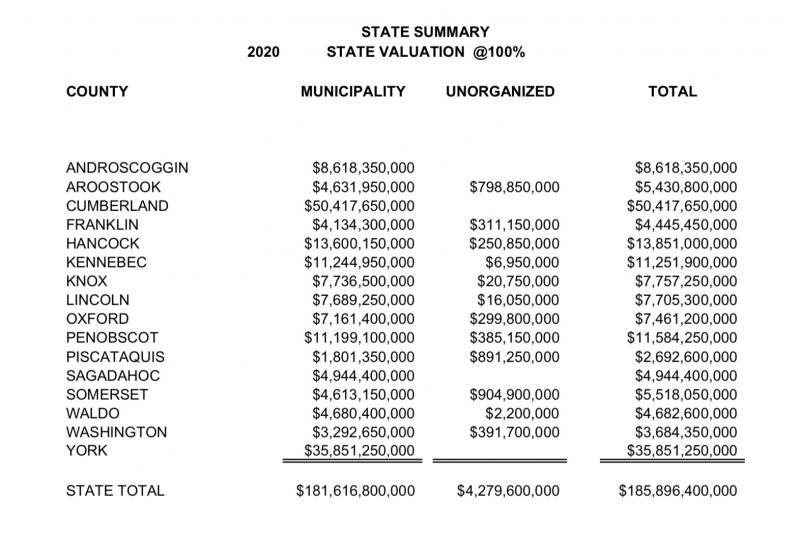

The Maine Dept. of Revenue Services finalized the 2020 State Valuation and reports an increase in value of $9.72 billion, or 5.52 percent, from the previous valuation year. In 2019, Maine’s total valuation was $176,176,000,000. This year, it is $185,896,400,000.

The largest increases, by county, were in York and Cumberland counties with increases of 7.05% and 7.52%, respectively, according to a news release from the department.

The 2020 State Valuation reflects the value of all real and personal property within Maine as of April 1, 2018.

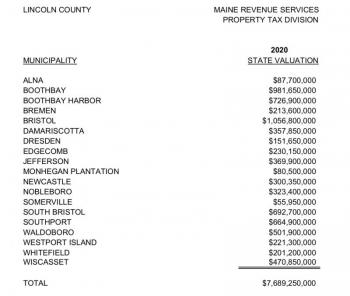

The valuation summary reports that Knox County has a valuation of $7.57 billion; Lincoln County, $7.7 billion; and Waldo County, $4.6 billion.

In Knox County, Camden carries the largest valuation, at $1.36 billion, followed by Rockport at $966 million; St. George at $926 million; and Rockland, at $827 million.

In Lincoln County, Bristol topped the valuation totals at $1 billion, followed by Boothbay at $981 million, and Boothbay Harbor, at $726 million.

In Waldo County, Belfast had the highest valuation at $813 million; Lincolnville at $486 million, and Searsport at $300 million.

Growth exceeded 3% in every other county, except for Washington, Lincoln and Piscataquis counties.

Annual State Valuation growth has not exceeded this level since the 2008 State Valuation that reported an increase of 9.26%.

“This is the largest annual valuation growth in 10 years,” said Kirsten Figueroa, Commissioner of the Department of Administrative and Financial Services, in the release. “This report shows that Maine’s economy continues to move in the right direction.”

The annual State Valuation process, which takes about 18 months to complete, begins with compiling a sales-ratio study for each municipality.

The sales-ratio study measures the assessed value of recently sold properties relative to their selling price. Sales-ratio data is derived from the declaration of value that is filed with the registry of deeds when a property is sold.

Maine Revenue Services staff then visit each municipality to audit municipal assessing records and to verify certain information with local assessing officials.

The State Valuation values are used by Maine Revenue Services and other state agencies for calculating municipal reimbursements for certain lost revenue, allocating money appropriated for State General Purpose Aid for Education, determining State Revenue Sharing to municipalities, and apportioning county taxes.

Maine Revenue Services is a bureau within the Department of Administrative and Financial Services. Maine Revenue Services is empowered to assess and collect Maine’s sales and use taxes, individual and corporate income taxes, motor fuel taxes, estate tax, business taxes, cigarette and tobacco taxes, special industry taxes, state valuation, and property taxes in the unorganized territory. It also administers the real estate transfer tax, the Maine Homestead Exemption Program, the Business Equipment Tax Reimbursement program, and several municipal tax reimbursement programs, and exercises general supervision of local assessing officials.